Microsoft 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 45 / 2002 FORM 10-K

Part II

Item 8

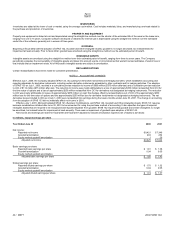

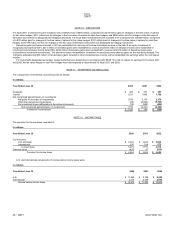

NOTE 10 DERIVATIVES

For fiscal 2001, investment income included a net unrealized loss of $592 million, comprised of a $214 million gain for changes in the time value of options

for fair value hedges, $211 million loss for changes in the time value of options for cash flow hedges, and $595 million loss for changes in the fair value of

derivative instruments not designated as hedging instruments. For fiscal 2002, investment income included a net unrealized loss of $480 million, comprised

of a $30 million gain for changes in the time value of options for fair value hedges, $331 million loss for changes in the time value of options for cash flow

hedges, and $179 million net loss for changes in the fair value of derivative instruments not designated as hedging instruments.

Derivative gains and losses included in OCI are reclassified into earnings at the time forecasted revenue or the sale of an equity investment is

recognized. During fiscal 2001, $214 million of derivative gains were reclassified to revenue and $416 million of derivative losses were reclassified to

investment income/(loss). During fiscal 2002, $234 million of derivative gains were reclassified to revenue and $10 million of derivative losses were

reclassified to investment income/(loss). The derivative losses reclassified to investment income/(loss) were offset by gains on the item being hedged. The

Company estimates that $63 million of net derivative gains included in other comprehensive income will be reclassified into earnings within the next twelve

months.

For instruments designated as hedges, hedge ineffectiveness, determined in accordance with SFAS 133, had no impact on earnings for the fiscal 2001

and 2002. No fair value hedges or cash flow hedges were derecognized or discontinued for fiscal 2001 and 2002.

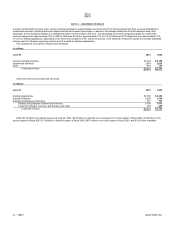

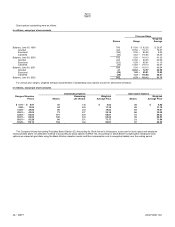

NOTE 11 INVESTMENT INCOME/(LOSS)

The components of investment income/(loss) are as follows:

In millions

Y

ear Ended June 30 2000 2001 2002

Dividends $ 363

$ 377 $357

Interest 1,231

1,808 1,762

Net recognized gains/(losses) on investments:

Net gains on the sales of investments 1,780

3,175 2,379

Other-than-temporary impairments (29)

(4,804) (4,323)

Net unrealized losses attributable to derivative instruments (19)

(592) (480)

Net recognized gains/(losses) on investments 1,732

(2,221) (2,424)

Investment income/(loss) $ 3,326

$ (36) $(305)

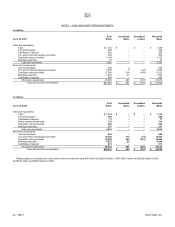

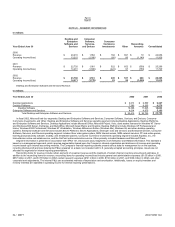

NOTE 12 INCOME TAXES

The provision for income taxes consisted of:

In millions

Y

ear Ended June 30 2000 2001 2002

Current taxes:

U.S. and state $ 4,744

$ 3,243 $3,644

International 535

514 575

Current taxes 5,279

3,757 4,219

Deferred taxes (425)

47 (535)

Provision for income taxes $ 4,854

$ 3,804 $3,684

U.S. and international components of income before income taxes were:

In millions

Y

ear Ended June 30 2000 2001 2002

U.S. $ 11,860 $ 9,189 $8,920

International 2,415 2,336 2,593

Income before income taxes $ 14,275 $ 11,525 $11,513