National Grid 2016 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

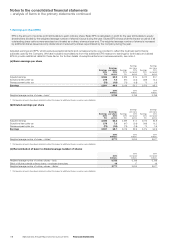

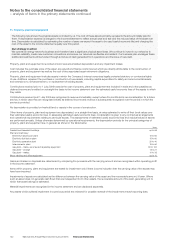

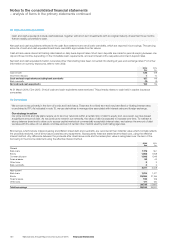

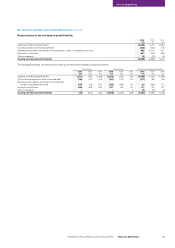

15. Derivative financial instruments continued

Derivatives not in a formal hedge relationship

Our policy is not to use derivatives for trading purposes. However, due to the complex nature of hedge accounting under IAS 39 some

derivatives may not qualify for hedge accounting, or are specifically not designated as a hedge where natural offset is more appropriate.

Changes in the fair value of any derivative instruments that do not qualify for hedge accounting are recognised in remeasurements within

theincome statement.

2016

£m

2015

£m

Cross-currency interest rate/interest rate swaps 51 119

Foreign exchange forward contracts 77 (24)

Inflation linked swaps (268) (271)

Equity options 1–

(139) (176)

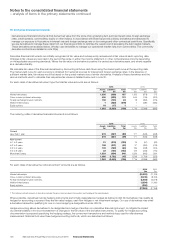

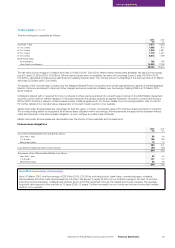

Discontinuation of hedge accounting

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, exercised or no longer qualifies for hedge

accounting. At that time, any cumulative gains or losses relating to cash flow hedges recognised in equity are initially retained in equity and

subsequently recognised in the income statement in the same periods in which the previously hedged item affects profit or loss. Amounts

deferred in equity with respect to net investment hedges are subsequently recognised in the income statement in the event of the disposal

ofthe overseas operations concerned. For fair value hedges, the cumulative adjustment recorded to the carrying value of the hedged item

atthe date hedge accounting is discontinued is amortised to the income statement using the effective interest method.

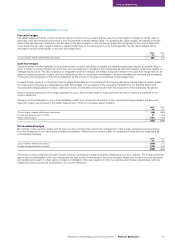

Embedded derivatives

No adjustment is made with respect to derivative clauses embedded in financial instruments or other contracts that are defined as closely

related to those instruments or contracts. Consequently these embedded derivatives are not accounted for separately from the debt

instrument. Where there are embedded derivatives in host contracts not closely related, the embedded derivative is separately accounted

foras a derivative financial instrument.

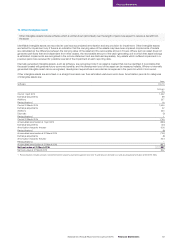

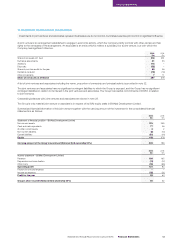

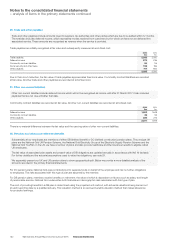

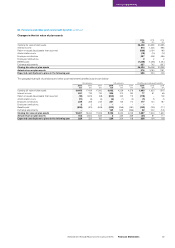

16. Inventories and current intangible assets

Inventories represent assets that we intend to use in order to generate revenue in the short term, either by selling the asset itself (for example

fuel stocks) or by using it to fulfil a service to a customer or to maintain our network (consumables).

Inventories are stated at the lower of weighted average cost and net realisable value.

Where applicable, cost comprises direct materials and direct labour costs as well as those overheads that have been incurred in bringing the

inventories to their present location and condition.

Emission allowances, principally relating to the emissions of carbon dioxide in the UK and sulphur and nitrous oxides in the US, are recorded

asintangible assets within current assets and are initially recorded at cost and subsequently at the lower of cost and net realisable value.

Where emission allowances are granted by relevant authorities, cost is deemed to be equal to the fair value at the date of allocation. Receipts

of such grants are treated as deferred income, which is recognised in the income statement as the related charges for emissions are recognised

or on impairment of the related intangible asset. A provision is recorded in respect of the obligation to deliver emission allowances and

emission charges are recognised in the income statement in the period in which emissions are made.

2016

£m

2015

£m

Fuel stocks 120 112

Raw materials and consumables 203 152

Work in progress 13 13

Current intangible assets – emission allowances 101 63

437 340

There is a provision for obsolescence of £28m against inventories as at 31 March 2016 (2015: £28m).

Notes to the consolidated financial statements

– analysis of items in the primary statements continued

128 National Grid Annual Report and Accounts 2015/16 Financial Statements