National Grid 2016 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

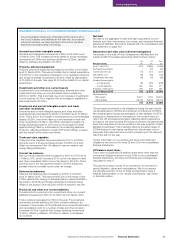

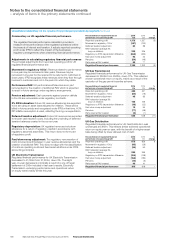

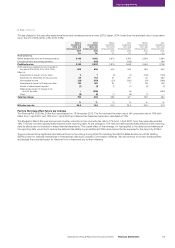

Unaudited commentary on the results of our principal operations by segment

As a business, we have three measures of operating profit that

are used on a regular basis and disclosed in this Annual Report.

Statutory operating profit: This is operating profit as calculated

under International Financial Reporting Standards (IFRS). Statutory

operating profit by segment is shown in note 2 on page 106.

Adjusted operating profit: Adjusted operating profit (business

performance) excludes items that if included could distort

understanding of our performance for the year and the comparability

between periods. Further details of items that are excluded in

adjusted operating profit are shown in note 4 on page 111.

Regulated financial performance: This is particularly relevant for

our UK operations and is a measure of operating profit that reflects

the impact of the businesses’ regulatory arrangements when

presenting financial performance.

Reconciliations between statutory and adjusted operating profit

canbe found on page 196. Reconciliations between adjusted

operating profit and regulated financial performance for UK

ElectricityTransmission, UK Gas Transmission and UK Gas

Distribution can be found on page 108.

Commentary on segmental adjusted operating profit results

We have summarised the results of our principal operating

segments here by segment to provide direct reference to the

results as disclosed in note 2. This analysis has been prepared

based on adjusted operating profit (operating profit before

exceptional items and remeasurements) as set out in note 2(b).

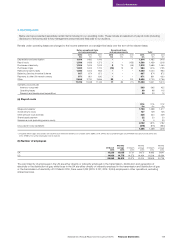

UK Electricity Transmission

For the year ended 31 March 2016, revenue in the UK Electricity

Transmission segment increased by £223m to £3,977m, and

adjusted operating profit decreased by £64m to £1,173m.

The revenue growth of £223m was principally due to the recovery

of higher pass-through costs such as payments to other UK

network owners and system balancing costs, and under-recoveries

of allowed revenues in the prior year. This was partly offset by

reductions inallowed revenues this year and a legal settlement

received in 2014/15 that did not repeat this year. Net revenue

(after deducting pass-through costs) was £14m higher. Regulated

controllable costs were £28m higher due to inflation and salary

growth, together with legal cost recoveries in the prior year, higher

tower maintenance costs and transformation costs associated with

our System Operator business. Depreciation and amortisation was

£14m higher reflecting the continued capital investment programme.

Other costs were £36m higher than prior year due to additional

asset impairments this year and lower scrap and disposal proceeds.

Capital investment remained around the same level as last year

at£1,084m.

UK Gas Transmission

Revenue in the UK Gas Transmission segment increased by £25m

in 2015/16 to £1,047m and adjusted operating profit increased by

£49m to £486m.

Revenue was £25m higher, principally due to over-recoveries

ofallowed revenues in the year. Regulated controllable costs were

£10m higher than last year, mainly as a result of inflation, higher

gassystem service charges and organisational change costs.

Depreciation costs were £6m higher due to ongoing investment

(investment in the year was £186m, similar to last year). Other

operating costs were £19m lower than last year, mostly reflecting

additional costs in 2014/15 relating to the closure of LNG facilities.

UK Gas Distribution

UK Gas Distribution revenue increased by £51m in the year

to£1,918m, and adjusted operating profit increased by £52m

to£878m.

Revenue was £51m higher, principally reflecting increased regulatory

allowances. In part, these allowances were increased to compensate

for expected increases in taxation costs reflecting a change to the

tax treatment of replacement expenditure. Regulated controllable

costs were £21m higher due to inflation, recruitment, property costs

and higher charges from our strategic partners to coverconnections

and winter resourcing. Depreciation and amortisation was £12m

higher reflecting the continued mains replacement programme

(investment in the year was £51m higher at £549m). Pass-through

costs charged to customers were £11m lower this year, and other

costs were £23m lower than prior year, which included provisions

for additional asset protection costs.

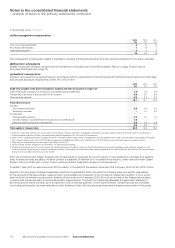

US Regulated

Revenue in our US Regulated businesses was £493m lower

at£7,493m, while adjusted operating profit increased by £21m

to£1,185m.

The stronger US dollar increased operating profit in the year by

£81m. Excluding the impact of foreign exchange rate movements,

revenue decreased by £1,051m, principally as a result of lower

commodity costs passed on to customers and unfavourable

timingof recoveries year over year, partly offset by higher revenue

allowances under the Niagara Mohawk three year rate plan and

thebenefit of capex trackers. The reduction in revenue was mostly

offset by a £1,027m reduction in pass-through costs incurred

(excluding the impact of foreign exchange). Regulated controllable

costs reduced by £71m at constant currency, partly as a result of

lower gas leak and compliance work this year and additional costs

incurred last year to improve data quality and bring regulatory filings

up to date. Depreciation and amortisation costs were £51m higher

this year at constant currency as a result of ongoing investment in

our networks. Pension costs were £15m higher at constant currency

due to changes in actuarial discount rates, while other operating

costs were £41m higher at constant currency including higher asset

removal costs.

Our capital investment programme continues in the US, with a

further £1,856m invested in 2015/16, including spend on gas mains

replacement, gas customer growth and electric system reinforcement.

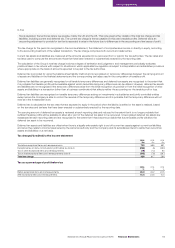

Other activities

Revenue in Other activities increased by £114m to £876m in the year

ended 31 March 2016. Adjusted operating profit was £175m higher

at £374m.

In the US, adjusted operating profit was £143m higher, reflecting

lower spend on upgrades to our finance systems which completed

last year. In addition, we benefited from a £49m gain on disposal of

our investment in the Iroquois pipeline, andthe deconsolidation of

our investment in Clean Line. In the UK, adjusted operating profit

was£32m higher as a result of strong auction revenues at the French

interconnector and higher property sales. Capital investment in our

Other activities was at a similar levelto last year at £218m.

Financial Statements

107National Grid Annual Report and Accounts 2015/16 Financial Statements