Microsoft 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 33 / 2002 FORM 10-K

Part II

Item 7

Intellectual Property Rights. Microsoft diligently defends its intellectual property rights, but unlicensed copying and use of software represents a loss of

revenue to the Company. While this adversely affects U.S. revenue, revenue loss is even more significant outside the United States, particularly in countries

where laws are less protective of intellectual property rights. Throughout the world, Microsoft actively educates consumers on the benefits of licensing

genuine products and educates lawmakers on the advantages of a business climate where intellectual property rights are protected. However, continued

efforts may not affect revenue positively and further deterioration in compliance with existing legal protections or reductions in the legal protection for

intellectual property rights of software developers could adversely affect revenue.

Taxation of Extraterritorial Income. In August 2001, a World Trade Organization (“WTO”) dispute panel determined that the extraterritorial tax (“ETI”)

provisions of the FSC Repeal and Extraterritorial Income Exclusion Act of 2000 constitute an export subsidy prohibited by the WTO Agreement on Subsidies

and Countervailing Measures Agreement. The U.S. government appealed the panel’s decision and lost its appeal. On January 29, 2002, the WTO Dispute

Settlement Body adopted the Appellate Body report. President Bush has stated the U.S. will bring its tax laws into compliance with the WTO ruling, but the

Administration and Congress have not decided on a solution for this issue. In July 2002, Representative Bill Thomas, Chairman of the House Ways and

Means Committee, introduced the American Competitiveness and Corporate Accountability Act of 2002. If enacted, that bill would repeal the ETI regime and

introduce broad-based international reform. The proposed reforms would not materially affect the Company. On August 30, 2002, a WTO arbitration panel

determined that the European Union may impose up to $4.04 billion per year in countermeasures if the U.S. rules are not brought into compliance. The WTO

decision does not repeal the ETI tax benefit and it does not require the European Union to impose trade sanctions, so it is not possible to predict what impact

the WTO decision will have on future results pending final resolution of these matters. If the ETI exclusion is repealed and replacement legislation is not

enacted, the loss of tax benefit to the Company could be significant.

Litigation. As discussed in Note 19—Contingencies of the Notes to Financial Statements, the Company is subject to a variety of claims and lawsuits. While

the Company believes that none of the litigation matters in which the Company is currently involved will have a material adverse impact on the Company’s

financial position or results of operations, it is possible that one or more of these matters could be resolved in a manner that would ultimately have a material

adverse impact on the business of the Company, and could negatively impact its revenues and operating margins.

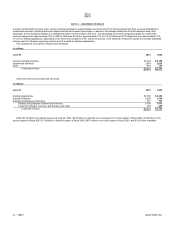

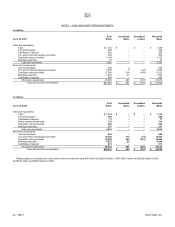

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company is exposed to foreign currency, interest rate, and equity price risks. A portion of these risks is hedged, but fluctuations could impact the

Company’s results of operations and financial position. The Company hedges the exposure of accounts receivable and a portion of anticipated revenue to

foreign currency fluctuations, primarily with option contracts. The Company monitors its foreign currency exposures daily to maximize the overall

effectiveness of its foreign currency hedge positions. Principal currencies hedged include the Euro, Japanese yen, British pound, and Canadian dollar. Fixed

income securities are subject to interest rate risk. The portfolio is diversified and consists primarily of investment grade securities to minimize credit risk. The

Company routinely uses options to hedge its exposure to interest rate risk in the event of a catastrophic increase in interest rates. Many securities held in the

Company’s equity and other investments portfolio are subject to price risk. The Company uses options to hedge its price risk on certain highly volatile equity

securities.

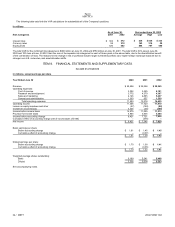

The Company uses a value-at-risk (VAR) model to estimate and quantify its market risks. VAR is the expected loss, for a given confidence level, in fair

value of the Company’s portfolio due to adverse market movements over a defined time horizon. The VAR model is not intended to represent actual losses in

fair value, but is used as a risk estimation and management tool. The model used for currencies and equities is geometric Brownian motion, which allow

incorporation of optionality of these exposures. For interest rates, the mean reverting geometric Brownian motion is used to reflect the principle that fixed-

income securities prices over time revert to maturity value.

Value-at-risk is calculated by, first, simulating 10,000 market price paths over 20 days for equities, interest rates and foreign exchange rates, taking into

account historical correlations among the different rates and prices. Each resulting unique set of equities prices, interest rates, and foreign exchange rates is

applied to substantially all individual holdings to re-price each holding. The 250th worst performance (out of 10,000) represents the value-at-risk over 20 days

at the 97.5th percentile. Several risk factors are not captured in the model, including liquidity risk, operational risk, credit risk, and legal risk.

A substantial amount of the Company’s equity portfolio is held for strategic purposes. The Company attempts to hedge the value of these securities

through the use of derivative contracts such as collars. The Company has incurred substantial impairment charges related to certain of these securities in

fiscal 2002 and fiscal 2001. Such impairment charges have been incurred primarily for strategic equity holdings that the Company has not been able to

hedge. The VAR amounts disclosed below are not necessarily reflective of potential accounting losses, as they are used as a risk management tool and

reflect an estimate of potential reductions in fair value of the Company’s portfolio. Losses in fair value over a 20-day holding period can exceed the reported

VAR by significant amounts and can also accumulate over a longer time horizon than the 20-day holding period used in the VAR analysis.

The VAR numbers are shown separately for interest rate, currency, and equity risks. These VAR numbers include the underlying portfolio positions and

related hedges. Historical data is used to estimate VAR. Given reliance on historical data, VAR is most effective in estimating risk exposures in markets in

which there are no fundamental changes or shifts in market conditions. An inherent limitation in VAR is that the distribution of past changes in market risk

factors may not produce accurate predictions of future market risk.