Microsoft 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 30 / 2002 FORM 10-K

Part II

Item 7

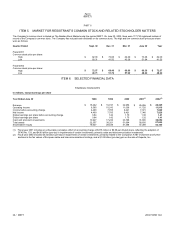

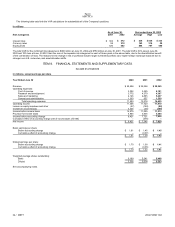

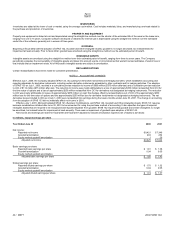

The Company recorded net investment income/(loss) in each year as follows:

In millions

Y

ear Ended June 30 2000 2001 2002

Dividends $ 363

$ 377 $357

Interest 1,231

1,808 1,762

Net recognized gains/(losses) on investments:

Net gains on the sales of investments 1,780

3,175 2,379

Other-than-temporary impairments (29)

(4,804) (4,323)

Net unrealized losses attributable to derivative instruments (19)

(592) (480)

Net recognized gains/(losses) on investments 1,732

(2,221) (2,424)

Investment income/(loss) $ 3,326

$ (36) $(305)

In fiscal 2002, other-than-temporary impairments primarily related to the Company’s investment in AT&T and other cable and telecommunication

investments. Net gains on the sales of investments included a $1.25 billion gain on the sale of the Company’s share of Expedia. Interest and dividend income

decreased $66 million from fiscal 2001 as a result of lower interest rates and dividend income.

In fiscal 2001, other-than-temporary impairments primarily related to cable and telecommunication investments. Net gains from the sales of investments

in fiscal 2001 included a gain from Microsoft’s investment in Titus Communications (which was merged with Jupiter Telecommunications) and the closing of

the sale of Transpoint to CheckFree Holdings Corp. Interest and dividend income increased $591 million from fiscal 2000, reflecting a larger investment

portfolio. In fiscal year 2000, investment income increased primarily as a result of a larger investment portfolio generated by cash from operations coupled

with realized gains from the sale of securities.

At June 30, 2002, unrealized losses on Equity and Other Investments of $623 million were deemed to be temporary in nature. The following, among other

factors, could result in some investments being deemed other-than-temporarily impaired in future periods: changes in the duration and extent to which the fair

value is less than cost; the financial health of and business outlook for the investee, including industry and sector performance, changes in technology, and

operational and financing cash flow factors; and the Company’s intent and ability to hold the investment.

In connection with the definitive agreement to combine AT&T Broadband with Comcast in a new company to be called AT&T Comcast Corporation,

Microsoft has agreed to exchange its AT&T 5% convertible preferred debt securities for approximately 115 million shares of AT&T Comcast Corporation. It is

expected that the transaction will close by December 31, 2002. While it is possible that Microsoft could incur a loss on this exchange transaction up to the

carrying value of the AT&T debt securities, management believes that the ultimate loss, if any, will be significantly less. As management is unable to predict

whether there will be a gain or loss on the exchange, no loss has been recorded related to this contingent exchange transaction as of June 30, 2002.

The Company’s effective tax rate for fiscal 2002 was 32%. The effective tax rate for fiscal 2001 and fiscal 2000 was 33% and 34%, respectively. The

decrease in the effective tax rate is due primarily to lower taxes on foreign earnings.

ACCOUNTING CHANGES

Effective July 1, 2001, Microsoft adopted SFAS 141, Business Combinations, and SFAS 142, Goodwill and Other Intangible Assets. SFAS 141 requires

business combinations to be accounted for using the purchase method of accounting. It also specifies the types of acquired intangible assets that are

required to be recognized and reported separate from goodwill. SFAS 142 requires that goodwill and certain intangibles no longer be amortized, but instead

tested for impairment at least annually. There was no impairment of goodwill upon adoption of SFAS 142. Goodwill amortization (on a pre-tax basis) was

$234 million in fiscal 2000 and $311 million in fiscal 2001.

Effective July 1, 2000, Microsoft adopted SFAS 133, Accounting for Derivative Instruments and Hedging Activities, which establishes accounting and

reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts and for hedging activities. The adoption

of SFAS 133 resulted in a cumulative pre-tax reduction to income of $560 million ($375 million after-tax) and a cumulative pre-tax reduction to other

comprehensive income (OCI) of $112 million ($75 million after-tax). The reduction to income was mostly attributable to a loss of approximately $300 million

reclassified from OCI for the time value of options and a loss of approximately $250 million reclassified from OCI for derivatives not designated as hedging

instruments. The reduction to OCI was mostly attributable to losses of approximately $670 million on cash flow hedges offset by the reclassifications out of

OCI of the approximately $300 million loss for the time value of options and the approximately $250 million loss for derivative instruments not designated as

hedging instruments.

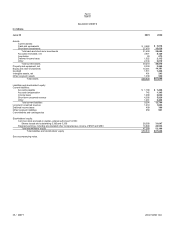

FINANCIAL CONDITION

The Company’s cash and short-term investment portfolio totaled $38.65 billion at June 30, 2002. The portfolio consists primarily of fixed-income securities,

diversified among industries and individual issuers. Microsoft’s investments are generally liquid and investment grade. The portfolio is invested predominantly

in U.S. dollar denominated securities, but also includes foreign currency positions in order to diversify financial risk. The portfolio is primarily invested in short-

term securities to minimize interest rate risk and facilitate rapid deployment for immediate cash needs.