Pentax 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

»Eye Care (Health Care Division)

The Health Care division posted 14.8% growth in net sales, to

¥23,106 million. The division’s share of total net sales increased

to 9.8% from 8.5% in the previous fiscal year. Operating in-

come jumped 42.6% to ¥3,429 million. Operating income ra-

tios by quarter were 12.9% for the first quarter, 14.7% for the

second, and 16.0% for the third. In the fourth quarter, operat-

ing income ratio dropped to 13.6%. For the fiscal year, the

operating income ratio was 14.3%, up from 11.1% in the pre-

vious fiscal year.

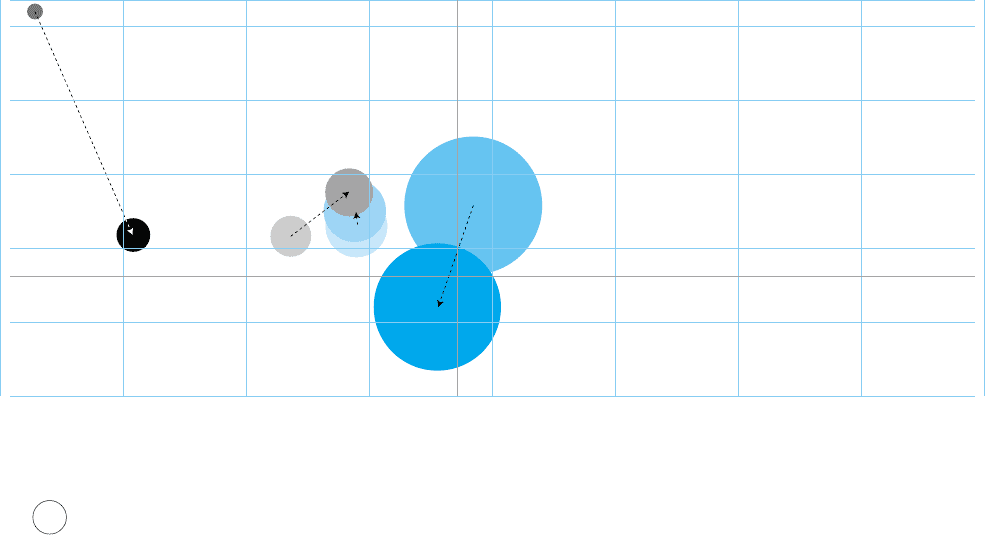

This division’s net sales growth rate showed a remarkable

increase, rising to 14.8 % from 3.1% a year ago. The position

of the circle on the graph on page 22 representing this division’s

net sales has improved significantly, and the circle represent-

ing operating income shows substantial growth. The circle is

moving toward the positive range on the abscissa, and the ra-

tio of operating income to net sales increased by 3.2 percent-

age points, as the division showed growth across the board.

Capital expenditures in this division were reduced by 39.6%

to ¥687 million.

»Lifestyle Refinement (Crystal Division)

Consolidated net sales in the Crystal division dropped 11.6%

to ¥8,788 million. As a percentage of the Company’s total net

sales, this represents a decline to 3.7% from 4.2% a year ago.

The division posted an operating loss of ¥1 million, compared

with income of ¥285 million in the previous fiscal year.

The net sales growth rate worsened to negative 11.6% from

negative 5.5% in the previous fiscal year, and this, together

with the operating loss, caused the division’s position on the

circle graphs to trend toward the negative range on the ordi-

nate, and the division’s circle itself to disappear. On the ab-

scissa, which represents the ratio of operating income to net

sales, the division’s circle is just above the 0% level.

Profitability is the most pressing issue for this division. Dis-

tortions in the industry structure have produced an environ-

ment in which a firm can no longer expect to succeed in im-

proving profitability just by expanding its sales. The first pri-

ority is setting the optimum level for sales, and steadily secur-

ing profits. This division’s goal now is to achieve an ordinary

income ratio of 10%, and it is proceeding with reforms to its

business structure. The division’s future issues are clear from

the graph on page 22. First, it needs to become profitable to

get on the graph at all. Then, the division has to trend upward

on the ordinate by expanding its net sales. After that, it needs

to move rightward on the abscissa by getting its profit ratios

up.

Capital expenditures in this division declined to ¥254 mil-

lion from ¥610 million in the previous fiscal year.

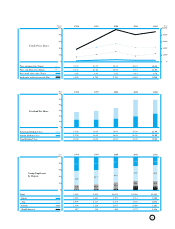

0 5 10 15 20 25 30 35 40

-25

0

-10

5

35

20

50

Sales Growth Ratio (%)

Operating Income Ratio (%)

North America

Europe

Japan

Asia Company-wide ratio

Company-wide ratio

Sales Growth and Profitability by Geographical Segment

Size of circle shows the volume of operating income.

Fiscal year ended March 31, 2002 (Compared with the previous fiscal year)