National Grid 2016 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

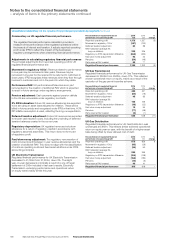

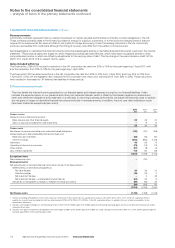

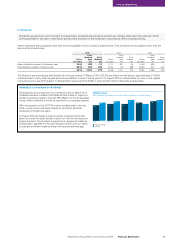

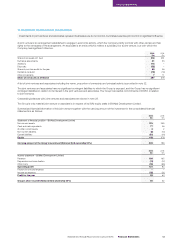

6. Tax continued

The tax charge for the year after exceptional items and remeasurements is lower (2015: higher; 2014: lower) than the standard rate of corporation

tax in the UK of 20% (2015: 21%; 2014: 23%):

Before

exceptional

items and

remeasurements

2016

£m

After

exceptional

items and

remeasurements

2016

£m

Before

exceptional

items and

remeasurements

2015

£m

After

exceptional

items and

remeasurements

2015

£m

Before

exceptional

items and

remeasurements

2014

£m

After

exceptional

items and

remeasurements

2014

£m

Prot before tax

Before exceptional items and remeasurements 3,142 3,142 2,876 2,876 2,584 2,584

Exceptional items and remeasurements –(110) –(248) –164

Profit before tax 3,142 3,032 2,876 2,628 2,584 2,748

Profit before tax multiplied by UK corporation

taxrateof 20% (2015: 21%; 2014: 23%) 628 606 604 552 594 632

Effect of:

Adjustments in respect of prior years 2 1 (3) (4) (109) (109)

Expenses not deductible for tax purposes 29 118 31 327 32 284

Non-taxable income (26) (113) (20) (320) (24) (268)

Adjustment in respect of foreign tax rates 124 129 91 77 98 138

Impact of share-based payment (1) (1) (1) (1) (3) (3)

Deferred tax impact of change in UK

andUStaxrates –(296) –(6) –(390)

Other (3) (6) (7) (8) (7) –

Total tax charge 753 438 695 617 581 284

% % % % % %

Effective tax rate 24.0 14.4 24.2 23.5 22.5 10.3

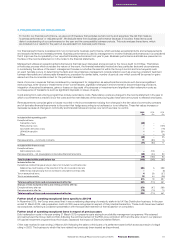

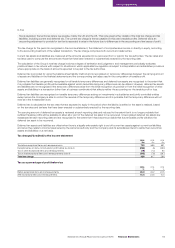

Factors that may affect future tax charges

The Finance Act 2015 (No.2) (the Act) was enacted on 18 November 2015. The Act reduced the main rate of UK corporation tax to 19% with

effect from 1 April 2017 and 18% from 1 April 2020 and deferred tax balances have been calculated at 18%.

The Budget in March this year announced a further reduction in the corporate tax rate to 17% from 1 April 2020, from the previously enacted

18%. This has not been substantively enacted at the reporting date. As the change to 17% had not been substantively enacted at the reporting

date its effects are not included in these financial statements. The overall effect of that change, if it had applied to the deferred tax balances at

the reporting date, would be to reduce the deferred tax liability by an additional £139m and reduce the tax expense for the period by £139m.

There continued to be significant international focus on tax reform during 2015/16, including the OECD’s Base Erosion and Profit Shifting

(BEPS) project to address mismatches in international rules and European Commission initiatives. We will continue to monitor developments

and assess the potential impact for National Grid of these and any further initiatives.

Financial Statements

115National Grid Annual Report and Accounts 2015/16 Financial Statements