National Grid 2016 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

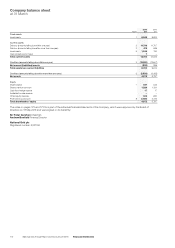

We are required to include the stand-alone balance sheet of our ultimate parent Company, National Grid plc, under the Companies Act 2006.

This is because the publicly traded shares are actually those of National Grid plc (the Company) and the following disclosures provide additional

information to shareholders.

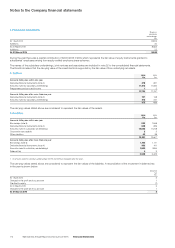

A. Basis of preparation

National Grid plc is the parent company of the National Grid Group

which is engaged in the transmission and distribution of electricity

and gas in Great Britain and northeastern US. The Company is a

public limited liability company incorporated and domiciled in England,

with its registered office at 1–3 Strand, London, WC2N 5EH.

The financial statements of National Grid plc for the year ended

31March 2016 were approved by the Board of Directors on

18May2016. The Company meets the definition of a qualifying

entityunder Financial Reporting Standard 100 (FRS 100) issued

bythe Financial Reporting Council. Accordingly these individual

financialstatements of the Company were prepared in accordance

with Financial Reporting Standard 101 ‘Reduced Disclosure

Framework’ (FRS 101). In preparing these financial statements the

Company applies the recognition and measurement requirements

ofInternational Financial Reporting Standards (IFRS) as adopted

bythe EU, but makes amendments where necessary in order to

comply with the provisions of the Companies Act 2006 and sets

outbelow where advantage of the FRS 101 disclosure exemptions

has been taken.

These individual financial statements for the year ended 31 March

2016 are the first prepared in accordance with FRS 101. Accordingly

the date of transition is 1 April 2014. The 2015 comparative financial

information has also been prepared on this basis.

There were no material measurement or recognition adjustments

onthe adoption of FRS 101.

These individual financial statements of the Company have been

prepared in accordance with applicable UK accounting and financial

reporting standards and the Companies Act 2006. They have been

prepared on an historical cost basis, except for the revaluation of

financial instruments, and are presented in pounds sterling, which

isthe currency of the primary economic environment in which the

Company operates.

These individual financial statements have been prepared on a

goingconcern basis, which presumes that the Company has

adequate resources to remain in operation, and that the Directors

intend it to do so, for at least one year from the date the financial

statements are signed. As the Company is part of a larger group it

participates in the Group’s centralised treasury arrangements and

so shares banking arrangements with its subsidiaries. The Company

is expected to continue to generate positive cash flows or be in

a position to obtain finance via intercompany loans to continue to

operate for the foreseeable future.

The Directors are not aware of any material uncertainties related

toevents or conditions that may cast significant doubt upon the

Company’s ability to continue as a going concern. Thus they continue

to adopt the going concern basis of accounting in preparing the

annual financial statements.

The Company has not presented its own income statement or

statement of comprehensive income as permitted by section 408

ofthe Companies Act 2006.

The following exemptions from the requirements of IFRS have

beenapplied in the preparation of these financial statements

of theCompany in accordance with FRS 101:

• a cash flow statement and related notes;

• disclosures in respect of transactions with wholly

ownedsubsidiaries;

• disclosures in respect of capital management;

• the presentation of a third balance sheet (being the opening

balance sheet of the Company at the date of application of

FRS101); and

• the effects of new but not yet effective IFRSs.

As the consolidated financial statements of National Grid plc,

whichare available from the registered office, include the equivalent

disclosures, the Company has also taken the exemptions under

FRS101 in respect of certain disclosures required by IFRS 13

‘Fairvalue measurement’ and the disclosures required by IFRS 7

‘Financial instruments: disclosures’. The Company intends to apply

the above exemptions in the financial statements for the year ending

31 March 2017.

There are no critical areas of judgement that are considered to

haveasignificant effect on the amounts recognised in the financial

statements. Key sources of estimation uncertainty that have

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year are

thevaluation of financial instruments and derivatives.

The balance sheet has been prepared in accordance with the

Company’s accounting policies approved by the Board and

described below:

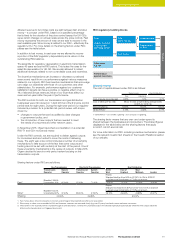

B. Fixed asset investments

Investments held as fixed assets are stated at cost less any provisions

for impairment. Investments are reviewed for impairment if events

or changes in circumstances indicate that the carrying amount

may not be recoverable. Impairments are calculated such that the

carrying value of the fixed asset investment is the lower of its cost

or recoverable amount. Recoverable amount is the higher of its

net realisable value and its value-in-use.

C. Tax

Current tax for the current and prior periods is provided at the

amountexpected to be paid or recovered using the tax rates and

taxlaws that have been enacted or substantively enacted by the

balance sheet date.

Deferred tax is provided in full on temporary differences which

resultin an obligation at the balance sheet date to pay more tax,

orthe right to pay less tax, at a future date, at tax rates expected

toapply when the temporary differences reverse based on tax rates

and tax laws that have been enacted or substantively enacted by

thebalance sheet date. Deferred tax is provided for using the

balancesheet liability method and is recognised on temporary

differences between the carrying amount of assets and liabilities

inthe financial statements and the corresponding tax bases used

inthe computation of taxable profit.

Deferred tax assets are recognised to the extent that it is regarded

asmore likely than not that they will be recovered. Deferred tax assets

and liabilities are not discounted.

168 National Grid Annual Report and Accounts 2015/16 Financial Statements

Company accounting policies