Pentax 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

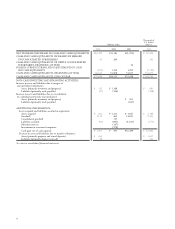

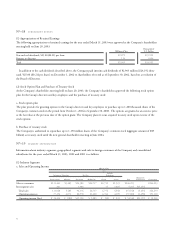

No»11 INCOME TAXES

The Company and its domestic subsidiaries are subject to Japanese national and local income taxes which, in the aggregate, resulted

in a normal effective statutory tax rate of approximately 41.7% for the years ended March 31, 2003, 2002 and 2001.

The tax effects of significant temporary differences and loss carryforwards which resulted in deferred tax assets and liabilities at

March 31, 2003 and 2002 are as follows:

Thousands of

Millions of Yen U.S. Dollars

2003 2002 2003

Current:

Deferred tax assets:

Accrued bonuses to employees ¥1,361 ¥1,090 $11,342

Amortization of goodwill 1,265,1,266 10,542

Inventories—intercompany unrealized profits 830 921 6,917

Accrued enterprise taxes 77 351 641

Other 772 622 6,433

Total 4,305 4,250 35,875

Deferred tax liabilities:

Enterprise taxes refund receivable 335 2,792

Prepaid pension cost 518

Other 117

Total 335 635 2,792

Net deferred tax assets ¥3,970 ¥3,615 $33,083

Non-current:

Deferred tax assets:

Amortization of goodwill ¥1,589 ¥2,910 $13,242

Devaluation of property, plant and equipment and software 913 677 7,608

Allowance for doubtful receivables 401 247 3,341

Accrued retirement benefits 2,548

Other 1,383 2,254 11,525

Total 4,286 8,636 35,716

Deferred tax liabilities:

Reserves for special depreciation and other 894 1,001 7,450

Other 181 224 1,508

Total 1,075 1,225 8,958

Net deferred tax assets ¥3,211 ¥7,411 $26,758

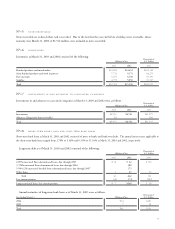

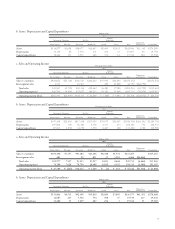

A reconciliation between the normal effective statutory tax rates and the actual effective tax rates reflected in the accompanying

consolidated statements of income for the years ended March 31, 2003, 2002 and 2001 is as follows:

2003 2002 2001

Normal effective statutory tax rate 41.7% 41.7% 41.7%

Lower income tax rates applicable to income in certain foreign countries (13.5) (5.2) (12.1)

Expenses not permanently deductible for income tax purposes 0.6 0.5 0.8

Per capita portion 0.4 0.3 0.4

Non-taxable dividend income (2.1) (3.9) (3.8)

Intercompany cash dividend 2.1 3.8 3.8

Adjustments of deferred tax assets and liabilities due to change 0.3

the normal effective statutory tax rate

Other—net 0.7 (0.6) (0.5)

Actual effective tax rate 30.2% 36.6% 30.3%