Microsoft 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 34 / 2002 FORM 10-K

Part II

Item 7A, 8

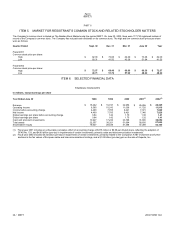

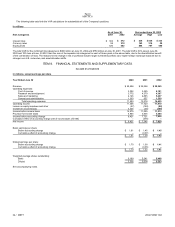

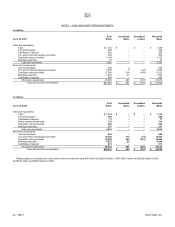

The following table sets forth the VAR calculations for substantially all of the Company’s positions:

In millions

A

so

f

June 30,

Y

ear ended June 30, 2002

Risk Categories 2001 2002 Average High Low

Interest rates $363 $472 $ 435 $535 $333

Currency rates 58 310 162 310 58

Equity prices 520 602 584 757 488

The total VAR for the combined risk categories is $908 million at June 30, 2002 and $759 million at June 30, 2001. The total VAR is 34% less at June 30,

2002 and 19% less at June, 30 2001 than the sum of the separate risk categories for each of those years in the above table, due to the diversification benefit

of the combination of risks. The reasons for the change in risk in portfolios include: larger investment portfolio size, higher foreign exchange exposure due to

stronger non-U.S. currencies, and asset allocation shifts.

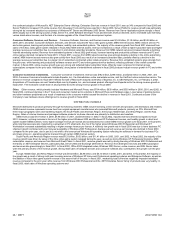

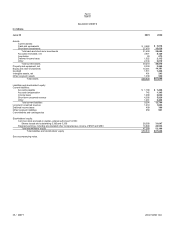

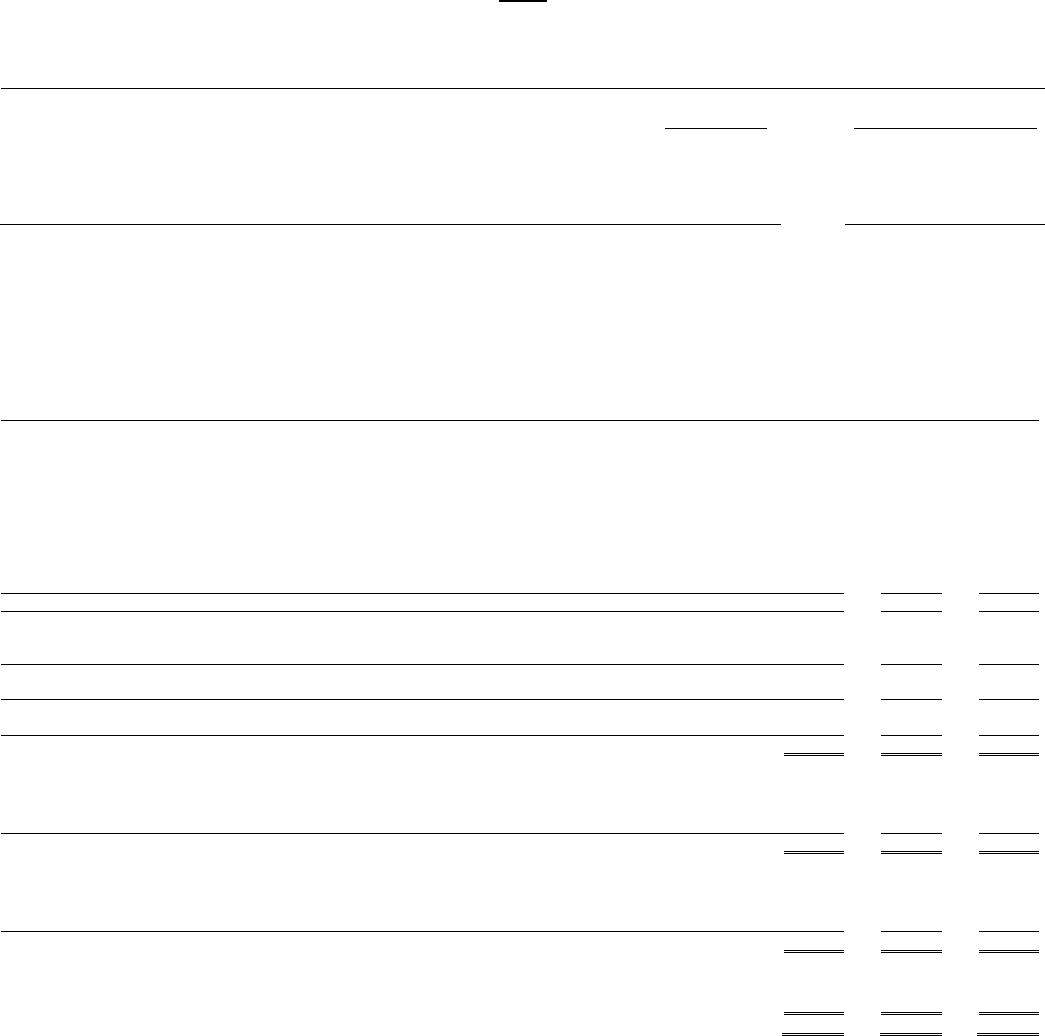

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

INCOME STATEMENTS

In millions, except earnings per share

Y

ear Ended June 30 2000 2001 2002

Revenue $ 22,956

$ 25,296 $28,365

Operating expenses:

Cost of revenue 3,002

3,455 5,191

Research and development 3,772

4,379 4,307

Sales and marketing 4,126

4,885 5,407

General and administrative 1,050

857 1,550

Total operating expenses 11,950

13,576 16,455

Operating income 11,006

11,720 11,910

Losses on equity investees and other (57)

(159) (92)

Investment income/(loss) 3,326

(36) (305)

Income before income taxes 14,275

11,525 11,513

Provision for income taxes 4,854

3,804 3,684

Income before accounting change 9,421

7,721 7,829

Cumulative effect of accounting change (net of income taxes of $185)

–

(375)

–

Net income $ 9,421

$ 7,346 $7,829

Basic earnings per share:

Before accounting change $ 1.81

$ 1.45 $1.45

Cumulative effect of accounting change

–

(0.07)

–

$ 1.81

$ 1.38 $1.45

Diluted earnings per share:

Before accounting change $ 1.70

$ 1.38 $1.41

Cumulative effect of accounting change

–

(0.06)

–

$ 1.70

$ 1.32 $1.41

Weighted average shares outstanding:

Basic 5,189

5,341 5,406

Diluted 5,536

5,574 5,553

See accompanying notes.