Nissan 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

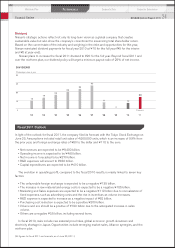

Dividend

Nissan’s strategic actions reflect not only its long-term vision as a global company that creates

sustainable value but also show the company’s commitment to maximizing total shareholder return.

Based on the current state of the industry and weighing in the risks and opportunities for this year,

Nissan reinstated dividend payments for fiscal year 2010 at ¥10 for the full year (¥5 for the interim

and ¥5 at year-end).

Nissan plans to increase the fiscal 2011 dividend to ¥20 for the full year. Beyond fiscal 2011 and

over the mid-term plan, our dividend policy will target a minimum payout ratio of 25% of net income.

(Dividend per share, in yen)

60

45

30

15

0

’02

14

’03

19

’05

29

’04

24

’10

10

(Forecast)

’11

20

’09

0

’08

11

’07

40

’06

34

DIVIDEND

Fiscal 2011 Outlook

In light of the outlook for fiscal 2011, the company filed its forecast with the Tokyo Stock Exchange on

June 23. Assumptions included retail unit sales of 4,600,000 units, which is an increase of 9.9% from

the prior year, and foreign exchange rates of ¥80 to the dollar and ¥115 to the euro.

• Net revenues are expected to be ¥9,400 billion.

• Operating income is expected to be ¥460 billion.

• Net income is forecasted to be ¥270 billion.

• R&D expenses will amount to ¥460 billion.

• Capital expenditures are expected to be ¥410 billion.

The evolution in operating profit, compared to the fiscal 2010 results, is mainly linked to seven key

factors:

• The unfavorable foreign exchange is expected to be a negative ¥135 billion.

• The increase in raw material and energy costs is expected to be a negative ¥155 billion.

• Marketing and Sales expenses are expected to be a negative ¥112 billion due to normalization of

fixed expenses, such as advertising costs and the rise in incentives as volume increases.

• R&D expense is expected to increase as a negative impact of ¥62 billion.

• Purchasing cost reduction is expected to be a positive ¥200 billion.

• Volume and mix should be a positive of ¥190 billion due to the anticipated increase in sales

volume.

• Others are a negative ¥3.5 billion, including several items.

In fiscal 2010, risks include raw material price hikes, global economic growth slowdown and

electricity shortage in Japan. Opportunities include emerging market sales, Alliance synergies, and the

mid-term plan.

(All figures for fiscal 2011 are forecasts, as of June 23, 2011.)

Financial Review

Performance

Corporate Data Corporate GovernanceMid-term Plan

24

NISSAN Annual Report 2011