Microsoft 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 28 / 2002 FORM 10-K

Part II

Item 7

the continued adoption of Microsoft’s .NET Enterprise Server offerings. Enterprise Services revenue in fiscal 2001, was up 34% compared to fiscal 2000 and

Server Platforms increased 10% while revenue from Developer Tools and Services was flat. In fiscal 2000, Server Platforms revenue growth was particularly

strong led by increased adoption by customers of Windows NT Server and Windows 2000 Server. Revenue from Server Applications grew strongly in fiscal

2000, largely due to the strong success of SQL Server 7.0, while Software Developer Tools and Services revenue declined, due to increased suite licensing

versus stand-alone licenses, and the lack of a release upgrade of the Visual Studio development system.

Consumer Software, Services, and Devices. Consumer Software, Services, and Devices revenue was $1.63 billion, $1.95 billion, and $3.59 billion in

2000, 2001, and 2002. Consumer Software, Services, and Devices includes the Xbox video game system; MSN Internet access; MSN network service; PC

and online games; learning and productivity software; mobility; and embedded systems. The majority of the revenue growth from fiscal 2001 stemmed from

sales of the Xbox video game system released in fiscal 2002. MSN Internet access revenue increased as a result of both a higher subscriber base and higher

average revenue per subscriber due to a reduction in promotional subscriber programs. Revenue from MSN network services increased despite a declining

Internet advertising market. Revenue from embedded systems in fiscal 2002 grew nicely, however learning and productivity software revenue and PC and

online games declined compared to fiscal 2001. In fiscal 2001, revenue from MSN network services grew strongly despite a decline in the online advertising

market. MSN Internet access revenue also grew solidly from fiscal 2000 as a result of an increased subscriber base, partially offset by a decline in the

average revenue per subscriber due to a larger mix of subscribers contracted under rebate programs. Revenue from embedded systems grew strongly from

the prior year, while learning and productivity software revenue and PC and online games revenue declined, reflecting softness in the overall consumer

market. In fiscal 2000, online revenue growth was very strong and reflected higher subscriber totals, offset by lower net prices for Internet access

subscriptions compared to the prior year. Additionally, strong sales of entertainment software in fiscal 2000 produced robust revenue growth in PC and online

games.

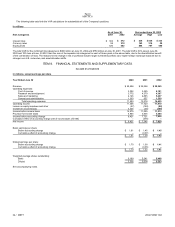

Consumer Commerce Investments. Consumer Commerce Investments revenue was $182 million, $299 million, and $242 million in 2000, 2001, and

2002. Consumer Commerce Investments include Expedia, Inc., the HomeAdvisor online real estate service, and the CarPoint online automotive service. The

decline in revenue compared to fiscal 2001 reflects the sale of Microsoft’s majority ownership of Expedia, Inc. to USA Networks, Inc. on February 4, 2002.

Acquisitions of Travelscape.com and VacationSpot.com by Expedia, Inc., and increased product offerings from Expedia led to the strong revenue growth in

fiscal 2001. The increased overall reach of all properties led to the strong revenue growth in fiscal 2000.

Other. Other revenue, which primarily includes Hardware and Microsoft Press, was $754 million, $630 million, and $530 million in 2000, 2001, and 2002. In

fiscal 2002, continued declines in the IT book and consumer market led to a decline in Microsoft Press and Hardware sales. Lower sales of gaming devices

and other hardware peripherals as a result of weakness in the consumer market caused the decline in revenue in fiscal 2001. Continued success of the

Company’s new hardware device offerings led to revenue growth in fiscal 2000.

DISTRIBUTION CHANNELS

Microsoft distributes its products primarily through the following channels: OEM; volume licensing; online services and products; and distributors and retailers.

OEM channel revenue represents license fees from original equipment manufacturers who preinstall Microsoft products, primarily on PCs. Microsoft has

three major geographic sales and marketing regions: the South Pacific and Americas Region; the Europe, Middle East, and Africa Region; and the Asia

Region. Sales of volume licenses and packaged software products via these channels are primarily to distributors and resellers.

OEM revenue was $7.01 billion in 2000, $7.86 billion in 2001, and $9.00 billion in 2002. In fiscal 2002, reported licenses declined compared to fiscal

2001. However, a strong increase in the mix of the higher priced Windows 2000 and Windows XP Professional licenses, and healthy growth in direct and

system builder OEMs licenses, led to higher average revenue per license and contributed to the overall OEM revenue growth over fiscal 2001. In fiscal 2001,

while total licenses were also impacted by a slowdown in PC shipments, the mix of the higher priced Windows 2000 Professional and Windows NT

Workstation increased substantially resulting in higher average revenue per license. A relatively low growth rate in fiscal 2000 was due to lower business PC

shipment growth combined with post mid-year availability of Windows 2000 Professional. Average earned revenue per license also declined in fiscal 2000

compared to the prior year, due in part to a mix shift to the lower-priced Windows 98 operating system reflecting the softness in demand for business PCs

and lower prices on operating systems licensed through certain OEM channel sectors.

South Pacific and Americas Region revenue was $8.33 billion, $9.52 billion, and $11.41 billion in 2000, 2001, and 2002. In fiscal 2002, the majority of the

revenue growth was driven by sales of the Xbox video game system released during the year, as well as strong Windows XP Professional licensing, MSN

subscription revenue, and revenue from Microsoft Great Plains. In fiscal 2001, revenue growth was led by strong licensing of Windows 2000 Professional and

the family of .NET Enterprise Servers, particularly SQL Server 2000 and Exchange 2000 Server. Revenue from Enterprise services and MSN subscription

and services also grew strongly in fiscal 2001. In fiscal 2000, Office 2000 integrated suites, Windows 2000 Server, online revenue, and SQL Server sales

were the primary drivers of the revenue growth. Strong retail sales of hardware devices and consumer software also contributed to the growth over the prior

year.

Europe, Middle East, and Africa Region revenue was $5.02 billion, $4.86 billion, and $5.13 billion in 2000, 2001, and 2002. In fiscal 2002, the majority of

the growth was a result of strong multi-year licensing revenue of Windows XP Home and Professional operating systems and Enterprise Software, as well as

the addition of Xbox video game system revenue in the second half of the year. In fiscal 2001, weakening local currencies negatively impacted translated

revenue compared to the prior year, while revenue from Windows 2000 Professional and the .NET Enterprise Server family of products was very healthy. In

fiscal 2000, retail sales of Windows operating systems and