National Grid 2016 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2016 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

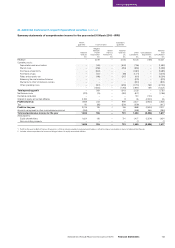

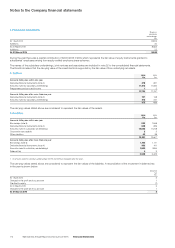

4. Derivative financial instruments

The fair values of derivative financial instruments are:

2016 2015

Assets

£m

Liabilities

£m

Total

£m

Assets

£m

Liabilities

£m

Total

£m

Amounts falling due within one year 279 (239) 40 281 (289) (8)

Amounts falling due after more than one year 157 (358) (201) 148 (411) (263)

436 (597) (161) 429 (700) (271)

For each class of derivative the notional contract1 amounts are as follows:

2016

£m

2015

£m

Interest rate swaps (2,442) (2,499)

Cross-currency interest rate swaps (3,537) (3,529)

Foreign exchange forward contracts (14,361) (13,708)

(20,340) (19,736)

1. The notional contract amounts of derivatives indicate the gross nominal value of transactions outstanding at the balance sheet date.

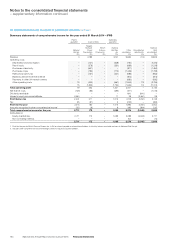

5. Investments

The following table sets out the Company’s current asset investments:

2016

£m

2015

£m

Investments in short-term money funds 1,007 217

Short-term deposits –252

Restricted balances – collateral 237 281

1,244 750

6. Borrowings

The following table analyses the Company’s total borrowings:

2016

£m

2015

£m

Amounts falling due within one year

Bank overdrafts –13

Bank loans 28 28

Bonds 21 70

Commercial paper 884 957

933 1,068

Amounts falling due after more than one year

Bonds 1,194 1,117

2,127 2,185

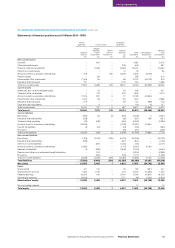

The maturity of total borrowings is disclosed in note 34 to the consolidated financial statements. There are no differences in the maturities

ascalculated under IFRS or FRS 101 ‘Reduced Disclosure Framework’.

The notional amount of borrowings outstanding as at 31 March 2016 was £2,101m (2015: £2,157m). Further information on significant

borrowings can be found on the debt investors section of our website.

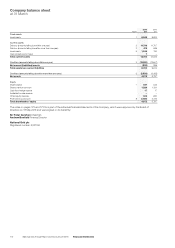

7. Share capital

The share capital amounting to £447m (2015: £443m) consists of 3,924,038,086 (2015: 3,891,691,900) ordinary shares. For further information

on share capital, refer to note 24 to the consolidated financial statements.

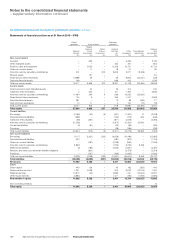

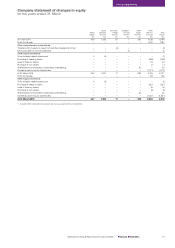

8. Shareholders’ equity and reserves

At 31 March 2016 the profit and loss account reserve stood at £2,880m (2015: £3,726m) of which £86m (2015: £86m) related to gains

onintra-group transactions which was not distributable to shareholders.

For further details of dividends paid and payable to shareholders, refer to note 8 to the consolidated financial statements.

9. Parent Company guarantees

The Company has guaranteed the repayment of the principal sum, any associated premium and interest on specific loans due by certain

subsidiary undertakings primarily to third parties. At 31 March 2016, the sterling equivalent amounted to £2,674m (2015: £2,593m). The

guarantees are for varying terms from less than one year to open-ended.

10. Audit fees

The audit fee in respect of the parent Company was £28,380 (2015: £27,553). Fees payable to PricewaterhouseCoopers LLP for non-audit

services to the Company are not required to be disclosed as they are included within note 3 to the consolidated financial statements.

Financial Statements

173National Grid Annual Report and Accounts 2015/16 Financial Statements