Microsoft 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MSFT 44 / 2002 FORM 10-K

Part II

Item 8

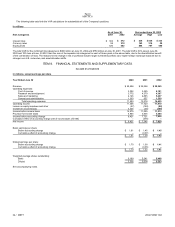

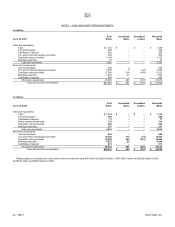

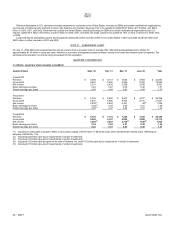

In millions

June 30, 2002

Cost

Basis

Unrealized

Gains Unrealized

Losses

Recorded

Basis

Debt securities recorded at market, maturing:

Within one year $ 485 $26 $

–

$511

Between 2 and 10 years 893 46 (4) 935

Between 10 and 15 years 541 19 (2) 558

Beyond 15 years 3,036

–

–

3,036

Debt securities recorded at market 4,955 91 (6) 5,040

Common stock and warrants 6,930 1,287 (617) 7,600

Preferred stock 1,382

–

–

1,382

Other investments 169

–

–

169

Equity and other investments $13,436 $1,378 $ (623) $14,191

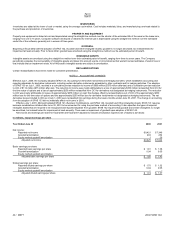

Debt securities include corporate and government notes and bonds and derivative securities. Debt securities maturing beyond 15 years are composed

entirely of AT&T 5% convertible preferred debt with a contractual maturity of 30 years. The debt is convertible at the Company’s option into AT&T common

stock on or after December 1, 2000, or may be redeemed by AT&T upon satisfaction of certain conditions on or after June 1, 2002. In connection with the

definitive agreement to combine AT&T Broadband with Comcast in a new company to be called AT&T Comcast Corporation, Microsoft has agreed to

exchange its AT&T 5% convertible preferred debt securities for approximately 115 million shares of AT&T Comcast Corporation. It is expected that the

transaction will close by December 31, 2002. While it is possible that Microsoft could incur a loss on this exchange transaction up to the carrying value of the

AT&T debt securities, management believes that the ultimate loss, if any, will be significantly less. As management is unable to predict whether there will be

a gain or loss on the exchange, no loss has been recorded related to this contingent exchange transaction as of June 30, 2002.

Equity securities that are restricted for more than one year or not publicly traded are recorded at cost. At June 30, 2001 the estimated fair value of these

investments in excess of their recorded basis was $161 million. At June 30, 2002 the recorded basis of these investments in excess of their estimated fair

value was $34 million. This excess of cost over estimated fair value was deemed temporary in nature. The estimate of fair value is based on publicly

available market information or other estimates determined by management. Realized gains and (losses) from equity and other investments (excluding

impairments discussed previously) were $1.94 billion and $(10) million in 2000, $3.03 billion and $(23) million in 2001, and $2.24 billion and $(121) million in

2002.

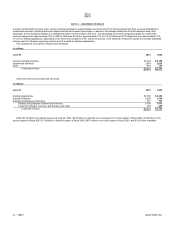

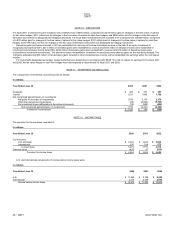

NOTE 8 GOODWILL

During fiscal 2002, goodwill was reduced by $85 million, principally in connection with Microsoft’s exchange of all of its 33.7 million shares and warrants of

Expedia, Inc. to USA Networks, Inc. No goodwill was acquired or impaired during fiscal 2002. As of June 30, 2002, Desktop and Enterprise Software and

Services goodwill was $1.1 billion, Consumer Software, Services, and Devices goodwill was $258 million, and Consumer Commerce Investments goodwill

was $72 million.

NOTE 9 INTANGIBLE ASSETS

During fiscal 2002, changes in intangible assets primarily relates to the Company’s acquisition of $25 million in patents and licenses and $27 million in

existing technology, which will be amortized over approximately 3 years. No significant residual value is estimated for these intangible assets. Intangible

assets amortization expense was $202 million for fiscal 2001 and $194 million for fiscal 2002. The components of intangible assets were as follows:

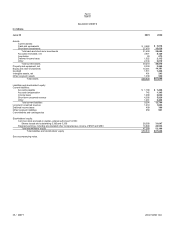

In millions

June 30

2001 2002

Gross Carrying

A

mount

A

ccumulated

Amortization Gross Carrying

Amount

A

ccumulated

Amortization

Patents and licenses $407 $(177)

$ 421 $(290)

Existing technology 157 (27)

172 (71)

Trademarks, tradenames and other 83 (42)

15 (4)

Intangible assets $647 $(246)

$ 608 $(365)

Amortization expense for the net carrying amount of intangible assets at June 30, 2002 is estimated to be $115 million in fiscal 2003, $90 million in fiscal

2004, $36 million in fiscal 2005, and $2 million in fiscal 2006.