Microsoft 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 52 / 2002 FORM 10-K

Part II

Item 8

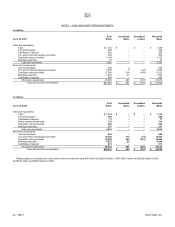

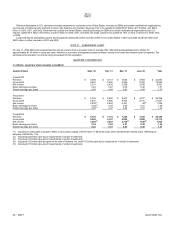

NOTE 20 SEGMENT INFORMATION

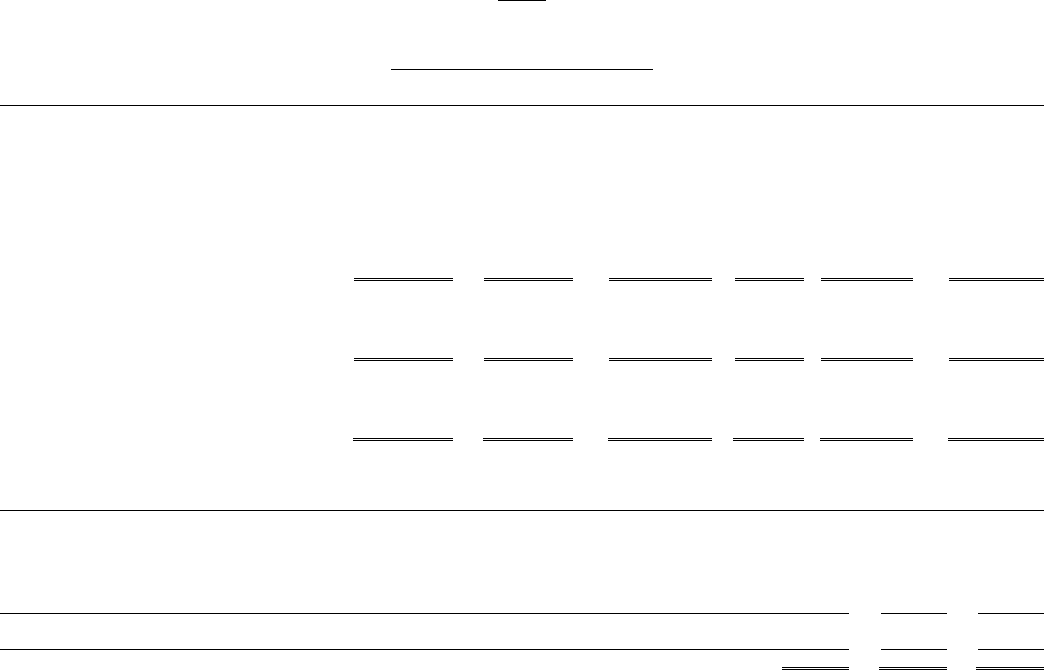

In millions

Year Ended June 30

Desktop and

Enterprise

Software and

Services

Consume

r

Software,

Services,

and Devices

Consume

r

Commerce

Investments Othe

r

Reconciling

Amounts Consolidated

2000

Revenue $ 20,410 $1,654 $182 $691

$ 19 $22,956

Operating income/(loss) 13,210 (1,090) (60) 86

(1,140) 11,006

2001

Revenue $ 22,720 $1,961 $522 $652

$ (559) $25,296

Operating income/(loss) 14,261 (1,666) (222) 97

(750) 11,720

2002

Revenue $ 23,786 $3,531 $245 $537

$ 266 $28,365

Operating income/(loss) 14,671 (1,778) 23 59

(1,065) 11,910

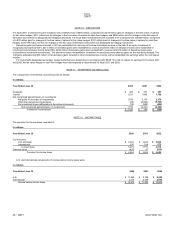

Desktop and Enterprise Software and Services Revenue:

In millions

Y

ear Ended June 30 2000 2001 2002

Desktop Applications $ 9,013 $ 9,580 $9,327

Desktop Platforms 7,383 8,265 9,276

Desktop Software 16,396 17,845 18,603

Enterprise Software and Services 4,014 4,875 5,183

Total Desktop and Enterprise Software and Services $ 20,410 $ 22,720 $23,786

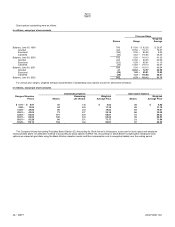

In fiscal 2002, Microsoft had four segments: Desktop and Enterprise Software and Services; Consumer Software, Services, and Devices; Consumer

Commerce Investments; and Other. Desktop and Enterprise Software and Services operating segment includes Desktop Applications, Desktop Platforms,

and Enterprise Software and Services. Desktop Applications include Microsoft Office; Microsoft Project; Visio; client access licenses for Windows NT Server

and Windows 2000 Server, Exchange, and BackOffice; Microsoft Great Plains; and bCentral. Desktop Platforms include Windows XP Professional and

Home, Windows 2000 Professional, Windows NT Workstation, Windows Millennium Edition (Windows Me), Windows 98, and other desktop operating

systems. Enterprise Software and Services includes Server Platforms; Server Applications; developer tools and services; and Enterprise services. Consumer

Software, Services, and Devices operating segment includes Xbox video game system, MSN Internet access, MSN network services, PC and online games,

learning and productivity software, mobility, and embedded systems. Consumer Commerce Investments operating segment includes Expedia, Inc., the

HomeAdvisor online real estate service, and the CarPoint online automotive service. Other primarily includes Hardware and Microsoft Press.

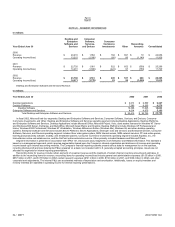

Segment information is presented in accordance with SFAS 131, Disclosures about Segments of an Enterprise and Related Information. This standard is

based on a management approach, which requires segmentation based upon the Company’s internal organization and disclosure of revenue and operating

income based upon internal accounting methods. The Company’s financial reporting systems present various data for management to run the business,

including internal profit and loss statements (P&Ls) prepared on a basis not consistent with U.S. generally accepted accounting principles. Assets are not

allocated to segments for internal reporting presentations.

Reconciling items for revenue include certain elements of unearned revenue and the treatment of certain channel inventory amounts and estimates. In

addition to the reconciling items for revenue, reconciling items for operating income/(loss) include general and administrative expenses ($1.05 billion in 2000,

$857 million in 2001, and $1.55 billion in 2002), certain research expenses ($141 million in 2000, $154 million in 2001, and $166 million in 2002), and other

corporate level adjustments. The internal P&Ls use accelerated methods of depreciation and amortization. Additionally, losses on equity investees and

minority interests are classified in operating income for internal reporting presentations.