Nissan 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Maintaining Trust Through Transparency

Automotive business must have adequate liquidity to provide for working capital needs of day-to-

day normal operations, capital investment needs for future expansion and repayment of maturing

debt. Liquidity can be secured through internal cash and cash equivalents or external borrowings. As

of the end of fiscal year 2010 (March 31, 2011), Nissan’s automotive business had ¥1,132.5 billion

of cash and cash equivalents (compared with ¥746.5 billion as of March 31, 2010). Additionally, we

had approximately ¥465.8 billion of committed lines available for drawing. As for external

borrowings, Nissan raises financing through several sources including bonds issuance in capital

markets, long- and short-term loans from banks, short-term commercial paper issuance and

committed credit lines from banks.

Nissan has a liquidity risk management policy which is intended to ensure adequate liquidity for

the business while at same time ensuring we mitigate liquidity risks such as unmanageable bunched

maturities of debt. Target liquidity is defined objectively considering several factors including debt

maturity, upcoming mandatory payments (such as dividends, investments, taxes) and peak operating

cash needs. We also benchmark our liquidity targets with other major Japanese corporations and

global auto companies to ensure we are reasonable in our assumptions.

Sales finance

Nissan operates captive sales finance companies in Japan, United States, Canada, Mexico, China,

Australia and Thailand. In these countries, banks and other financial institutions are also involved in

providing financing solutions to Nissan’s customers and dealers. Additionally, in Europe and other

regions, RCI Banque and several other banks/financial institutions are providing financing to

Nissan’s customers and dealers. We monitor liquidity of sales finance companies on an ongoing

basis to ensure we have adequate liquidity to meet maturing debt and continue operations. As a

policy, we target to match maturity of liabilities with maturity of assets wherever possible. In some of

the countries where we operate, long-term capital markets are not developed and thus it is not

always possible to be perfectly match-funded. Match funding policy allows us to meet maturing debt

obligations even in an environment in which we cannot raise additional debt due to the state of

capital markets.

In addition to match funding, we manage liquidity risk at sales financing through several measures

including keeping adequate liquidity in form of cash and unutilized committed lines, unencumbered

assets (mainly vehicle loans and leases), liquidity support from auto operations to the extent we have

excess cash in auto operations, diversified funding sources and geographical diversification of

capital markets’ access. As of March 31, 2011, sales finance companies’ liquidity (cash and

unutilized committed lines) was approximately ¥474 billion. Additionally, we have a healthy mix of

secured (39%) and unsecured (61%) funding sources which ensure a stronger balance sheet and

incremental liquidity through utilization of unencumbered assets.

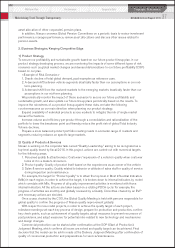

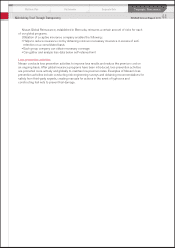

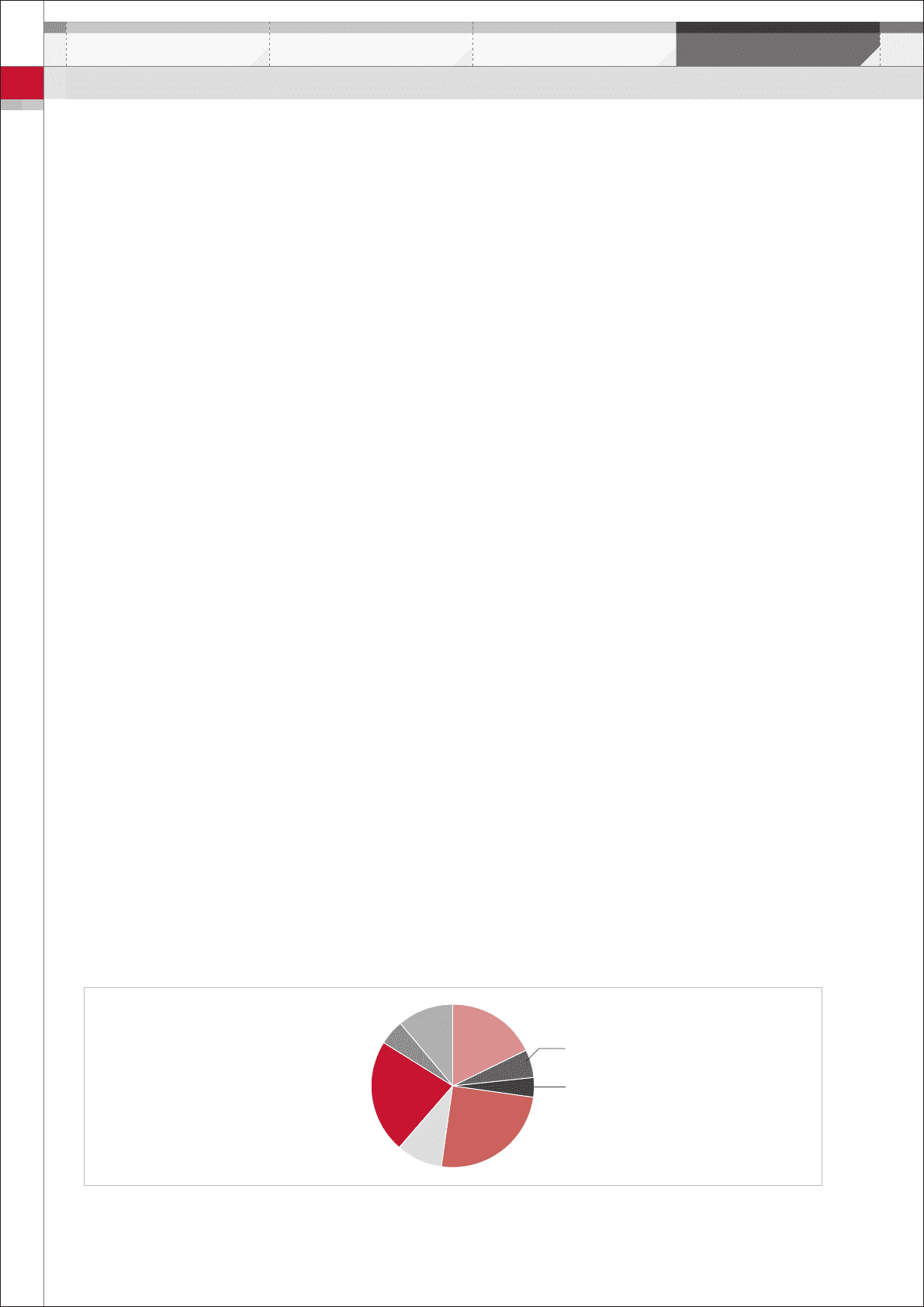

The pie chart below describes our diversified funding sources in sales finance business. During

fiscal year 2010, we were able to raise new financings through bank loans, asset securitization,

asset-backed commercial paper, commercial paper and bonds reflecting our diversified access to

financing instruments.

SALES FINANCE BUSINESS FUNDING SOURCES (As of March, 2011)

Group Finance (Inter-Company)

17.8%

Commercial Paper 5.6%

ABS On B/S 22.4%

L/T Loan 25.0%

Bonds 9.3%

S/T Loan 3.9%

Equity 10.9%

ABS Off B/S 5.1%

Corporate Governance

Performance Corporate DataMid-term Plan

34

NISSAN Annual Report 2011