Pentax 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

NO»9RETIREMENT BENEFITS AND PENSION PLANS

The Company and certain consolidated domestic subsidiaries had two types of pension plans for employees; a non-contributory and a

contributory funded pension plan. The Company and certain domestic subsidiaries have severance payment plans for directors and

corporate auditors.

For the year ended March 31, 2003 the contributory funded pension plan was dissolved and the unfunded retirement benefit plan was

abolished.

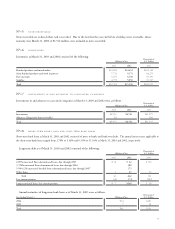

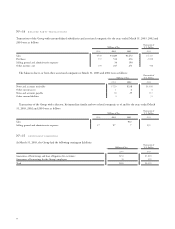

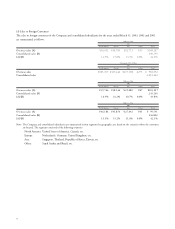

The liability for employees’ retirement benefits at March 31, 2002 consisted of the following:

Millions of Yen

2002

Projected benefit obligation ¥ 66,510

Fair value of plan assets (37,126)

Unrecognized prior service cost 1,696

Unrecognized actuarial loss (27,757)

Unrecognized transitional obligation 2,745

Prepaid pension cost 1,244

Net liability ¥ 07,312

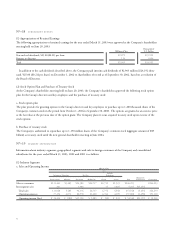

The components of net periodic benefit costs for the years ended March 31, 2003, 2002 and 2001 are as follows:

Thousands of

Millions of Yen U.S. Dollars

2003 2002 2001 2003

Service cost ¥01,695 ¥1,667 ¥1,798 $014,125

Interest cost 1,234 1,879 1,810 10,283

Expected return on plan assets (1,523) (2,194) (2,568) (12,692)

Amortization of prior service cost (122) (163) (83) (1,017)

Recognized actuarial loss 1,781 1,021 14,842

Amortization of transitional obligation (157) (210) (210) (1,308)

Total 2,908 2,000 747 24,233

Additional expense incurred to discontinue contributory funded

pension plan 14,949 124,575

Additional expense incurred to discontinue unfunded retirement

benefit plan 351 2,925

Additional retirement benefits paid to employees 3,691 1,996 176 30,758

Net periodic benefit costs ¥21,899 ¥3,996 ¥923 $182,491

Additional expense incurred to discontinue contributory funded pension plan is the remaining liability exceeding liability for retirement

benefit at the dissolution of the plan.

Additional expense incurred to discontinue unfunded retirement benefit plan is equal to the difference between retirement benefits paid

to employees due to abolishment and the recorded liability for retirement benefits.