Microsoft 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 50 / 2002 FORM 10-K

Part II

Item 8

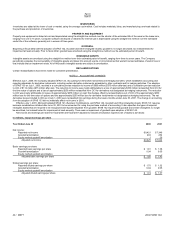

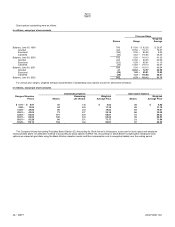

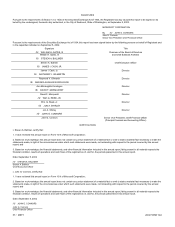

NOTE 16 EARNINGS PER SHARE

Basic earnings per share is computed on the basis of the weighted average number of common shares outstanding. Diluted earnings per share is computed

on the basis of the weighted average number of common shares outstanding plus the effect of outstanding preferred shares using the “if-converted” method,

outstanding put warrants using the “reverse treasury stock” method, and outstanding stock options using the “treasury stock” method.

The components of basic and diluted earnings per share were as follows:

In millions, except per share amounts

Y

ear Ended June 30 2000 2001 2002

Income before accounting change $ 9,421 $ 7,721 $7,829

Preferred stock dividends 13 – –

Net income available for common shareholders $ 9,408 $ 7,721 $7,829

Weighted average outstanding shares of common stock 5,189 5,341 5,406

Dilutive effect of:

Put warrants 2 21

–

Preferred stock 7 –

–

Employee stock options 338 212 147

Common stock and common stock equivalents 5,536 5,574 5,553

Earnings per share before accounting change:

Basic $ 1.81 $ 1.45 $1.45

Diluted $ 1.70 $ 1.38 $1.41

For the years ended June 30, 2000, 2001 and 2002, 45 million, 351 million, and 373 million shares attributable to outstanding stock options were

excluded from the calculation of diluted earnings per share because the effect was antidilutive.

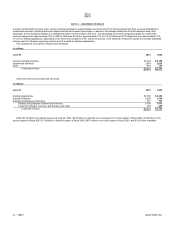

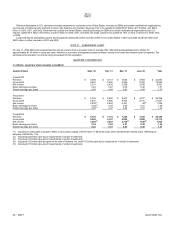

NOTE 17 OPERATIONAL TRANSACTIONS

In January 2000, the Company acquired Visio Corporation in a transaction that was accounted for as a pooling of interests. Microsoft issued 14 million shares

valued at approximately $1.5 billion in the exchange for the outstanding stock of Visio. Visio’s assets and liabilities, which were nominal, are included with

those of Microsoft as of the merger. Operating results for Visio from periods prior to the merger were not material to the combined results of the two

companies. Accordingly, the financial statements for such periods have not been restated.

In April 2001, the Company acquired Great Plains Software, Inc. for approximately $1.1 billion in stock. Great Plains is a leading supplier of mid-market

business applications. The acquisition was accounted for by the purchase method and operating results for Great Plains subsequent to the date of acquisition

are included with those of Microsoft. The pro forma impact of Great Plains’ operating results prior to the date of acquisition was not material.

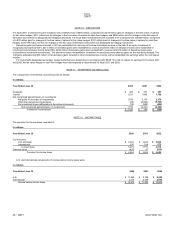

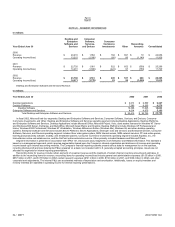

NOTE 18 COMMITMENTS

The Company has operating leases for most U.S. and international sales and support offices and certain equipment. Rental expense for operating leases

was $201 million, $281 million, and $318 million in 2000, 2001, and 2002. Future minimum rental commitments under noncancellable leases, in millions of

dollars, are: 2003, $260; 2004, $219; 2005, $197; 2006, $170; 2007, $135; and thereafter, $302. Microsoft has committed $111 million for constructing new

buildings. In addition, the Company has guaranteed $536 million in debt of its equity investees.

NOTE 19 CONTINGENCIES

The Company is a defendant in U.S. v. Microsoft, a lawsuit filed by the Antitrust Division of the U.S. Department of Justice (DOJ) and a group of eighteen

state Attorneys General alleging violations of the Sherman Act and various state antitrust laws. After the trial, the District Court entered Findings of Fact and

Conclusions of Law stating that Microsoft had violated Sections 1 and 2 of the Sherman Act and various state antitrust laws. A Judgment was entered on

June 7, 2000 ordering, among other things, the breakup of Microsoft into two companies.