Microsoft 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 53 / 2002 FORM 10-K

Part II

Item 8

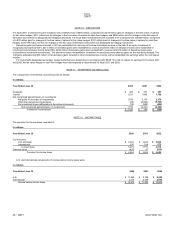

Revenue attributable to U.S. operations includes shipments to customers in the United States, licensing to OEMs and certain multinational organizations,

and exports of finished goods, primarily to Asia, Latin America, and Canada. Revenue from U.S. operations totaled $15.7 billion, $17.8 billion, and $20.9

billion in 2000, 2001, and 2002. Revenue from outside the United States, excluding licensing to OEMs and certain multinational organizations and U.S.

exports, totaled $7.3 billion, $7.5 billion, and $7.5 billion in 2000, 2001, and 2002. No single customer accounted for 10% or more of revenue in 2000, 2001,

or 2002.

Long-lived assets (principally property and equipment) totaled $2.2 billion and $2.0 billion in the United States in 2001 and 2002 and $154 million and

$220 million in other countries in 2001 and 2002.

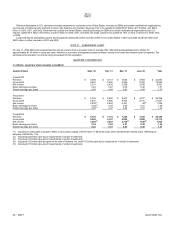

NOTE 21 SUBSEQUENT EVENT

On July 11, 2002, Microsoft acquired Navision a/s as a result of the successful close of a tender offer. Microsoft purchased Navision’s shares for

approximately $1.45 billion in stock and cash. Navision is a provider of integrated business software solutions for small and medium-sized companies. The

purchase price allocation is currently being developed for this acquisition.

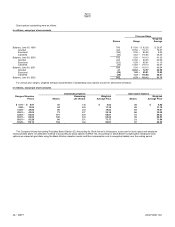

QUARTERLY INFORMATION

In millions, except per share amounts (unaudited)

Quarter Ended Sept. 30 Dec. 31 Mar. 31

June 30

Y

ea

r

Fiscal 2000

Revenue $5,384 $6,112 $5,656 $ 5,804 $22,956

Gross profit 4,672 5,356 4,904 5,022 19,954

Net income 2,191 2,436 2,385 2,409 9,421

Basic earnings per share 0.43 0.47 0.46 0.46 1.81

Diluted earnings per share 0.40 0.44 0.43 0.44 1.70

Fiscal 2001

Revenue $5,766 $6,550 $6,403 $ 6,577 $25,296

Gross profit 4,941 5,686 5,504 5,710 21,841

Net income 2,206

(1)

2,624 2,451 65

(2)

7,346

Basic earnings per share 0.42

(1)

0.49 0.46 0.01 1.38

Diluted earnings per share 0.40

(1)

0.47 0.44 0.01 1.32

Fiscal 2002

Revenue $6,126 $7,741 $7,245 $ 7,253 $28,365

Gross profit 5,242 6,197 5,850 5,885 23,174

Net income 1,283

(3)

2,283 2,738

(4)

1,525

(5)

7,829

Basic earnings per share 0.24 0.42 0.51 0.28 1.45

Diluted earnings per share 0.23 0.41 0.49 0.28 1.41

(1) Includes an unfavorable cumulative effect of accounting change of $375 million or $0.07 per basic share and $0.06 per diluted share, reflecting the

adoption of SFAS No. 133.

(2) Includes $3.92 billion (pre-tax) in impairments of certain investments.

(3) Includes $1.82 billion (pre-tax) in impairments of certain investments.

(4) Includes $1.25 billion (pre-tax) gain on the sale of Expedia, Inc. and $1.19 billion (pre-tax) in impairments of certain investments.

(5) Includes $1.19 billion (pre-tax) in impairments of certain investments.