Microsoft 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 46 / 2002 FORM 10-K

Part II

Item 8

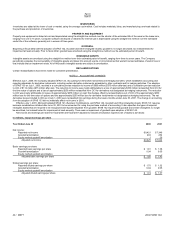

In 2000, the effective tax rate was 34.0%, and included the effect of a 2.5% reduction from the U.S. statutory rate for tax credits and a 1.5% increase for

other items. In 2001, the effective tax rate was 33.0%, and included the effect of a 3.1% reduction from the U.S. statutory rate for tax credits and a 1.1%

increase for other items. The effective tax rate in 2002 was 32.0%, and included the effect of a 2.4% reduction from the U.S. statutory rate for the

extraterritorial income exclusion tax benefit and a 0.6% reduction for other items.

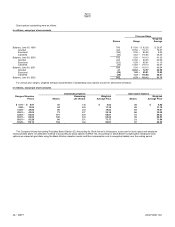

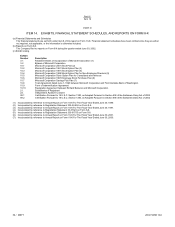

Deferred income taxes were:

In millions

June 30 2001 2002

Deferred income tax assets:

Revenue items $1,469 $2,261

Expense items 691 945

Impaired investments 1,070 2,016

Deferred income tax assets $3,230 $5,222

Deferred income tax liabilities:

Unrealized gain on investments $(395) $(887)

International earnings (1,667) (1,818)

Other (55) (803)

Deferred income tax liabilities $(2,117) $(3,508)

Microsoft has not provided for U.S. deferred income taxes or foreign withholding taxes on $780 million of its undistributed earnings for certain non-U.S.

subsidiaries, all of which relate to fiscal 2002 earnings, since these earnings are intended to be reinvested indefinitely.

On September 15, 2000, the U.S. Tax Court issued an adverse ruling with respect to Microsoft’s claim that the Internal Revenue Service (IRS) incorrectly

assessed taxes for 1990 and 1991. The Company has filed an appeal with the Ninth Circuit Court of Appeals on this matter. Income taxes, except for items

related to the 1990 and 1991 assessments, have been settled with the IRS for all years through 1996. The IRS is examining the Company’s 1997 through

1999 U.S. income tax returns. Management believes any adjustments which may be required will not be material to the financial statements. Income taxes

paid were $800 million in 2000, $1.3 billion in 2001, and $1.9 billion in 2002.

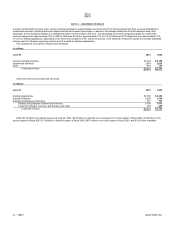

NOTE 13 STOCKHOLDERS’ EQUITY

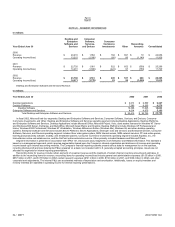

Shares of common stock outstanding were as follows:

In millions

Y

ear Ended June 30 2000 2001 2002

Balance, beginning of year 5,109 5,283 5,383

Issued 229 189 104

Repurchased (55) (89) (128)

Balance, end of year 5,283 5,383 5,359

The Company repurchases its common shares in the open market to provide shares for issuance to employees under stock option and stock purchase

plans. In 2002, the Company acquired 5.1 million of its shares as a result of a structured stock repurchase transaction entered into in 2001, which gave it the

right to acquire such shares in exchange for an up-front net payment of $264 million. To enhance its stock repurchase program, Microsoft has sold put

warrants to independent third parties. These put warrants entitled the holders to sell shares of Microsoft common stock to the Company on certain dates at

specified prices. In the third quarter of fiscal 2001, the Company issued 2.8 million shares to settle a portion of the outstanding put warrants. At June 30, 2001

and 2002, there were no outstanding put warrants.

During 1996, Microsoft issued 12.5 million shares of 2.75% convertible exchangeable principal-protected preferred stock. The Company’s convertible

preferred stock matured on December 15, 1999. Each preferred share was converted into 1.1273 common shares.