Pentax 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

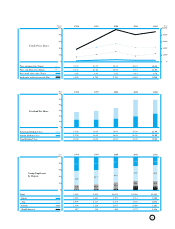

1998 1999 2000 2001 2002

240,000

160,000

120,000

80,000

40,000

0

(Millions of yen)

200,000

Net sales

Net sales

(Millions of yen)

193,473 201,290 201,110 236,802 235,265

1998 1999 2000 2001 2002

50,000

0

10,000

20,000

30,000

40,000

(Millions of yen)

Operating Income, Ordinary Income

and Net Income

Operating Income

Ordinary Income

Net Income

26,395

26,759

12,348

31,726

33,612

17,837

34,688

35,484

20,716

45,128

48,184

21,860

43,898

45,774

23,741

Management's Discussion and Analysis

Scope of Consolidation

The Hoya Group includes Hoya Corporation and its 51 consoli-

dated subsidiaries (seven domestic and 44 overseas), as well as six

domestic affiliates (two of which are accounted for by the equity

method).

This includes a net total of five consolidated subsidiaries added

during the fiscal year under review. Of these, three are newly es-

tablished firms, while two others became consolidated subsidiar-

ies from equity-method affiliates as a result of an increase in Hoya’s

equity in those firms. In addition, Hoya gained one domestic sub-

sidiary as a result of the split-up of a division from a subsidiary,

and another through the acquisition of an overseas firm. How-

ever, the total number decreased by two as a result of the merger

of some overseas subsidiaries.

The Company has two fewer affiliates than in the previous fis-

cal year, as HOYA-OPTIKSLIP AB (which changed its company

name to HOYA LENS SWEDEN AB in April, 2002) and THAI

HOYA LENS LTD., both of which, as mentioned above, had been

equity-method affiliates, became consolidated subsidiaries as a re-

sult of Hoya’s enlarged equity stake in those firms.

Net Sales

Consolidated net sales for the fiscal year ended March 31, 2002,

edged down 0.6% to ¥235,265 million. Compared with the previ-

ous fiscal year, net sales in the Information Technology field fell

9.7%, but the Eye Care Company achieved 9.4% sales growth. As

a result, total net sales for the Group were virtually unchanged

from the previous fiscal year.

Domestic sales declined 3.6% to ¥132,248 million, while over-

seas sales grew 3.4% to ¥103,017 million. This represents a 1.7

percentage point contraction in the share of domestic net sale as a

percentage of total net sales, to 56.2% from 57.9% in fiscal 2001.

The share of overseas net sales as a percentage of total sales showed

a corresponding 1.7 percentage point rise, to 43.8% from 42.1%.

The declining trend of the yen in comparison to a basket of

international currencies intensified, with the yen falling 13.2%

against the U.S. dollar, to ¥125.89, 10.5% against the euro, to

¥110.98, and 6.8% against the Thai baht, to ¥2.83.

A year-on-year comparison of fiscal 2002 with the previous fiscal

year shows quarterly net sales up 7.1% in the first quarter, down

2.2% in the second, down 5.7% in the third, and 1.3% lower in the

fourth. A quarter-on-quarter comparison of fiscal 2002 with the im-

mediately preceding quarter shows a 0.4% decline in the first quar-

ter, a 3.8% decrease in the second, and a 1.6% contraction in the

third, but a turnaround in the fourth to post 4.8% growth.

Net Income

Since net sales were virtually unchanged in comparison to the pre-

vious fiscal year, while cost of sales was ¥134,258 million, this

term’s 57.1% cost of sales ratio was also about even with last

term’s level. Selling, general and administrative expenses rose 1.3%

to ¥57,109 million, and the ratio of SG&A to net sales increased

to 24.3% from 23.8% in the previous fiscal year. R&D expenses

were ¥7,289 million, and the ratio of R&D expenses to net sales

was unchanged at 3.1%.

Chiefly as a result of the increase in the ratio of SG&A to net

sales, operating income slid 2.7% to ¥43,898 million, and the

operating income margin declined 0.4 percentage point to 18.7%.

Looking at the operating income margin by quarter, the first quar-

ter showed 19.3%, the second 19.4%, the third 17.7%, and the

fourth 18.4%.