National Grid 2016 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

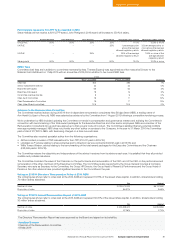

Materiality

Materiality is the magnitude of misstatement in the financial statements that makes it probable that the economic decisions ofreasonably

knowledgeable members would be changed or influenced. We use materiality both in planning the scope of our auditwork and inevaluating

the results of our work.

Based on our professional judgement, we determined materiality forthe financial statements as a whole as follows:

Area Commentary

Overall Group materiality

£157m

£157m (2015: £132m) is 5% of profit before tax, exceptional items and remeasurements

(‘adjusted profit before tax’). Whilst the benchmark has not changed, this ishigher than the

level we set for last year reflecting the increased profitability of the Group during the period.

Rationale for benchmark applied

5% of adjusted prot before tax,

exceptionalitems and remeasurements

We have chosen adjusted profit before tax because it is disclosed onthe face of the

consolidated income statement as the consistent yearon year measure of performance and

excludes the non-recurring disproportionate impact of exceptional items and remeasurements.

We also considered this measure to be suitable having compared to other benchmarks: our

materiality is 5.2% of statutory profit before tax,0.3% of total assets and 1.2% of net assets.

Performance materiality

£117m

We set a lower level of performance materiality for planning our auditto reduce the probability

that the aggregate of uncorrected andundetected misstatements exceeds materiality for the

financial statements as a whole to an appropriately low level.

Our judgement was that performance materiality for the Group shouldbe 75% (2015: 75%)

of overall materiality, being £117m (2015:£105m).

In planning our audit we allocate a specific performance materiality toeach of our component

audit teams. This is used to determine the extent of our audit procedures at a component level

for the purposes of reporting on the National Grid Group financial statements. These are

summarised below.

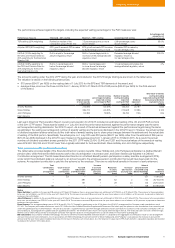

Component performance materiality

2016

£m

2015

£m

US Regulated (full scope audit) 65 60

UK Electricity Transmission (full scope audit) 38 32

UK Gas Transmission (full scope audit) 30 19

UK Gas Distribution (full scope audit) 39 29

Corporate activities

UK treasury and UK tax

UK pensions

68

83

65

65

UK Property (environmental provisions only) andInsurance

(accounts payable and financialinvestments only) 88

Reporting level

£7m

We agreed with the Audit Committee that we would report to them misstatements identified

during our audit above £7m (2015: £6m) being 5% of our overall materiality. We also report

misstatements below that amount that, in our view, warrant reporting for qualitativereasons.

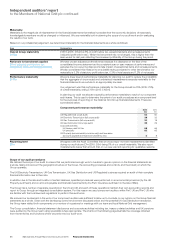

Scope of our audit procedures

We tailored the scope of our audit to ensure that we performed enough work to be able to give an opinion on the financial statementsas

awhole, taking into account the geographic structure ofthe Group, the accounting processes and controls, and the industry inwhich the

Group operates.

The UK Electricity Transmission, UK Gas Transmission, UK Gas Distribution and US Regulated business required an audit of their complete

financial information due to their size.

In addition due to the size and location of certain balances, specifiedprocedures were performed on environmental provisions (by theUK

Property audit team) and on amounts payable and financial investments (by the PwC Insurance audit team in the IsleofMan).

The Group has a number of separate operations in the US and UK and each of these operations maintain their own accounting records and

report to Group through an integrated consolidation system. Forthis reason we used component auditors within PwC UK and PwC US who

are familiar with the local laws and regulations to perform thisaudit work.

We ensured our involvement in the work of our component auditors was sufficient to allow us to conclude on our opinion on the Group financial

statements as a whole. Given both the developing control environment discussed below and the potential UK Gas Distribution transaction,

the Group team visited both components on a number ofoccasions for meetings with our team and local National Grid management.

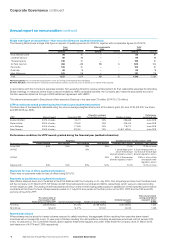

The Group consolidation, financial statement disclosures and corporate activities including tax, treasury related activities and UKpensions

were audited by the Group team using specialists whereappropriate. The charts on the following page illustrate the coverage obtained

fromthe territories andfunctions where we performed ouraudit work.

86 National Grid Annual Report and Accounts 2015/16 Financial Statements

Independent auditors’ report

to the Members of National Grid plc continued