Pentax 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

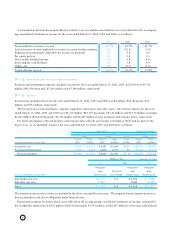

shareholders at the general shareholders' meeting and dispose of such treasury stock by resolution of the Board of Directors

after March 31, 2002. The repurchased amount of treasury stock cannot exceed the amount available for future dividend plus

amount of stated capital, additional paid-in capital or legal reserve to be reduced in the case where such reduction was resolved

at the general shareholders’ meeting.

The Code permits companies to transfer a portion of additional paid-in capital and legal reserve to stated capital by resolu-

tion of the Board of Directors. The Code also permits companies to transfer a portion of unappropriated retained earnings,

available for dividends, to stated capital by resolution of the shareholders.

Dividends are approved by the shareholders at a meeting held subsequent to the fiscal year to which the dividends are

applicable. Semiannual interim dividends may also be paid upon resolution of the Board of Directors, subject to certain

limitations imposed by the Code.

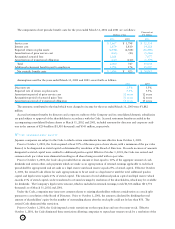

Under the Code, the amount available for dividends is based on retained earnings as recorded on the Company’s books. At

March 31, 2002, retained earnings recorded on the Company’s books were ¥148,147 million ($1,113,887 thousand), which

are available for future dividends subject to approval of the shareholders and legal reserve requirements.

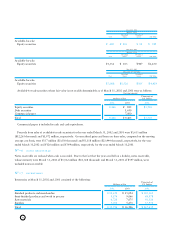

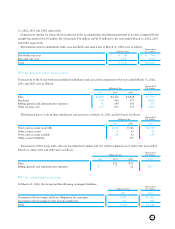

No»11 income taxes

The Company and its domestic subsidiaries are subject to Japanese national and local income taxes which, in the aggregate,

resulted in a normal effective statutory tax rate of approximately 41.7% for the years ended March 31, 2002, 2001 and 2000.

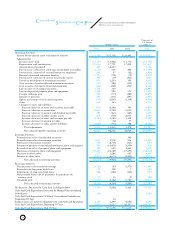

The tax effects of significant temporary differences which resulted in deferred tax assets and liabilities at March 31, 2002

and 2001 are as follows:

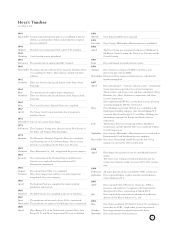

Thousands of

Millions of Yen U.S. Dollars

2002 2001 2002

Current:

Deferred tax assets:

Amortization of goodwill ¥1,266 ¥1,265 $ 9,519

Accrued bonuses to employees 1,090 870 8,195

Inventories-intercompany unrealized profits 921 1,068 6,925

Accrued enterprise taxes 351 737 2,639

Other 622 1,174 4,677

Total 4,250 5,114 31,955

Deferred tax liabilities:

Prepaid pension cost 518 487 3,895

Other 117 127 879

Total 635 614 4,774

Net deferred tax assets ¥3,615 ¥4,500 $27,181

Non-current:

Deferred tax assets:

Amortization of goodwill ¥2,910 ¥4,328 $21,880

Accrued retirement benefits 2,548 2,520 19,158

Devaluation of property, plant and equipment

and software 677 641 5,090

Allowance for doubtful receivables 247 626 1,857

Other 2,254 1,730 16,947

Total 8,636 9,845 64,932

Deferred tax liabilities:

Reserves for special depreciation and other 1,001 1,019 7,526

Other 224 171 1,684

Total 1,225 1,190 9,210

Net deferred tax assets ¥7,411 ¥8,655 $55,722