Pentax 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

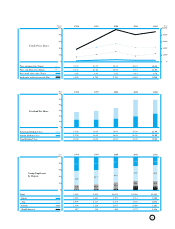

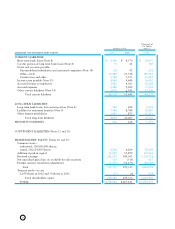

Net sales (Millions of yen)

Operating income ratio (%)

Ordinary income ratio (%)

Return on sales (%)

120,000

90,000

60,000

30,000

0

(Millions of yen)

(%)

Quarterly Net Sales

April 2000 to March 2002

2002

-4Q

2002

-3Q

2002

-2Q

2002

-1Q

2001

-4Q

2001

-3Q

2001

-2Q

2001

-1Q

* The worsening of return on sales for the fourth quarter of the fiscal year ended March 31, 2001, was due to the recording of an extraordinary loss that included ¥14,347 million of the

amortization of goodwill accompanying the integration of U.S. subsidiaries.

56,323

17.5

18.0

11.1

59,372

20.2

21.8

12.6

60,529

20.0

21.0

12.9

60,578

18.4

20.4

0.6

60,321

19.3

20.1

12.4

58,037

19.4

18.2

10.7

57,088

17.7

19.9

9.0

59,819

18.4

19.6

8.3*

30.0

15.0

0

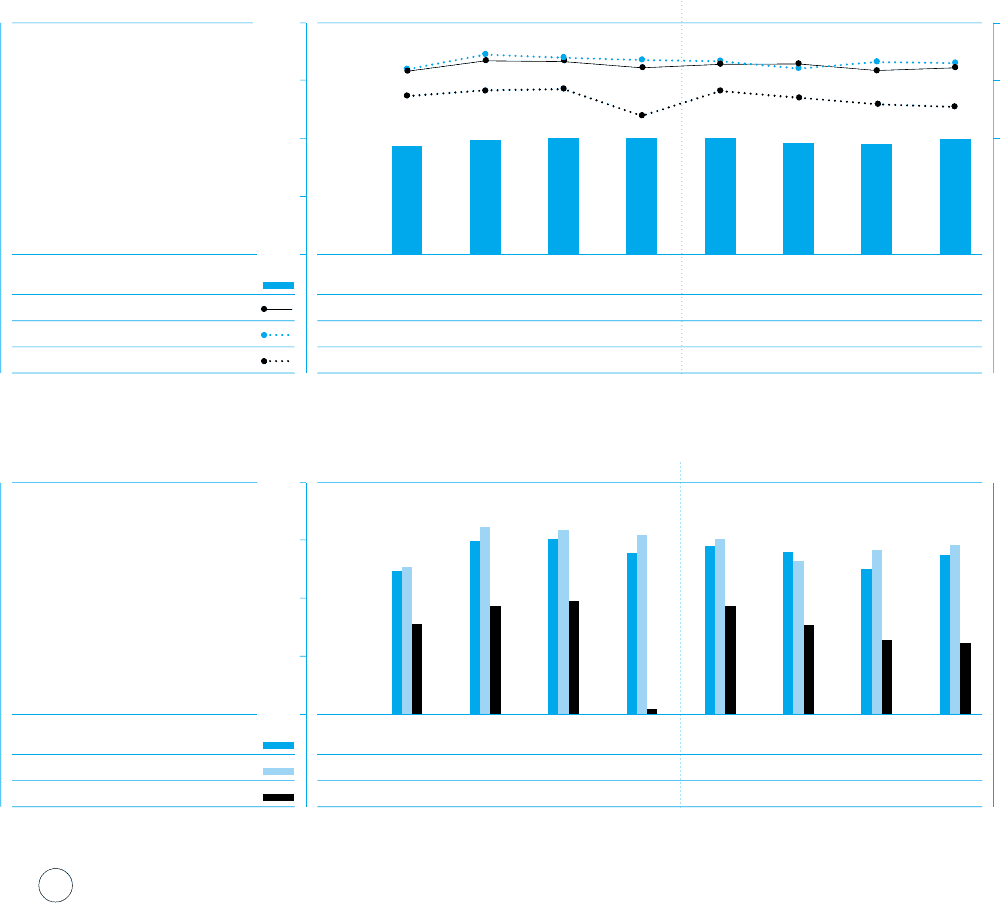

16,000

12,000

8,000

4,000

0

(Millions of yen)

Operating income (Millions of yen)

Ordinary income (Millions of yen)

Net income (Millions of yen)

11,166

12,376

364

2002-4Q2002-3Q2002-2Q2002-1Q2001-4Q2001-3Q2001-2Q2001-1Q

* Net income of ¥364 million for the fourth quarter of the fiscal year ended March 31, 2001, was due to the recording of an extraordinary loss that included ¥14,347 million of the

amortization of goodwill accompanying the integration of U.S. subsidiaries.

Quarterly Profits

April 2000 to March 2002

9,885

10,146

6,233

11,987

12,967

7,458

12,090

12,695

7,805

11,166

12,376

364

11,613

12,124

7,468

11,234

10,573

6,192

10,068

11,368

5,142

10,983

11,709

4,939*

NH Technoglass Co., Ltd., founded through equal investment

by Hoya and Nippon Sheet Glass Co., Ltd., has a plant that pro-

duces liquid crystal display glass substrates in Yokkaichi, Mie Pre-

fecture. We deeply regret to report that, during this term, there

was an incident in which dust containing arsenic trioxide was

emitted from the plant. Hoya’s portion of NH Technoglass’s loss

in that connection, approximately ¥200 million, was posted against

equity in earnings of associated companies. After the incident, all

operations at the plant were halted while steps were taken to pre-

vent a recurrence. The plant’s divisions resumed operations once

they were able to confirm the safety of their respective areas.

Consolidated net income grew 8.6% to ¥23,741 million in the

fiscal year under review. Extraordinary losses of ¥8,700 million

were posted in connection with losses on sales of marketable secu-

rities, retirement and severance payments in connection with struc-

tural reforms, losses on liquidation of fixed assets, and expenses

arising from the temporary plant closure. In the previous fiscal

year, the Company posted an extraordinary loss of ¥17,087mil-

lion that included ¥14,347 million of goodwill amortization from

certain U.S. subsidiaries. In the fiscal year under review, amortiza-

tion of goodwill totaled ¥469 million, a significant drop that al-

lowed the Company to post its highest net income ever. Despite

the fact that extraordinary losses were posted, net income per share

rose ¥16.20, to ¥204.44 from ¥188.24 in the previous fiscal year.

Return on assets (ROA) rose by 0.1 percentage point to 8.7%, but

return on equity (ROE) slipped 0.3 percentage point to 11.5%.

Dividends remained steady at ¥50.00 per share.