Microsoft 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 47 / 2002 FORM 10-K

Part II

Item 8

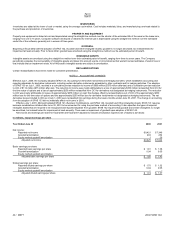

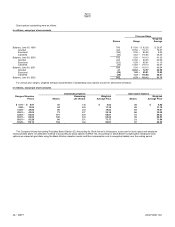

NOTE 14 OTHER COMPREHENSIVE INCOME

In millions

Y

ear Ended June 30 2000 2001 2002

Cumulative effect of accounting change, net of tax effect of $(37) $ –

$ (75) $

–

Net gains/(losses) on derivative instruments:

Unrealized gains, net of tax effect of $246 in 2001 and $30 in 2002 –

499 55

Reclassification adjustment for (gains)/losses included in net income, net of tax effect

of $67 in 2001 and $(79) in 2002 –

135 (146)

Net gains/(losses) on derivative instruments –

634 (91)

Net unrealized investment gains/(losses):

Unrealized holding gains/(losses), net of tax effect of $248 in 2000, $(351) in 2001,

and $(955) in 2002 531

(1,200) (1,774)

Reclassification adjustment for (gains)/losses included in net income, net of tax effect

of $(420) in 2000, $(128) in 2001, and $958 in 2002 (814)

(260) 1,779

Net unrealized investment gains/(losses) (283)

(1,460) 5

Translation adjustments and other 23

(39) 82

Other comprehensive income/(loss) $ (260)

$ (940) $(4)

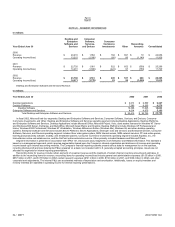

The components of accumulated other comprehensive income were:

In millions

June 30 2001 2002

Net gains on derivative instruments $177 $86

Net unrealized investment gains 598 603

Translation adjustments and other (188) (106)

Accumulated other comprehensive income $587 $583

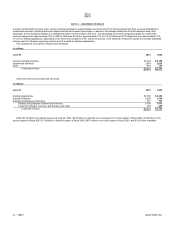

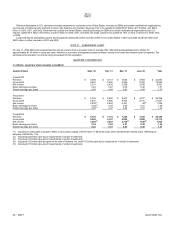

NOTE 15 EMPLOYEE STOCK AND SAVINGS PLANS

EMPLOYEE STOCK PURCHASE PLAN

The Company has an employee stock purchase plan for all eligible employees. Under the plan, shares of the Company’s common stock may be purchased

at six-month intervals at 85% of the lower of the fair market value on the first or the last day of each six-month period. Employees may purchase shares

having a value not exceeding 15% of their gross compensation during an offering period. During 2000, 2001, and 2002, employees purchased 2.5 million, 5.7

million, and 5.4 million shares at average prices of $72.38, $36.87, and $50.52 per share. At June 30, 2002, 56.8 million shares were reserved for future

issuance.

SAVINGS PLAN

The Company has a savings plan, which qualifies under Section 401(k) of the Internal Revenue Code. Participating employees may contribute up to 25% of

their pretax salary, but not more than statutory limits. The Company contributes fifty cents for each dollar a participant contributes, with a maximum

contribution of 3% of a participant’s earnings. Matching contributions were $47 million, $63 million, and $77 million in 2000, 2001, and 2002.

STOCK OPTION PLANS

The Company has stock option plans for directors, officers, and employees, which provide for nonqualified and incentive stock options. Options granted prior

to 1995 generally vest over four and one-half years and expire 10 years from the date of grant. Options granted between 1995 and 2001 generally vest over

four and one-half years and expire seven years from the date of grant, while certain options vest either over four and one-half years or over seven and one-

half years and expire after 10 years. Options granted during 2002 vest over four and one-half years and expire 10 years from the date of grant. At June 30,

2002, options for 371 million shares were vested and 543 million shares were available for future grants under the plans.