Pentax 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

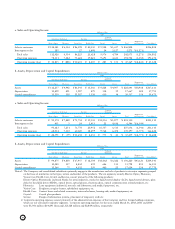

51

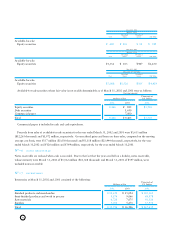

Notes:1. The Company and consolidated subsidiaries are summarized in four segments by geographic area based on the countries where the

Group is located. The segments consisted of the following countries:

North America: United States of America, Canada, etc.

Europe: Netherlands, Germany, United Kingdom, etc.

Asia: Singapore, Thailand, Republic of Korea, Taiwan, etc.

2. Corporate operating expenses consist primarily of the administration expenses of the Company, which are not allocated to segments

by geographic area. Corporate operating expenses for the years ended March 31, 2002, 2001 and 2000 were ¥1,771 million ($13,316

thousand), ¥2,144 million and ¥2,716 million, respectively.

3. Corporate assets consist primarily of cash, time deposits, short-term investments, investments securities and administrative assets of

the Company. Corporate assets as of March 31, 2002, 2001 and 2000 were ¥48,342 million ($363,474 thousand), ¥44,664 million

and ¥47,699 million, respectively.

4. Consolidated operating expenses are equal to the total of cost of sales and selling, general and administrative expenses shown in the

accompanying consolidated statements of income.

5. Effective April 1, 2000, the Company and domestic consolidated subsidiaries adopted a new accounting standard for employees’

retirement benefits. The adoption of the new accounting standard had a negative effect on operating income of Japan and Corporate

of ¥1,420 million and ¥100 million, respectively.

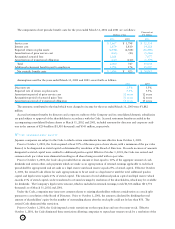

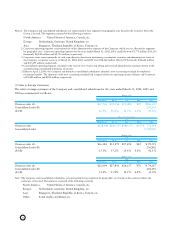

(3) Sales to Foreign Customers

The sales to foreign customers of the Company and consolidated subsidiaries for the years ended March 31, 2002, 2001 and

2000 are summarized as follows:

Millions of Yen

2002

North America Europe Asia Other Total

Overseas sales (A) ¥39,746 ¥38,144 ¥25,080 ¥47 ¥103,017

Consolidated sales (B) 235,265

(A)/(B) 16.9% 16.2% 10.7% 0.0% 43.8%

Thousands of U.S. Dollars

2002

North America Europe Asia Other Total

Overseas sales $298,842 $286,797 $188,572 $353 $ 774,564

Consolidated sales 1,768,910

Millions of Yen

2001

North America Europe Asia Other Total

Overseas sales (A) ¥36,184 ¥35,870 ¥27,492 ¥45 ¥99,591

Consolidated sales (B) 236,802

(A)/(B) 15.3% 15.2% 11.6% 0.0% 42.1%

Millions of Yen

2000

North America Europe Asia Other Total

Overseas sales (A) ¥22,099 ¥27,841 ¥24,257 ¥70 ¥74,267

Consolidated sales (B) 201,110

(A)/(B) 11.0% 13.8% 12.1% 0.0% 36.9%

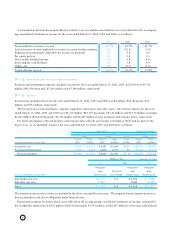

Note: The Company and consolidated subsidiaries are summarized in four segments by geographic area based on the countries where the

customers are located. The segments consisted of the following countries:

North America: United States of America, Canada, etc.

Europe: Netherlands, Germany, United Kingdom, etc.

Asia: Singapore, Thailand, Republic of Korea, Taiwan, etc.

Other: Saudi Arabia and Brazil, etc.