National Grid 2016 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

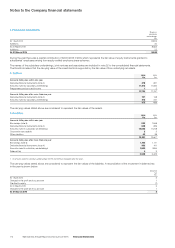

D. Foreign currencies

Transactions in currencies other than the functional currency of the

Company are recorded at the rates of exchange prevailing on the

dates of the transactions. At each balance sheet date, monetary

assets and liabilities that are denominated in foreign currencies are

retranslated at closing exchange rates. Gains and losses arising on

retranslation of monetary assets and liabilities are included in the

profit and loss account.

E. Financial instruments

The Company’s accounting policies are the same asthe Group’s

accounting policies under IFRS, namely IAS 32 ‘Financial Instruments:

Presentation’, IAS 39 ‘Financial Instruments: Recognition and

Measurement’ and IFRS 7 ‘Financial Instruments: Disclosures’.

TheCompany applies these policies only in respect of the financial

instruments that it has, namely investments, derivative financial

instruments, debtors, cash at bank and in hand, borrowings

andcreditors.

The policies are set out in notes 13, 15, 17, 18, 19 and 20 to the

consolidated financial statements. The Company is taking the

exemption for financial instruments disclosures, because IFRS 7

disclosures are given in notes 30 and 33 to the consolidated

financialstatements.

F. Hedge accounting

The Company applies the same accounting policy as the Group

inrespect of fair value hedges and cash flow hedges. This policy

isset out in note 15 to the consolidated financial statements.

G. Parent Company guarantees

The Company has guaranteed the repayment of the principal

sum,any associated premium and interest on specific loans

duebycertain subsidiary undertakings primarily to third parties.

Intheevent of default or non performance by the subsidiary, the

Company recognises such guarantees as insurance contracts,

atfairvalue witha corresponding increase in the carrying value

oftheinvestment.

H. Share awards to employees of subsidiary undertakings

The issuance by the Company to employees of its subsidiaries of

agrant over the Company’s options represents additional capital

contributions by the Company to its subsidiaries. An additional

investment in subsidiaries results in a corresponding increase in

shareholders’ equity. The additional capital contribution is based

onthe fair value of the option at the date of grant, allocated over

theunderlying grant’s vesting period. Where payments are

subsequently received from subsidiaries, these are accounted

forasa return of a capital contribution and credited against

theCompany’s investments in subsidiaries. The Company has

noemployees.

I. Dividends

Interim dividends are recognised when they are paid to the

Company’s shareholders. Final dividends are recognised when

theyare approved by shareholders.

J. Directors’ remuneration

Full details of Directors’ remuneration are disclosed on pages

68to81.

Financial Statements

169National Grid Annual Report and Accounts 2015/16 Financial Statements