Pentax 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

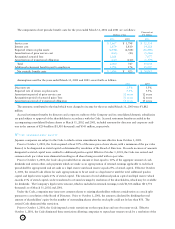

No»12 research and development expenses

Research and development expenses charged to income for the years ended March 31, 2002, 2001 and 2000 were ¥5,511

million ($41,436 thousand), ¥5,161 million and ¥5,146 million, respectively.

No»13 leases

Income from equipment leases for the years ended March 31, 2002, 2001 and 2000 was ¥4 million ($30 thousand), ¥38

million and ¥155 million, respectively.

The Group leases certain machinery, computer equipment, office space and other assets. Total rental expenses for the years

ended March 31, 2002, 2001 and 2000 were ¥8,739 million ($65,707 thousand), ¥8,352 million and ¥5,559 million, including

¥1,413 million ($10,624 thousand), ¥1,745 million and ¥2,047 million of lease payments under finance leases, respectively.

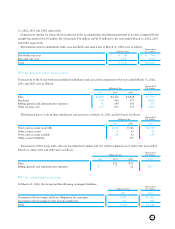

Pro forma information of leased property under finance leases that do not transfer ownership of the leased property to the

lessee on an “as if capitalized” basis for the years ended March 31, 2002, 2001 and 2000 were as follows:

