Microsoft 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 39 / 2002 FORM 10-K

Part II

Item 8

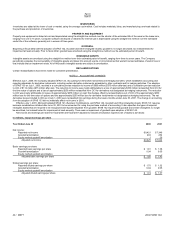

INCOME TAXES

Income tax expense includes U.S. and international income taxes, plus the provision for U.S. taxes on undistributed earnings of international subsidiaries not

deemed to be permanently invested. Certain items of income and expense are not reported in tax returns and financial statements in the same year. The tax

effect of this difference is reported as deferred income taxes.

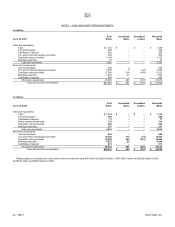

FINANCIAL INSTRUMENTS

The Company considers all liquid interest-earning investments with a maturity of three months or less at the date of purchase to be cash equivalents. Short-

term investments generally mature between three months and six years from the purchase date. Investments with maturities beyond one year may be

classified as short-term based on their highly liquid nature and because such marketable securities represent the investment of cash that is available for

current operations. All cash and short-term investments are classified as available for sale and are recorded at market value using the specific identification

method; unrealized gains and losses are reflected in OCI.

Equity and other investments include debt and equity instruments. Debt securities and publicly traded equity securities are classified as available for sale

and are recorded at market using the specific identification method. Unrealized gains and losses (excluding other-than-temporary impairments) are reflected

in OCI. All other investments, excluding those accounted for using the equity method, are recorded at cost.

Microsoft lends certain fixed income and equity securities to enhance investment income. Collateral and/or security interest is determined based upon the

underlying security and the creditworthiness of the borrower. The fair value of collateral that Microsoft is permitted to sell or repledge was $499 million at both

June 30, 2001 and 2002.

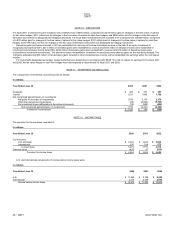

Investments are considered to be impaired when a decline in fair value is judged to be other-than-temporary. The Company employs a systematic

methodology that considers available evidence in evaluating potential impairment of its investments. In the event that the cost of an investment exceeds its

fair value, the Company evaluates, among other factors, the duration and extent to which the fair value is less than cost; the financial health of and business

outlook for the investee, including industry and sector performance, changes in technology, and operational and financing cash flow factors; and the

Company’s intent and ability to hold the investment. Once a decline in fair value is determined to be other-than-temporary, an impairment charge is recorded

and a new cost basis in the investment is established. In 2001, the Company recognized $4.80 billion in impairments of certain investments, primarily in the

cable and telecommunication industries. In 2002, Microsoft recognized $4.32 billion in impairments of certain investments, primarily related to further declines

in the fair values of U.S. and European cable and telecommunications holdings.

The Company uses derivative instruments to manage exposures to foreign currency, security price, and interest rate risks. The Company’s objectives for

holding derivatives are to minimize these risks using the most effective methods to eliminate or reduce the impact of these exposures.

Foreign Currency Risk. Certain forecasted transactions and assets are exposed to foreign currency risk. The Company monitors its foreign currency

exposures daily to maximize the overall effectiveness of its foreign currency hedge positions. Principal currencies hedged include the Euro, Japanese yen,

British pound, and Canadian dollar. Options used to hedge a portion of forecasted international revenue for up to three years in the future are designated as

cash flow hedging instruments. Options and forwards not designated as hedging instruments under SFAS 133 are also used to hedge the impact of the

variability in exchange rates on accounts receivable and collections denominated in certain foreign currencies.

Securities Price Risk. Strategic equity investments are subject to market price risk. From time to time, the Company uses and designates options to

hedge fair values and cash flows on certain equity securities. The security, or forecasted sale thereof, selected for hedging is determined by market

conditions, up-front costs, and other relevant factors. Once established, the hedges are not dynamically managed or traded, and are generally not removed

until maturity.

Interest Rate Risk. Fixed-income securities are subject to interest rate risk. The fixed-income portfolio is diversified and consists primarily of investment

grade securities to minimize credit risk. The Company routinely uses options, not designated as hedging instruments, to hedge its exposure to interest rate

risk in the event of a catastrophic increase in interest rates.

Other Derivatives. In addition, the Company may invest in warrants to purchase securities of other companies as a strategic investment. Warrants that can

be net share settled are deemed derivative financial instruments and are not designated as hedging instruments.

For options designated either as fair value or cash flow hedges, changes in the time value are excluded from the assessment of hedge effectiveness.

