Nissan 2011 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2011 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

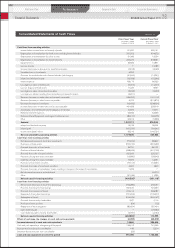

Sales finance

Due to the increase in retail sales, total financial assets of the sales finance segment increased by

1.3% to ¥4,414.3 billion from ¥4,355.9 billion in fiscal 2010. The sales finance segment generated

¥100.4 billion in operating profits in fiscal 2010, up from ¥77.5 billion in fiscal 2009. The improvement

in profitability was due to improved borrowing rates and lower credit loss ratio compared to the prior

year.

Investment policy

Capital expenditures totaled ¥312 billion, which was 3.6% of net revenue. Despite the economic crisis,

the company used capital expenditures in order to ensure Nissan’s future competitiveness. For fiscal

year 2010, the company invested committed to strategic initiatives, such as the zero-emission Nissan

LEAF electric vehicle and the V-platform Global Compact Car.

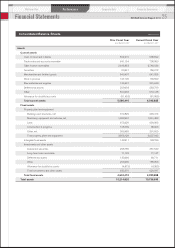

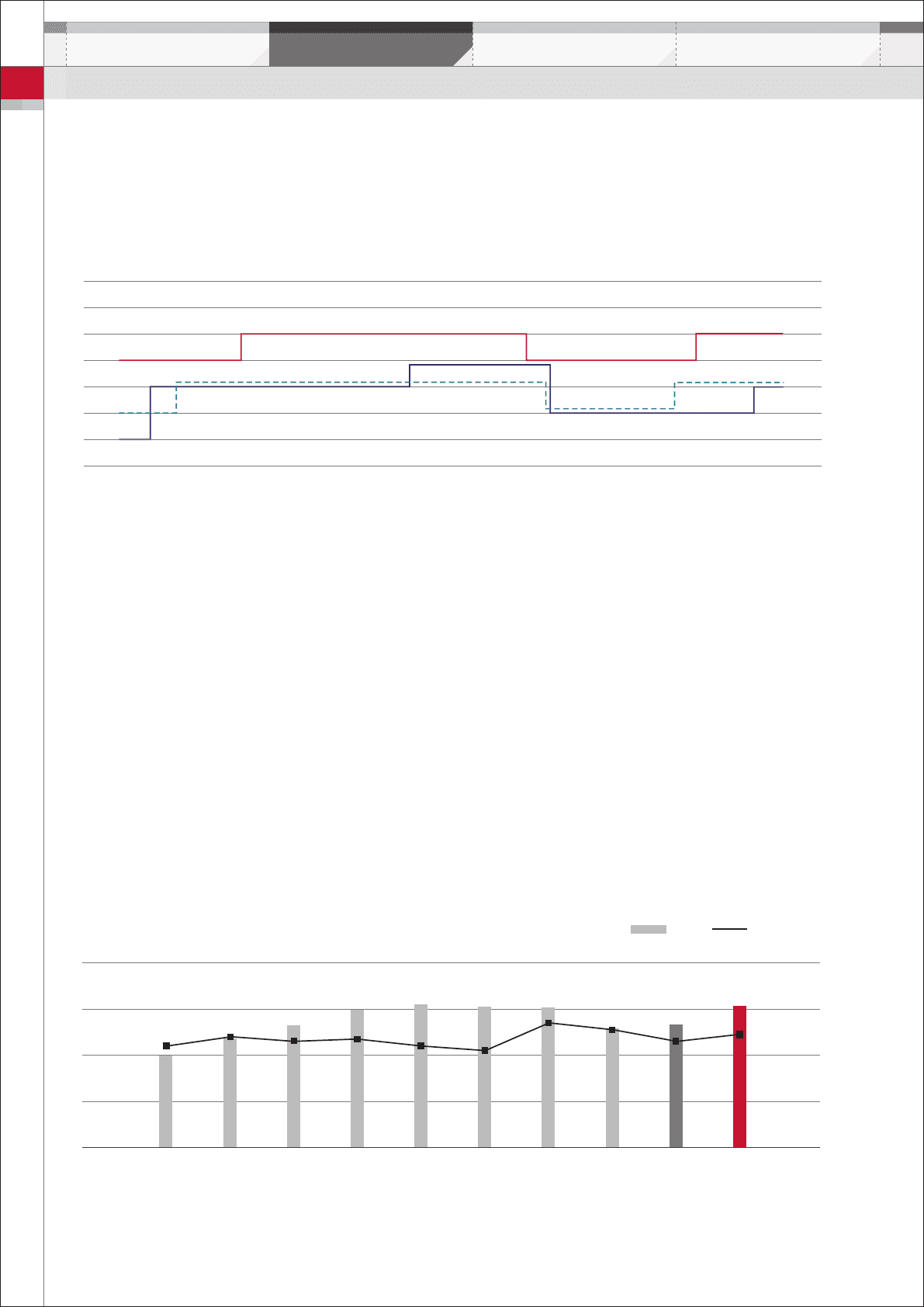

R&D expenditures totaled ¥399.3 billion. These funds were used to develop new technologies and

products. One of the company’s strengths is its extensive collaboration and development structure with

Renault’s R&D team, resulting from the Alliance.

Nissan plans more than 90 new advanced technologies, averaging 15 per year during our mid-term

plan, by 2016.

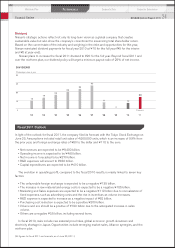

Aa3

A1

A2

A3

Baa1

Baa2

Baa3

Ba1

10/03 4/04 10/04 4/05 10/05 4/06 10/06 4/07 10/07 4/08 10/08 4/09 10/09 4/10 10/10 4/11 7/11

AA-

A+

A

A-

BBB+

BBB

BBB-

BB+

R&I

S&P

Moody’s

CORPORATE RATINGS

600

(Billions of yen)

450

300

150

0

8

6

4

2

0

(%)

’10

399.3

’11

(Forecast)

460

’09

386

’02

300

4.4%

’03

354

4.8%

’05

448

4.7%

’04

398

4.6% 4.6%

4.9%

5.1%

’08

456

5.4%

’07

458

4.2%

’06

465

4.4%

R&D EXPENDITURES % of net revenue

R&D

Credit rating

Nissan’s long-term credit rating with R&I is A with a stable outlook. S&P’s long-term credit rating for

Nissan is BBB+ with a stable outlook. Nissan’s rating with Moody’s is Baa1 with a positive outlook.

Financial Review

Performance

Corporate Data Corporate GovernanceMid-term Plan

23

NISSAN Annual Report 2011