Microsoft 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 38 / 2002 FORM 10-K

Part II

Item 8

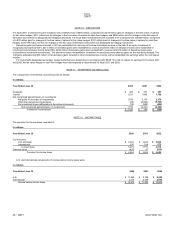

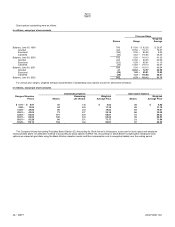

NOTES TO FINANCIAL STATEMENTS

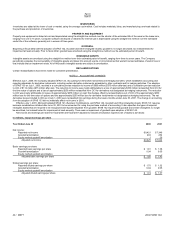

NOTE 1 ACCOUNTING POLICIES

ACCOUNTING PRINCIPLES

The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America.

PRINCIPLES OF CONSOLIDATION

The financial statements include the accounts of Microsoft Corporation and its subsidiaries (Microsoft). Intercompany transactions and balances have been

eliminated. Equity investments in which Microsoft owns at least 20% of the voting securities are accounted for using the equity method, except for

investments in which the Company is not able to exercise significant influence over the investee, in which case, the cost method of accounting is used.

Issuances of shares by a subsidiary are accounted for as capital transactions.

ESTIMATES AND ASSUMPTIONS

Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and

expenses. Examples include estimates of loss contingencies and product life cycles, and assumptions such as the elements comprising a software

arrangement, including the distinction between upgrades/enhancements and new products; when the Company reaches technological feasibility for its

products; the potential outcome of the future tax consequences of events that have been recognized in the Company’s financial statements or tax returns;

and determining when investment impairments are other-than-temporary. Actual results and outcomes may differ from these estimates and assumptions.

FOREIGN CURRENCIES

Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date. Translation adjustments resulting from this

process are charged or credited to other comprehensive income (OCI). Revenue and expenses are translated at average rates of exchange prevailing during

the year.

REVENUE RECOGNITION

Microsoft accounts for the licensing of software in accordance with American Institute of Certified Public Accountants (AICPA) Statement of Position (SOP)

97-2, Software Revenue Recognition. The Company recognizes revenue when (i) persuasive evidence of an arrangement exists; (ii) delivery has occurred or

services have been rendered; (iii) the sales price is fixed or determinable; and (iv) collectibility is reasonably assured. For software arrangements with

multiple elements, revenue is recognized dependent upon whether vendor-specific objective evidence (VSOE) of fair value exists for each of the elements.

When VSOE does not exist for all the elements of a software arrangement and the only undelivered element is postcontract customer support (PCS), the

entire licensing fee is recognized ratably over the contract period. Revenue attributable to undelivered elements, including technical support and Internet

browser technologies, is based on the average sales price of those elements when sold separately, and is recognized ratably on a straight-line basis over the

product’s life cycle. PCS and subscription revenue is recognized ratably over the contract period.

Revenue from products licensed to original equipment manufacturers (OEMs) is based on the licensing agreement with an OEM and has historically been

recognized when OEMs ship licensed products to their customers. Licensing provisions were modified with the introduction of Windows XP in 2002 and

revenue for certain products is recorded upon shipment of the product to OEMs. The effect of this change in licensing provisions was not material. Revenue

from packaged product sales to distributors and resellers is usually recorded when related products are shipped. However, when the revenue recognition

criteria required for distributor and reseller arrangements are not met, revenue is recognized as payments are received. Revenue related to the Company’s

Xbox game console is recognized upon shipment of the product to retailers. Online advertising revenue is recognized as advertisements are displayed. Costs

related to insignificant obligations, which include telephone support for certain products, are accrued. Provisions are recorded for estimated returns,

concessions, and bad debts.

COST OF REVENUE

Cost of revenue includes direct costs to manufacture and distribute product and direct costs to provide online services, consulting, product support, and

training and certification of system integrators.

RESEARCH AND DEVELOPMENT

Technological feasibility for Microsoft’s software products is reached shortly before the products are released to manufacturing. Costs incurred after

technological feasibility is established are not material, and accordingly, the Company expenses all research and development costs when incurred.

ADVERTISING COSTS

Advertising costs are expensed as incurred. Advertising expense was $1.23 billion in 2000, $1.36 billion in 2001, and $1.27 billion in 2002.