Microsoft 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

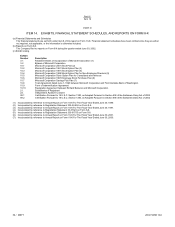

MSFT 48 / 2002 FORM 10-K

Part II

Item 8

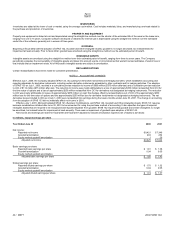

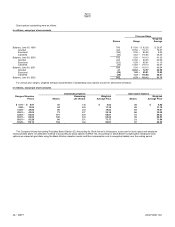

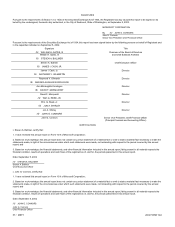

Stock options outstanding were as follows:

In millions, except per share amounts

Price per Share

Shares Range

Weighted

Average

Balance, June 30, 1999 766 $ 0.56 – $ 83.28 $ 23.87

Granted 304 65.56 – 119.13 79.87

Exercised (198) 0.56 – 82.94 9.54

Canceled (40) 4.63 – 116.56 36.50

Balance, June 30, 2000 832 0.56 – 119.13 41.23

Granted 224 41.50 – 80.00 60.84

Exercised (123) 0.59 – 85.81 11.13

Canceled (35) 13.83 – 119.13 63.57

Balance, June 30, 2001 898 0.56 – 119.13 49.54

Granted 41 48.62

–

72.57 62.50

Exercised (99) 1.02

–

69.81 12.82

Canceled (38) 1.15

–

116.56 68.67

Balance, June 30, 2002 802 0.79

–

119.13 53.75

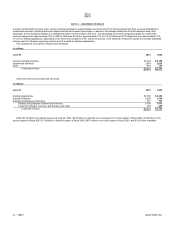

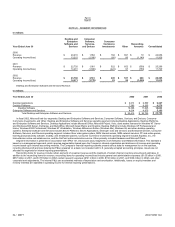

For various price ranges, weighted average characteristics of outstanding stock options at June 30, 2002 were as follows:

In millions, except per share amounts

Outstanding Options Exercisable Options

Range of Exercise

Prices Shares Remaining

Life (Years)

Weighted

Average Price Shares Weighted

Average Price

$ 0.79

–

$ 5.97 36 1.6 $ 4.83 35 $ 4.82

5.98

–

13.62 44 0.5 11.19 42 11.18

13.63

–

29.80 90 2.0 15.02 84 14.97

29.81

–

43.62 73 2.7 32.19 66 32.09

43.63

–

60.00 191 6.9 55.81 41 54.03

60.01

–

69.50 146 6.4 66.24 35 66.53

69.51

–

83.28 80 5.1 71.17 21 71.84

83.29

–

119.13 142 4.2 89.87 47 89.29

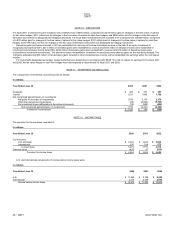

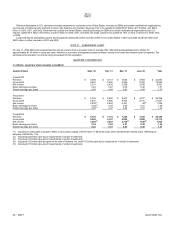

The Company follows Accounting Principles Board Opinion 25, Accounting for Stock Issued to Employees, to account for stock option and employee

stock purchase plans. An alternative method of accounting for stock options is SFAS 123, Accounting for Stock-Based Compensation. Employee stock

options are valued at grant date using the Black-Scholes valuation model, and this compensation cost is recognized ratably over the vesting period.