Pentax 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Information Technology (Electro-Optics Division)

Review by Segment

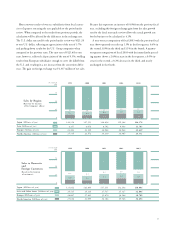

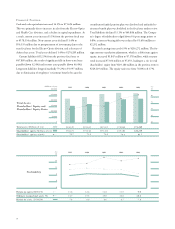

Net sales in the Information Technology field increased 7.6% from

the previous fiscal year to ¥116,946 million. This was due mainly to a

9.8% increase in sales by the Electro-Optics division to ¥111,461 mil-

lion. Sales by product group are as follows. In mask blanks for the

manufacture of semiconductors, sales of high-precision products in-

creased. In photomasks for semiconductor manufacture, although the

domestic market tended toward decline, the shift to high-precision

products and a larger percentage of overseas sales kept overall sales on

par with the previous year. In LCD photomasks, increasing demand,

especially for large photomasks, resulted in rising sales. In glass disks

for HDDs, sales of media products (glass substrates coated with a

magnetic layer) rose following increased shipments of HDDs, while

sales of substrates (glass substrates, the polished glass disks) remained

flat, leading to an overall decline in revenue. In optical glass products,

sales of lenses for digital cameras and video recorders recovered from

the inventory adjustment phase that characterized the previous fiscal

year, and revenue increased. In laser products from the Photonics di-

vision, as part of the Company’s restructuring plan, the section han-

dling physical- and chemical-use lasers in the Photonics division was

sold off in October, resulting in a decline in sales from the previous

fiscal year.

Operating income for the Information Technology field increased

23.8% from the previous fiscal year to ¥33,826 million. The operat-

ing income ratio for the Electro-Optics division was 29.2% in the

first quarter, 31.8% in the second, 32.8% in the third, and 29.4% in

the fourth, rising for each corresponding quarter of the previous fiscal

year, and from 27.3% in the previous term to 30.8% for the full fiscal

year. This was the principal reason for the notable rise in the operat-

ing income ratio for the Information Technology field.

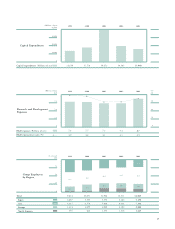

The Electro-Optics division’s net sales growth rate improved to a

positive 9.8% from a negative 9.7% for the previous year. The graph

labeled “Sales Growth and Profitability by Business Segment” on this

page shows that the position of the circle representing this segment

has moved up the vertical axis, (which shows the net sales growth

rate) to a level above the Company’s consolidated total of 4.7%. Due

to an increase of 3.5 percentage points in the operating income ratio,

moreover, the circle representing the segment has moved in a positive

direction to the right along the horizontal axis (representing the oper-

ating income ratio). During the period under review, this segment was

able to recovery significantly the declines of the previous fiscal year,

and even surpass former levels.

Capital expenditures for the Electro-Optics division were reduced

by 21.4% to ¥10,444 million, the result of planned investments being

held over to the next fiscal period. As a result, capital expenditures for

the Information Technology field totaled ¥10,595 million. This rep-

resents 66.4% of investment for the entire Group, down 1.7 percent-

age points from the previous fiscal year.

0

90,000

60,000

30,000

120,000

(%)

40.0

20.0

0

112,341 101,496 111,461

34,815

30.8%

27,789

27.3%

34,414

30.8%

2001 2002 2003

112,257 111,806 114,877

10,299

15,230

12,687

13,280

13,129

10,444

(Millions of yen)

Net sales

Operating income

Operating income ratio

Assets

Depreciation

Capital expenditures

Notes: 1. The operating income ratio above is calculated on net sales plus intersegment sales. Please

refer to details on page 52 Segment Information.

2. Data above doesn’t include Photonics division.

20

30

10

0

-10

-20

1002030

Sales Growth and

Profitability by

Business Segment

Fiscal year ended March 31, 2003

(Compared with the previous fiscal year)

Vision Care

Size of circle shows the volume of operating income.

Health Care

Crystal

Electro-Optics

Sales Growth Ratio (%)

Operating Income Ratio (%)

Consolidated Basis

Consolidated Basis