National Grid 2016 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

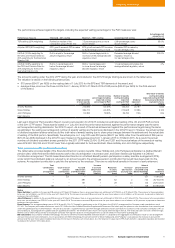

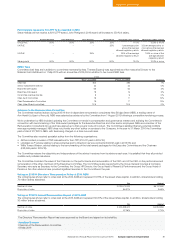

Shareholding requirement

The requirement of Executive Directors to build up and hold a relatively high value of National Grid shares ensures they share a significant

level of risk with shareholders and their interests are aligned.

From 2014/15, Executive Directors are required to build up and retain shares in the Company. The level of holding required is 500% of salary

for the CEO and 400% of salary for the other Executive Directors.

Unless the shareholding requirement is met, Executive Directors will not be permitted to sell shares, other than to pay tax or in

exceptionalcircumstances.

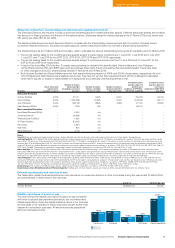

Policy on recruitment remuneration

Salaries for new Executive Directors appointed to the Board will be set in accordance with the terms of the approved remuneration policy

in force at the time of appointment, and in particular will take account of the appointee’s skills and experience as well as the scope and market

rate for the role.

Where appropriate, salaries may be set below market level initially, with the Committee retaining discretion to award increases in salary in excess

of those of the wider workforce and inflation to bring salary to a market level over time, where this is justified by individual and Company

performance.

Benefits consistent with those offered to other Executive Directors under the approved remuneration policy in force at the time of appointment will

be offered, taking account of local market practice. The Committee may also agree that the Company will meet certain costs associated with the

recruitment, for example legal fees, and the Committee may agree to meet certain relocation expenses or provide tax equalisation as appropriate.

Pensions for new Executive Directors appointed to the Board will be set in accordance with the terms of the approved remuneration policy in force

at the time of appointment.

Ongoing incentive pay (APP and LTPP) for new Executive Directors will be in accordance with the approved remuneration policy in force at the

time of appointment. This means the maximum APP award in any year would be 125% of salary and the maximum LTPP award would be 300%

of salary (350% of salary for a new CEO).

For an externally appointed Executive Director, the Company may offer additional cash or share-based payments that it considers necessary

to buy out current entitlements from the former employer that will be lost on recruitment to National Grid. Any such arrangements would reflect

the delivery mechanisms, time horizons and levels of conditionality of the remuneration lost.

In order to facilitate buy-out arrangements as described above, existing incentive arrangements will be used to the extent possible, although

awards may also be granted outside of these shareholder-approved schemes if necessary and as permitted under the Listing Rules.

For an internally appointed Executive Director, any outstanding variable pay element awarded in respect of the prior role will continue on

its original terms.

Fees for a new Chairman or Non-executive Director will be set in line with the approved policy in force at the time of appointment.

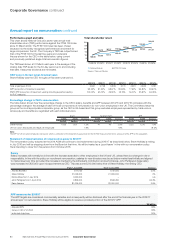

Policy on payment for loss of office

In line with our policy, all Executive Directors have service contracts which are terminable by either party with 12 months’ notice.

The contracts contain provisions for payment in lieu of notice, at the sole and absolute discretion of the Company. Such payments are limited

to payment of salary only for the remainder of the notice period. In the UK such payments would be phased on a monthly basis, over a period

no greater than 12 months, and the Executive Director would be expected to mitigate any losses where employment is taken up during the notice

period. In the US, for tax purposes the policy is to make any payment in lieu of notice as soon as reasonably practicable, and in any event within

two and a half months of the later of 31 December and 31 March immediately following the notice date.

In the event of a UK Director being made redundant, statutory compensation would apply and the relevant pension plan rules may result in the

early payment of an unreduced pension.

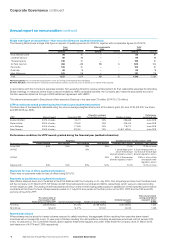

On termination of employment, no APP award would generally be payable and any DSP awards would generally lapse. However, the Committee

has the discretion to deem an individual to be a ‘good leaver’, in which case an APP award would be payable on the termination date, based on

performance during the financial year up to termination, and DSP awards would vest on the termination date. Examples of circumstances in which

a Director would be treated as a ‘good leaver’ include redundancy, retirement, illness, injury, disability and death. Any APP award would be

prorated and would be subject to performance achieved against the objectives for that year.

On termination of employment, outstanding awards under the share plans will be treated in accordance with the relevant plan rules approved by

shareholders. Share awards would normally lapse. ‘Good leaver’ provisions apply at the Committee’s discretion and in specified circumstances,

including redundancy, retirement, illness, injury, disability and death, where awards will be released to the departing Executive Director or, in the

case of death, to their estate. Long-term share plan awards held by ‘good leavers’ may vest subject to performance measured at the normal

vesting date and are prorated. Such awards would vest at the same time as for other participants.

The Chairman’s appointment is subject to six months’ notice by either party; for the other Non-executive Directors, notice is one month.

No compensation is payable to Non-executive Directors if required to stand down.

Directors’ remuneration policy – approved by shareholders in 2014 continued

74 National Grid Annual Report and Accounts 2015/16 Corporate Governance

Corporate Governance continued