Pentax 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

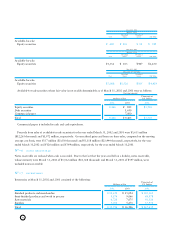

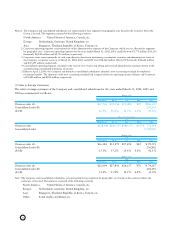

Annual maturities of long-term bank loans as of March 31, 2002 were as follows:

Thousands of

Year Ending March 31 Millions of Yen U.S. Dollars

2003 ¥73 $ 549

2004 466 3,504

2005 45 338

2006 39 293

2007 19 143

Total ¥642 $4,827

N

O

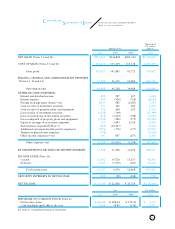

»9RETIREMENT BENEFITS AND PENSION PLANS

The Company and its certain consolidated domestic subsidiaries have severance payment plans for employees, directors and

corporate auditors.

Under most circumstances, employees terminating their employment are entitled to retirement benefits determined based on

the rate of pay at the time of termination, years of service and certain other factors. Such retirement benefits are made in the

form of a lump-sum severance payment from the Company or from certain consolidated subsidiaries and annuity payments

from a trustee. Employees are entitled to larger payments if the termination is involuntary, by retirement at the mandatory

retirement age, by death, or by voluntary retirement at certain specific ages prior to the mandatory retirement age.

Effective April 1, 2000, the Group adopted a new accounting standard for employees’ retirement benefits.

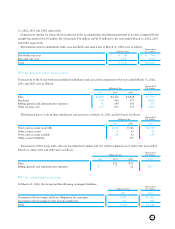

The liability for employees’ retirement benefits at March 31, 2002 and 2001 consisted of the following:

Thousands of

Millions of Yen U.S. Dollars

2002 2001 2002

Projected benefit obligation ¥66,510 ¥54,238 $ 500,075

Fair value of plan assets (37,126) (40,108) (279,143)

Unrecognized prior service cost 1,696 1,858 12,752

Unrecognized actuarial loss (27,757) (12,300) (208,699)

Unrecognized transitional obligation 2,745 2,956 20,639

Prepaid pension cost 1,244 1,717 9,353

Net liability ¥7,312 ¥8,361 $ 54,977

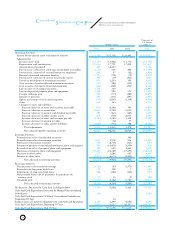

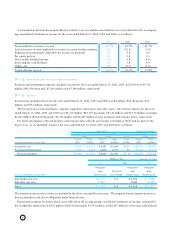

No»8short-term bank loans and long-term bank loans

Short-term bank loans at March 31, 2002 and 2001 consisted of the following:

Thousands of

Millions of Yen U.S. Dollars

2002 2001 2002

Short-term loans and overdrafts, principally from banks, with interest rates

ranging from 0.33% to 11.16% (2002) and

from 0.9125% to 7.85% (2001) ¥3,306 ¥4,570 $24,857

Long-term bank loans as of March 31, 2002 and 2001 consisted of the following:

Thousands of

Millions of Yen U.S. Dollars

2002 2001 2002

3.724% unsecured Euro-denominated loans, ¥380 ¥333 $ 2,857

due through 2004 (in 2002) and 5.30912% unsecured

France franc-denominated loans, due through 2003 (in 2001)

5.9%-6.2% unsecured Swedish kroua-denominated loans, 173 1,301

due through 2007

Other loans 89 152 669

Total 642 485 4,827

Less current portion (73) (61) (549)

Long-term bank loans, less current portion ¥569 ¥424 $ 4,278