National Grid 2016 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

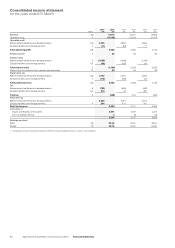

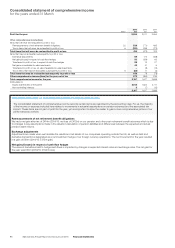

Notes

2016

£m

2015

£m

2014

£m

Profit for the year 2,594 2,011 2,464

Other comprehensive income/(loss)

Items that will never be reclassified to profit or loss:

Remeasurements of net retirement benefit obligations 22 539 (771) 485

Tax on items that will never be reclassified to profit or loss 6(125) 299 (172)

Total items that will never be reclassified to profit or loss 414 (472) 313

Items that may be reclassified subsequently to profit or loss:

Exchange adjustments 69 175 (158)

Net gains/(losses) in respect of cash flow hedges 50 (154) 63

Transferred to profit or loss in respect of cash flow hedges 29 13 27

Net gains on available-for-sale investments 43 41 6

Transferred to profit or loss on sale of available-for-sale investments –(8) (14)

Tax on items that may be reclassified subsequently to profit or loss 6(32) 11 (2)

Total items that may be reclassified subsequently to profit or loss 159 78 (78)

Other comprehensive income/(loss) for the year, net of tax 573 (394) 235

Total comprehensive income for the year 3,167 1,617 2,699

Attributable to:

Equity shareholders of the parent 3,164 1,624 2,711

Non-controlling interests 3(7) (12)

3,167 1,617 2,699

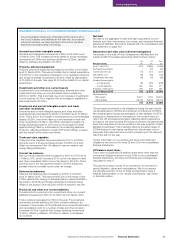

Unaudited commentary on consolidated statement of comprehensive income

The consolidated statement of comprehensive income records certain items as prescribed by the accounting rules. For us, the majority

ofthe income or expense included here relates to movements in actuarial assumptions on pension schemes and the associated tax

impact.These items are not part of profit for the year, yet are important to allow the reader to gain a more comprehensive picture of our

performance as a whole.

Remeasurements of net retirement benefit obligations

We had a net gain after tax of £414m (2014/15: net loss of £472m) on our pension and other post-retirement benefit schemes which is due

tochanges in key assumptions made in the valuation calculation of pension liabilities and differences between the expected and actual

pension asset returns.

Exchange adjustments

Adjustments are made when we translate the results and net assets of our companies operating outside the UK, as well as debt and

derivative transactions designated as a net investment hedge of our foreign currency operations. The net movement for the year resulted

ina gain of £69m (2014/15: £175m gain).

Net gains/(losses) in respect of cash flow hedges

The value of derivatives held to hedge cash flows is impacted by changes in expected interest rates and exchange rates. The net gain for

the year was £50m (2014/15: £154m loss).

96 National Grid Annual Report and Accounts 2015/16 Financial Statements

Consolidated statement of comprehensive income

for the years ended 31 March