Pentax 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

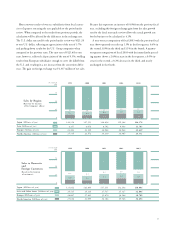

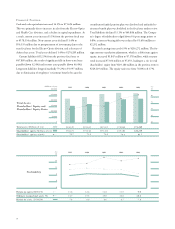

The Company pushed through a number of structural reform

measures during the fiscal year under review with the aim of elimi-

nating future liabilities. The Company posted ¥14,949 million for

compensation resulting from the dissolution of the Company’s em-

ployees’ funded pension plan, and ¥3,691 million for additional

retirement benefits paid to employees resulting from restructuring

of 19 domestic businesses. As a result, income before income taxes

and minority interests fell 23.5% from the previous fiscal year to

¥28,743 million, and net income declined 15.6% to ¥20,038

million.

Net income per share fell from ¥203.15 for the previous fiscal

year to ¥171.10, a decline of ¥32.05. Return on assets (ROA) fell

1.4 percentage points to 7.3%, and return on equity (ROE)

dropped 2.5 percentage points to 9.0%.

19.3

20.1

12.4

19.4

18.2

10.7

17.7

19.9

9.0

18.4

19.6

8.3

20.6

17.7

11.2

22.6

23.0

12.9

21.8

20.2

-3.4*

21.1

21.8

11.9

2002-4Q2002-3Q2002-2Q2002-1Q

30.0

20.0

0

-10.0

10.0

2003-4Q2003-3Q2003-2Q2003-1Q

Operating income ratio (%)

Ordinary income ratio (%)

Return on sales (%)

Quarterly Profit Ratio

1st quarter of 2002

to 4th quarter of 2003

(%)

*An extraordinary loss of ¥14,949 million for compensation resulting from the dissolution of the Company’s employees’ funded pension plan was posted during the third quarter of fiscal 2003, resulting in return

on sales for the quarter of -3.4%.

Operating income ratio (%)

Ordinary income ratio (%)

Return on sales (%)

Profit Ratio

15.8

16.7

8.9

17.2

17.6

10.3

19.1

20.3

9.2

18.7

19.5

10.1

21.5

20.7

8.1

30.0

22.5

7.5

15.0

0

1999 2000 2001 2002 2003

(%)