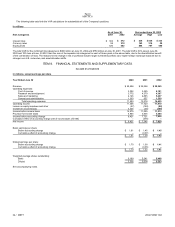

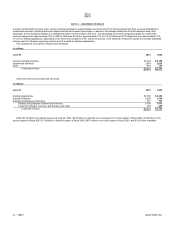

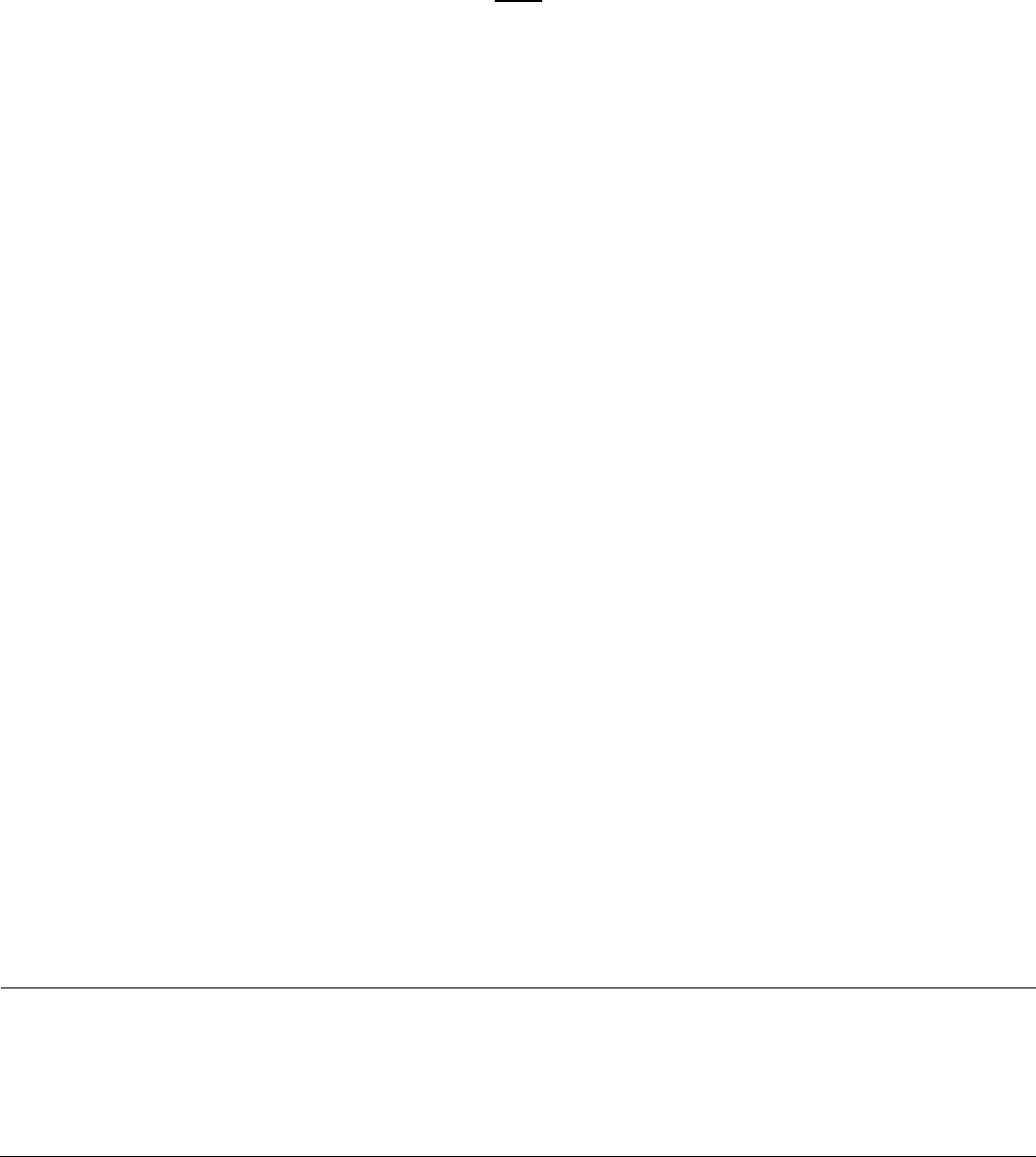

ALLOWANCE FOR DOUBTFUL ACCOUNTS

The allowance for doubtful accounts reflects management’s best estimate of probable losses inherent in the account receivable balance. Management

determines the allowance based on known troubled accounts, historical experience, and other currently available evidence. Activity in the allowance for

doubtful accounts is as follows:

In millions

Year Ended June 30

Balance at

Beginning of Period

Charged to Costs

and Expenses

Write-

offs

and

Othe

r

Balance at

End of Period

2002 $174 $192 $ 157 $209

2001 186 157 169 174

2000 204 77 95 186