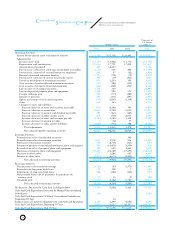

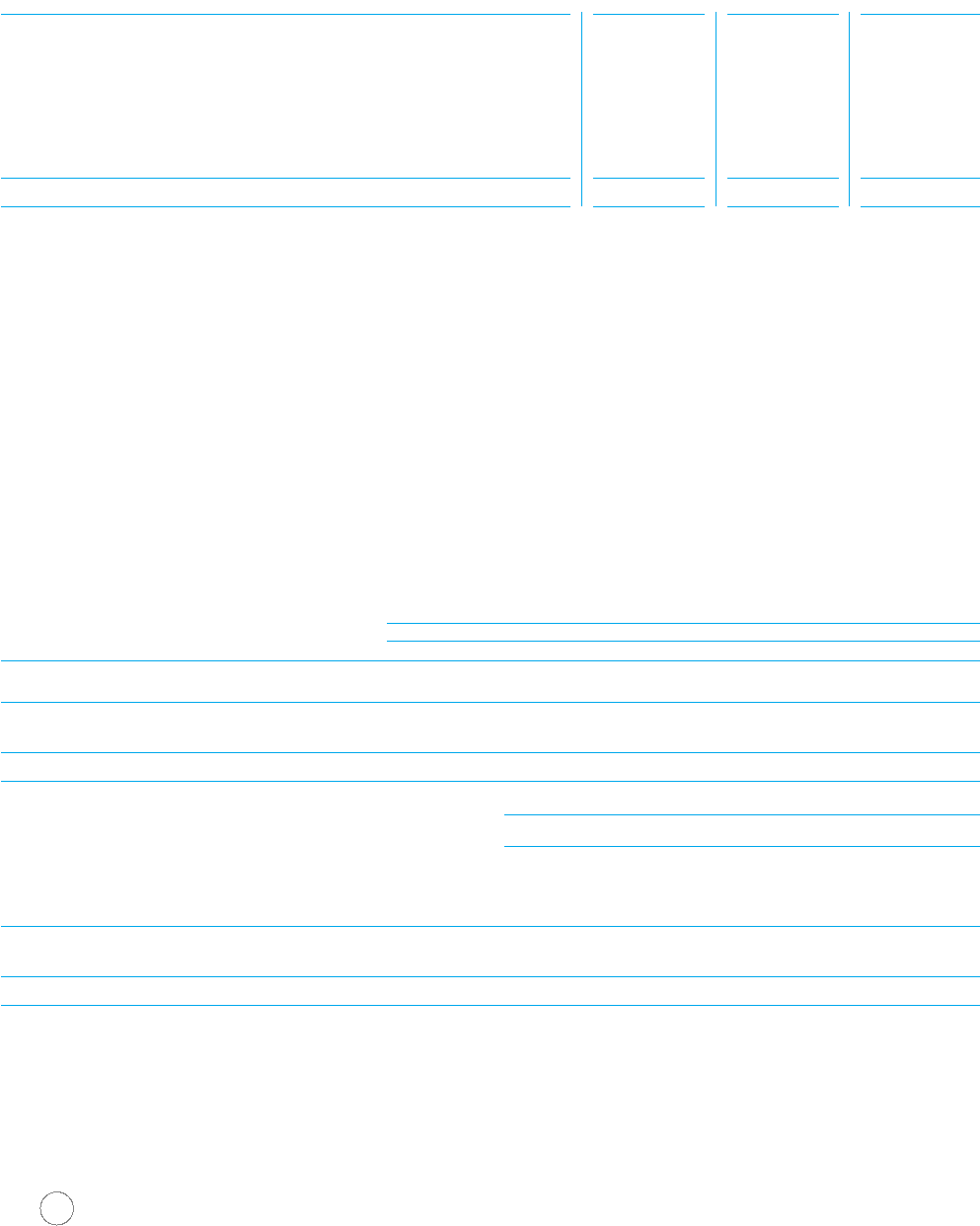

Millions of Yen Thousands of U.S. Dollars

2002 2001 2002

As Lessee As Lessee As Lessor As Lessee

Machinery Furniture Machinery Furniture Furniture Machinery Furniture

and and and and and and and

For the Years Ended March 31, 2002 and 2000 Vehicles Equipment Vehicles Equipment Equipment Vehicles Equipment

Acquisition cost ¥2,966 ¥3,975 ¥4,483 ¥3,964 ¥37 $ 22,301 $ 29,887

Accumulated depreciation 1,470 2,282 2,450 2,373 33 11,053 17,158

Net leased property ¥1,496 ¥1,693 ¥2,033 ¥1,591 ¥ 4 $ 11,248 $ 12,729

Millions of Yen Thousands of U.S. Dollars

2002 2001 2002

Obligations Obligations Obligations

under Unearned under under

For the Years Ended March 31, 2002 and 2000 Finance Lease Lease Income Finance Lease Finance Lease

Due within one year ¥1,235 ¥ 4 ¥ 1,582 $ 9,285

Due after one year 1,954 2,042 14,692

Total ¥3,189 ¥ 4 ¥ 3,624 $ 23,977

The interest income portion as lessor is included in the above unearned lease income. The imputed interest expense portion as

lessee is included in the above obligations under finance leases.

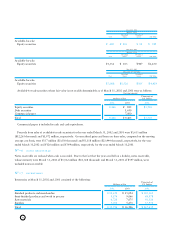

Depreciation expense for lessee, which is not reflected in the accompanying consolidated statements of income, computed by

the straight-line method was ¥1,413 million ($10,624 thousand), ¥1,745 million and ¥2,047 million for the years ended March

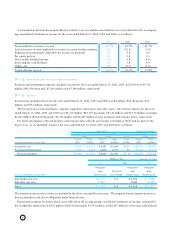

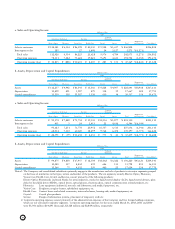

A reconciliation between the normal effective statutory tax rates and the actual effective tax rates reflected in the accompany-

ing consolidated statements of income for the years ended March 31, 2002, 2001 and 2000 is as follows:

2002 2001 2000

Normal effective statutory tax rate 41.7% 41.7% 41.7%

Lower income tax rates applicable to income in certain foreign countries (5.2) (12.1) (3.0)

Expenses not permanently deductible for income tax purposes 0.5 0.8 0.6

Per capita portion 0.3 0.4 0.3

Non-taxable dividend income (3.9) (3.8) (4.6)

Intercompany cash dividend 3.8 3.8 4.4

Other—net (0.6) (0.5) (1.6)

Actual effective tax rate 036.6% 30.3% 37.8%