Pentax 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

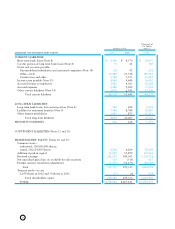

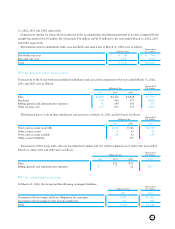

standard, all securities are classified as available-for-sale

securities and are reported at fair value, with unrealized gains

and losses, net of applicable taxes, reported in a separate

component of shareholders’ equity. The cost of securities sold

is determined based on the moving-average method. The

effect of this change was to increase income before income

taxes by ¥987 million for the year ended March 31, 2001.

Non-marketable available-for-sale securities are stated at

cost determined by the moving-average method.

For other than temporary declines in fair value, investment

securities are reduced to net realizable value by a charge to

income.

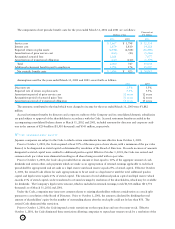

e. Property, Plant and Equipment

Property, plant and equipment are stated at cost. Deprecia-

tion of property, plant and equipment of the Company and its

consolidated domestic subsidiaries is computed substantially

by the declining-balance method at rates based on the

estimated useful lives of the assets, while the straight-line

method is applied to buildings of the Company and its

domestic subsidiaries, and to all property, plant and equip-

ment of consolidated foreign subsidiaries. The net book

value of tangible fixed assets depreciated by the straight-line

method was approximately 42.8% of total tangible fixed

assets in 2002 and 37.1% in 2001. The ranges of useful lives

are from 10 to 50 years for buildings and structures and from

5 to 10 years for machinery and vehicles.

f. Intangible Assets

Intangible assets are carried at cost less accumulated amorti-

zation, which are calculated by the straight-line method.

Amortization of software is calculated by the straight-line

method over 5 years.

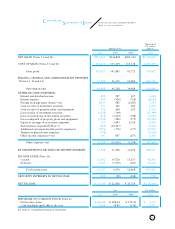

g. Retirement Benefits

The Company and certain consolidated subsidiaries have

contributory funded pension plans and unfunded retirement

benefit plans which cover substantially all of their employees.

Other subsidiaries have unfunded retirement benefit plans.

Prior to April 1, 2000, amounts contributed to the plan were

charged to income when paid. Certain consolidated subsid-

iaries have unfunded retirement benefit plans and have

recorded a liability for retirement allowances at 100% of the

amount which would be required if all employees voluntarily

terminated their employment at the balance sheet date prior

to April 1, 2000.

Effective April 1, 2000, the Company and domestic

consolidated subsidiaries adopted a new accounting standard

for employees' retirement benefits and accounted for the

liability for retirement benefits based on projected benefit

obligations and plan assets at the balance sheet date. The

transitional obligation of ¥3,166 million, determined as of

April 1, 2000, is being amortized over 15 years and presented

as other expense in the consolidated statements of income.

As a result, net periodic benefit costs, as compared with the

prior method, decreased by ¥1,742 million and income before

income taxes and minority interests increased by ¥1,603

million for the year ended March 31, 2001.

The annual provision for accrued retirement benefits for

directors and corporate auditors of the Company and its

consolidated domestic subsidiaries is also calculated to state

the liability at the amount that would be required if all

directors and corporate auditors retired at each balance sheet

date. The provisions for the retirement benefits are not

funded.

h. Research and Development Expenses

Research and development expenses are charged to income

when incurred.

i. Leases

All leases are accounted for as operating leases. Under

Japanese accounting standards for leases, finance leases that

deem to transfer ownership of the leased property to the

lessee are to be capitalized, while other finance leases are

permitted to be accounted for as operating lease transactions

if certain “as if capitalized” information is disclosed in the

notes to the lessee’s consolidated financial statements.

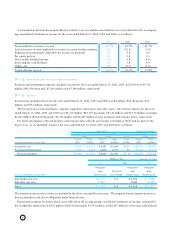

j. Income Taxes

The provision for income taxes is computed based on the

pretax income included in the consolidated statements of

income. The asset and liability approach is used to recognize

deferred tax assets and liabilities for the expected future tax

consequences of temporary differences between the carrying

amounts and the tax bases of assets and liabilities. Deferred

taxes are measured by applying currently enacted tax laws to

the temporary differences. Effective April 1, 1999, the Group

adopted the new accounting standard for interperiod alloca-

tion of income taxes based on the asset and liability method.

The cumulative effect of the application of interperiod tax

allocation in prior years in the amount of ¥6,718 million is

included as an adjustment to retained earnings as of April 1,

1999. Such cumulative effect is calculated by applying the

income tax rate stipulated by enacted tax laws as of April 1,

1999.