National Grid 2016 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

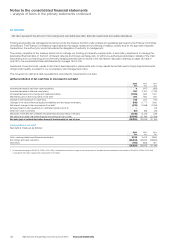

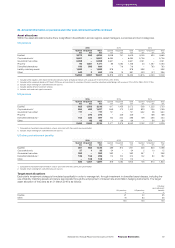

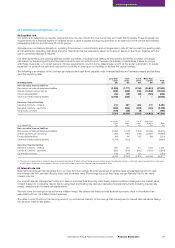

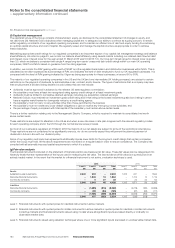

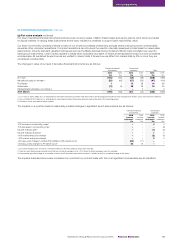

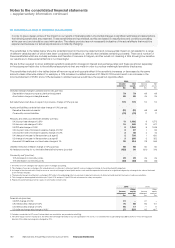

30. Financial risk management continued

(c) Interest rate risk continued

During 2016 and 2015, net debt was managed using derivative instruments to hedge interest rate risk as follows:

2016 2015

Fixed rate

£m

Floating

rate

£m

Inflation

linked

£m

Other1

£m

Total

£m

Fixed rate

£m

Floating

rate

£m

Inflation

linked

£m

Other1

£m

Total

£m

Cash and cash equivalents 1126 – – 127 1118 – – 119

Financial investments 54 2,939 – 5 2,998 281 2,273 – 5 2,559

Borrowings2(17,706) (3,008) (7,62 9) (1) (28,344) (16,229) (2,746) (6,933) (2) (25,910)

Pre-derivative position (17,651) 57 (7,629) 4(25,219) (15,947) (355) (6,933) 3(23,232)

Derivative effect31,788 (2,481) 587 –(106) 1,593 (2,294) 18 –(683)

Net debt position (15,863) (2,424) (7,042) 4(25,325) (14,354) (2,649) (6,915) 3(23,915)

1. Represents financial instruments which are not directly affected by interest rate risk, such as investments in equity or other similar financial instruments.

2. Includes bank overdrafts.

3. The impact of 2016/17 (2015: 2015/16) maturing short-dated interest rate derivatives is included.

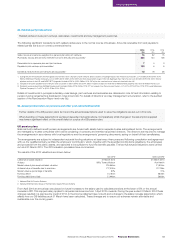

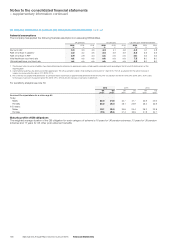

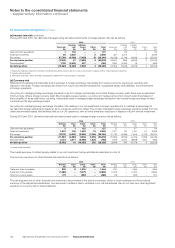

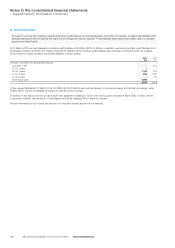

(d) Currency risk

National Grid operates internationally and is exposed to foreign exchange risk arising from various currency exposures, primarily with

respecttothe dollar. Foreign exchange risk arises from future commercial transactions, recognised assets and liabilities, and investments

inforeignoperations.

Our policy for managing foreign exchange transaction risk is to hedge contractually committed foreign currency cash flows over a prescribed

minimum size. Where foreign currency cash flow forecasts are less certain, our policy is to hedge a proportion of such cash flows based on

theprobability of those cash flows occurring. Instruments used to manage foreign exchange transaction risk include foreign exchange forward

contracts and foreign exchange swaps.

Our policy for managing foreign exchange translation risk relating to our net investment in foreign operations is to maintain a percentage of

netdebt and foreign exchange forwards so as to provide an economic offset. The primary managed foreign exchange exposure arises from the

dollar denominated assets and liabilities held by our US operations, with a further small euro exposure in respect of a joint venture investment.

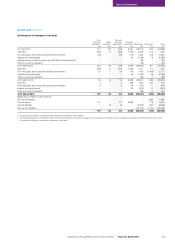

During 2016 and 2015, derivative financial instruments were used to manage foreign currency risk as follows:

2016 2015

Sterling

£m

Euro

£m

Dollar

£m

Other

£m

Total

£m

Sterling

£m

Euro

£m

Dollar

£m

Other

£m

Total

£m

Cash and cash equivalents 3 1 123 –127 12 –107 –119

Financial investments 1,201 105 1,622 70 2,998 1,227 90 1,181 61 2,559

Borrowings1(13,131) (5,061) (8,806) (1,346) (28,344) (11,791) (5,099) ( 7, 6 0 4 ) (1,416) (25,910)

Pre-derivative position (11,927) (4,955) (7,0 61) (1,276) (25,219) (10,552) (5,009) (6,316) (1,355) (23,232)

Derivative effect 2,374 4,971 (8,989) 1,538 (106) 1,608 5,203 (8,858) 1,364 (683)

Net debt position (9,553) 16 (16,050) 262 (25,325) (8,944) 194 (15,174) 9(23,915)

1. Includes bank overdrafts.

The overall exposure to dollars largely relates to our net investment hedge activities as described in note 15.

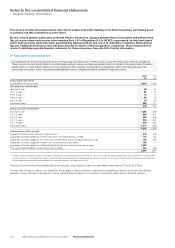

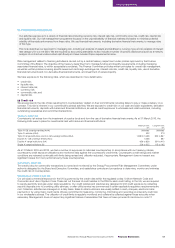

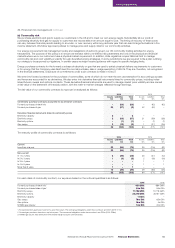

The currency exposure on other financial instruments is as follows:

2016 2015

Sterling

£m

Euro

£m

Dollar

£m

Other

£m

Total

£m

Sterling

£m

Euro

£m

Dollar

£m

Other

£m

Total

£m

Trade and other receivables 220 81,236 –1,464 200 –1,495 –1,695

Trade and other payables (1,380) –(1,471) –(2,851) (1,403) –(1,457) –(2,860)

Other non-current assets (17) –(252) –(269) (19) –(252) –(271)

The carrying amounts of other financial instruments are denominated in the above currencies, which in most instances are the functional

currency of the respective subsidiaries. Our exposure to dollars is due to activities in our US subsidiaries. We do not have any other significant

exposure to currency risk on these balances.

152 National Grid Annual Report and Accounts 2015/16 Financial Statements

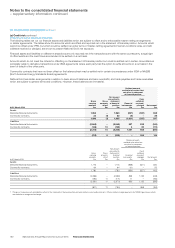

Notes to the consolidated financial statements

– supplementary information continued