Pentax 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

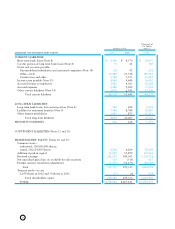

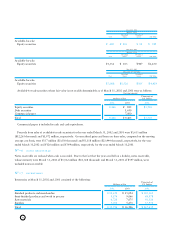

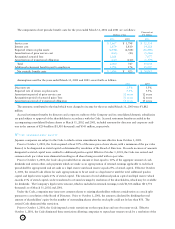

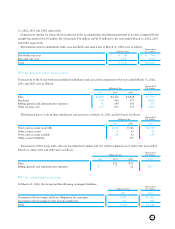

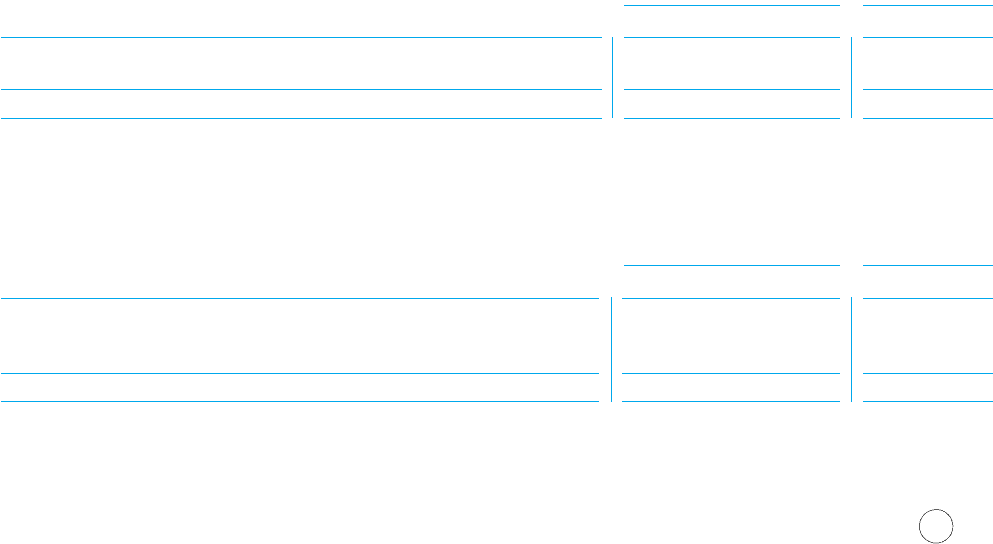

No»4cash and cash equivalents

Cash and cash equivalents as of March 31, 2002 and 2001 consisted of the following:

Thousands of

Millions of Yen U.S. Dollars

2002 2001 2002

Cash on hand and in banks ¥66,321 ¥44,698 $498,654

Commercial paper 7,000

Total ¥66,321 ¥51,698 $498,654

No»5investment securities

Investment securities as of March 31, 2002 and 2001 consisted of the following:

Thousands of

Millions of Yen U.S. Dollars

2002 2001 2002

Marketable equity securities ¥589 ¥2,450 $ 4,429

Government and corporate bonds 1,650

Non-marketable equity securities 466 815 3,503

Total ¥1,055 ¥4,915 $ 7,932

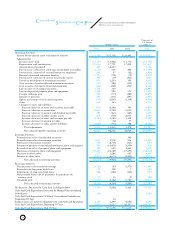

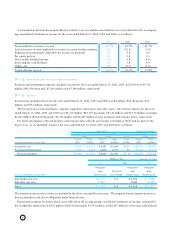

No»3reorganization

(i) Merger of the company with subsidiaries

On July 1, 1999, the Company merged with Hoya Lens

Corporation, which had been a wholly owned subsidiary of

the Company. The Japanese Commercial Code (the “Code”)

requires that the legal reserve of the merged company be

transferred to additional paid-in capital in the event of a

merger.

On July 1, 2001, the Company merged with Hoya Fiber

Photonics Corporation, which had been a wholly owned

unconsolidated subsidiary of the Company.

(ii) Reorganization of subsidiaries to the Company’s branches

On April 1, 2000, the Company purchased ORI Group which

consisted of 11 companies in the United States for ¥ 15,896

million and on October 31,2000, Midwest Optical Laborato-

ries, Inc. (“MOL”) for ¥ 513 million. ORI Group, MOL and

a newly established American company consisted of Hoya

Optical Laboratories, Inc. (“HOL”) and 12 consolidated

subsidiaries, which had been wholly owned American

subsidiaries of HOL.

On March 1, 2001, the Company reorganized HOL and the

12 consolidated subsidiaries to the Company’s branches. Due

to the reorganization, goodwill of ¥15,167 million was

recorded and subsequently ¥14,347 million, which was

charged to income. Also an adjustment of retained earnings for

the reorganization of consolidated subsidiaries to branches was

recorded in the amount of ¥820 million as an adjustment to

income from April 1, 2000 to February 28, 2001 of HOL and

subsidiaries.

(iii) Reorganization of Subsidiaries

On September 30, 2001, the Company purchased the

minority interest of Hoya Optikslip AB (“HOSL”) in Sweden

for ¥384 million ($2,887 thousand) to become a wholly

owned consolidated subsidiary. Previously, HOSL had been

accounted for by the equity method.

On October 1, 2001, Welfare Corporation, which had a

wholly owned unconsolidated subsidiary of the Company,

was merged into Hoya Healthcare Corporation (“HHC”).

On January 1, 2002, Welfare Corporation was then split

up from HHC.

On February 1, 2002, the Company purchased Eagle

Optics, Inc. in the United States for ¥474 million ($3,563

thousand).

On March 31, 2002, the Company increased its ownership

of Thai Hoya Lens Ltd. to become a consolidated subsidiary,

which had been accounted for by the equity method.

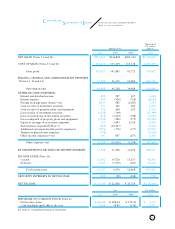

The carrying amounts and aggregate fair values of marketable equity securities at March 31, 2002 and 2001 were as follows: