Nissan 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

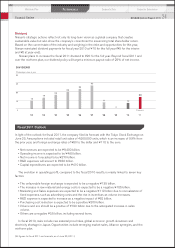

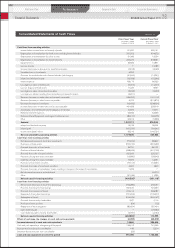

Fiscal 2010 Financial Performance

Net sales

For fiscal year 2010, consolidated net revenues increased 16.7%,

to ¥8.773 trillion, which reflected sales volume increase in spite of

the strong yen.

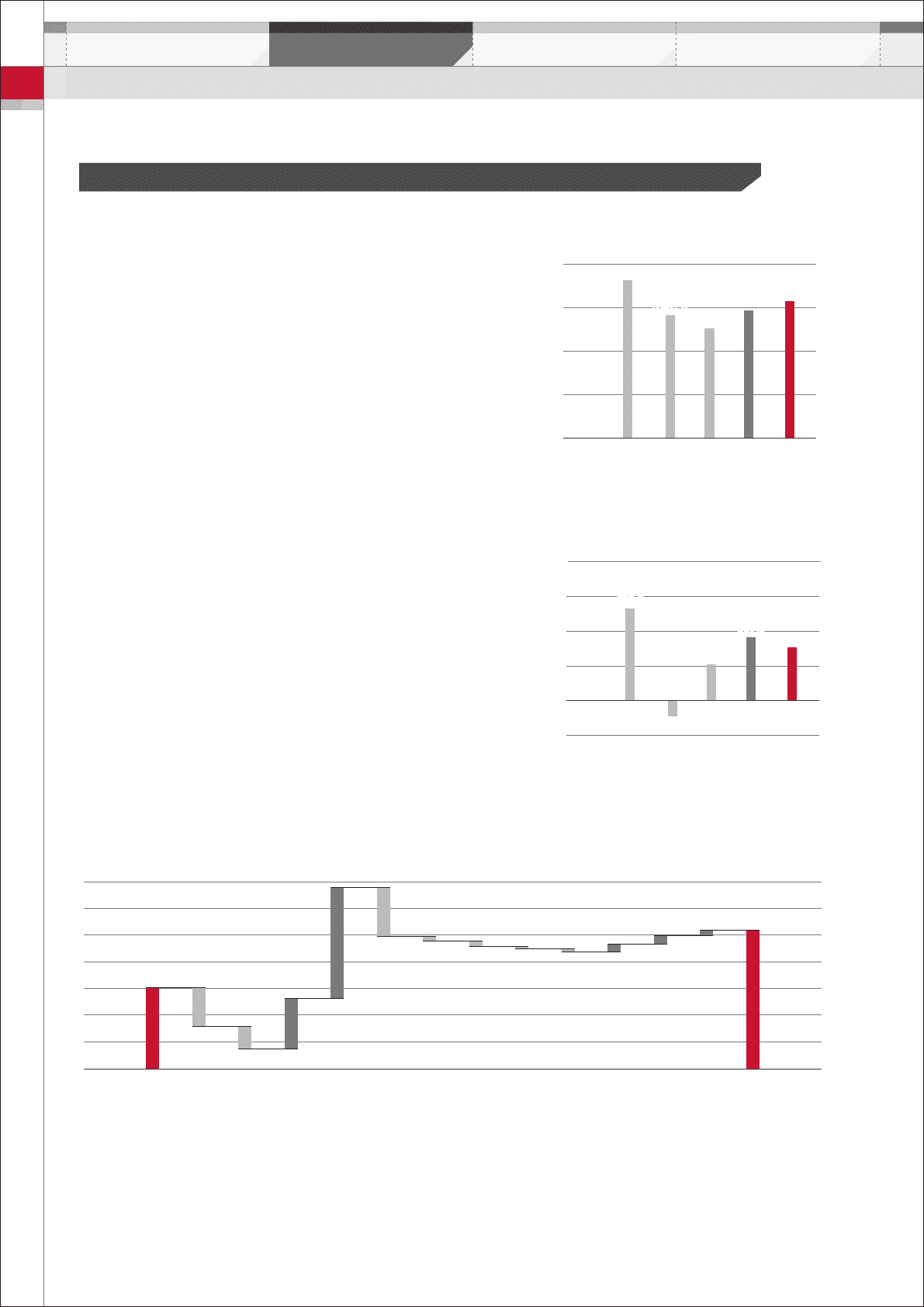

Operating profit

Consolidated operating profit totaled ¥537.5 billion, which was

improved 72.5% from last year. In comparison to last year’s

consolidated operating profit, the variance was due to the following

factors:

• Foreign exchange rate movements resulted in a ¥147.5 billion

negative impact. By currency, the majority of this variance was

due to the impact of the U.S. dollar at ¥117.3 billion, the

Russian ruble at ¥17.7 billion and the Canadian dollar at ¥1.8

billion.

• Net purchasing cost reduction efforts were a positive ¥105.8

billion. This included the negative impact from the increase in

raw material and energy cost by ¥85.2 billion.

• Volume and mix was a positive ¥433.1 billion due to the

increase in global sales volume.

• The increase in marketing and sales expenses was a negative

¥191.5 billion. This mainly came from the sales incentive

increase related to sales volume increase.

• R&D costs increased ¥18.5 billion.

• Sales financing contributed a positive ¥29.5 billion. This was

due mainly to improved borrowing costs across the globe and

lower credit loss ratio compared to fiscal year 2009.

• The remaining variance was a positive ¥15 billion, due mainly to

the increase in profit from affiliated companies.

NET SALES

12,000

9,000

6,000

3,000

0

(Billions of yen)

’10

8,773.1

’11

(Forecast)

9,400.0

’07

10,824.2

’08

8,437.08,437.0

’09

7,517.3

1,200

(Billions of yen)

900

600

0

300

−300

OPERATING PROFIT

’10

537.5537.5

(Forecast)

’11

460.0

’07

790.8790.8

’08

–137.9

’09

311.6

(Billions of yen)

FY09

O.P.

FY10

O.P.

IMPACT ON OPERATING PROFIT

Raw

material

/energy

cost

Mfg.

exp.

R&D

exp.

FOREX Selling

exp. Warranty

exp.

Purch.

cost

reduction

Resale of

returned

lease

vehicles

Volume/

mix AFLSales

finance After sales

&

others

311.6

311.6

537.5

-147.5

–147.5

–85.2

+191.0

–191.5

–19.8 –18.5

+433.1

–11.7 –7.1

+29.5 +32.2 +21.4

Financial Review

Performance

Corporate Data Corporate GovernanceMid-term Plan

21

NISSAN Annual Report 2011