Pentax 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

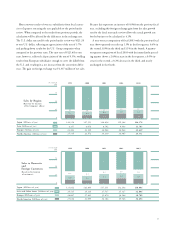

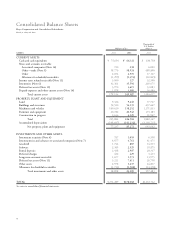

Financial Position

Cash and cash equivalents increased 14.1% to ¥75,694 million.

This was primarily due to increases in sales from the Electro-Optics

and Health Care divisions, and a decline in capital expenditures. As

a result, current assets increased 5.1% from the previous fiscal year

to ¥178,154 million. Non-current assets declined 11.4% to

¥96,135 million due to postponement of investment plans to the

next fiscal year for the Electro-Optics division, and a decrease of

deferred tax assets. Total assets declined 1.4% to ¥274,289 million.

Current liabilities fell 2.5% from the previous fiscal year to

¥47,889 million, the result of significant falls in short-term loans

payable (down 32.4%) and income taxes payable (down 46.4%).

Long-term liabilities dropped markedly 79.2% to ¥1,997 million,

due to elimination of employees’ retirement benefits because the

contributory funded pension plan was dissolved and unfunded re-

tirement benefit plan was abolished in the fiscal year under review.

Total liabilities declined 15.1% to ¥49,886 million. The Compa-

ny’s degree of indebtedness edged down 0.6 percentage points to

0.8%, as interest-bearing debt was reduced by ¥1,656 million to

¥2,292 million.

Retained earnings increased 6.9% to ¥216,272 million. The for-

eign currency translation adjustment, which is a debit item against

equity, increased ¥1,847 million to ¥7,178 million, while treasury

stock increased ¥7,036 million to ¥7,053, leading to a rise in total

shareholders’ equity from ¥219,180 million in the previous term to

¥224,219 million. The equity ratio rose from 78.8% to 81.7%.

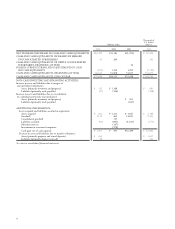

Total assets (Millions of yen)

Shareholders’ equity (Millions of yen)

Shareholders’ equity ratio(%)

300,000

200,000

250,000

150,000

100,000

50,000

0

20032002200120001999

Total Assets,

Shareholders’ Equity and

Shareholders’ Equity Ratio

(%)

70.7 73.2 73.0 78.8 81.7

224,335 239,341 267,611

158,473

278,068

219,180175,146 195,333

274,289

224,219

85

75

80

70

65

60

(Millions of yen)

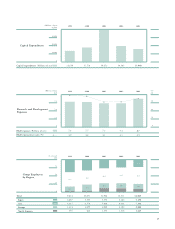

Return on equity [ROE](%)

Ordinary income/total assets (%)

Return on assets [ROA](%)

20

12

16

8

4

0

(%)

20032002200120001999

11.6 12.4 11.8 11.5 9.0

14.7 15.3 19.0 16.8 18.4

7.8 8.9 8.6 8.7 7.3

Profitability