National Grid 2016 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

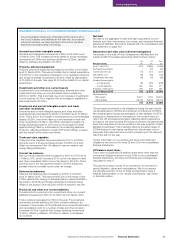

1. Basis of preparation and recent accounting developments continued

C. Foreign currencies

Transactions in currencies other than the functional currency of the Company or subsidiary concerned are recorded at the rates of exchange

prevailing on the dates of the transactions. At each reporting date, monetary assets and liabilities that are denominated in foreign currencies

are retranslated at closing exchange rates. Non-monetary assets are not retranslated unless they are carried at fair value.

Gains and losses arising on the retranslation of monetary assets and liabilities are included in the income statement, except where the adoption

of hedge accounting requires inclusion in other comprehensive income – note 15.

On consolidation, the assets and liabilities of operations that have a functional currency different from the Company’s functional currency

ofpounds sterling, principally our US operations that have a functional currency of US dollars, are translated at exchange rates prevailing at the

reporting date. Income and expense items are translated at the average exchange rates for the period where these do not differ materially from

rates at the date of the transaction. Exchange differences arising are classified as equity and transferred to the consolidated translation reserve.

D. Areas of judgement and key sources of estimation uncertainty

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets

and liabilities, disclosures of contingent assets and liabilities and the reported amounts of revenue and expenses during the reporting period.

Actual results could differ from these estimates. Information about such judgements and estimations is contained in the notes to the financial

statements, and the key areas are summarised below.

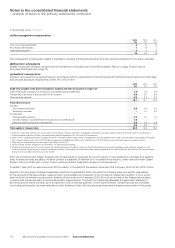

Areas of judgement that have the most significant effect on the amounts recognised in the financial statements are as follows:

• the categorisation of certain items as exceptional items and the definition of adjusted earnings – notes 4 and 7;

• energy purchase contracts as being for normal purchase, sale or usage – note 27; and

• the recognition of surpluses in respect of defined benefit pension schemes – notes 22 and 29.

IFRS provides certain options available within accounting standards. Choices we have made, and continue to make, include the following:

• Presentational formats: we use the nature of expense method for our income statement and aggregate our statement of financial

positiontonet assets and total equity. In the income statement, we present subtotals of total operating profit, profit before tax and

profitfrom continuing operations, together with additional subtotals excluding exceptional items and remeasurements. Exceptional

itemsand remeasurements are presented separately on the face of the income statement.

• Customer contributions: contributions received prior to 1 July 2009 towards capital expenditure are recorded as deferred income

andamortised in line with the depreciation on the associated asset.

• Financial instruments: we normally opt to apply hedge accounting in most circumstances where this is permitted. For net investment

hedges, we have chosen to use the spot rate method, rather than the alternative forward rate method.

Key sources of estimation uncertainty that have significant risk of causing a material adjustment to the carrying amounts of assets and liabilities

within the next financial year are as follows:

• review of residual lives, carrying values and impairment charges for other intangible assets and property, plant and equipment – notes

10and 11;

• estimation of liabilities for pensions and other post-retirement benefits – notes 22 and 29;

• valuation of financial instruments and derivatives – notes 15 and 30;

• revenue recognition and assessment of unbilled revenue – note 2; and

• environmental and decommissioning provisions – note 23.

In order to illustrate the impact that changes in assumptions could have on our results and financial position, we have included sensitivity

analysis in note 33.

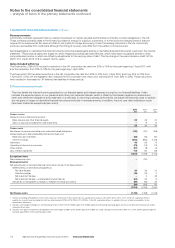

New IFRS accounting standards and interpretations adopted in 2015/16

The following standards, interpretations and amendments, issued by the IASB and by the IFRS Interpretations Committee (IFRIC), are effective

for the year ended 31 March 2016. None of the pronouncements has had a material impact on the Company’s consolidated results or assets

and liabilities for the year ended 31 March 2016.

• Amendment to IAS 19 ‘Defined Benefit Plans: Employee Contributions’;

• Annual Improvements to IFRSs 2010-2012 Cycle; and

• Annual Improvements to IFRSs 2011-2013 Cycle.

Financial Statements

103National Grid Annual Report and Accounts 2015/16 Financial Statements