Lumber Liquidators 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

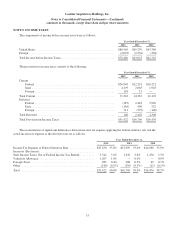

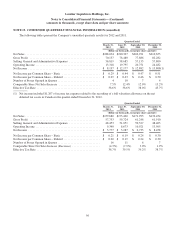

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

As described in Note 6, the Company leases a number of its store locations and Corporate Headquarters from Controlled

Companies.

NOTE 12. COMMITMENTS AND CONTINGENCIES

The Company is, from time to time, subject to claims and disputes arising in the normal course of business. In the

opinion of management, while the outcome of any such claims and disputes cannot be predicted with certainty, the ultimate

liability of the Company in connection with these matters is not expected to have a material adverse effect on the Company’s

results of operations, financial position or cash flows.

On May 21, 2012, Harbor Freight Tools USA, Inc. and Central Purchasing, LLC (together, the “Plaintiffs”) filed an

action, which was subsequently amended, in the Superior Court for the County of Los Angeles, California against the

Company and certain purported Company employees (the “State Court Action”). In the State Court Action, the Plaintiffs

contended that they previously employed several individuals now working for the Company, and alleged, among other

claims, the improper use and possession by the Company and/or its employees of trade secrets belonging to the Plaintiffs and

unfair business practices. The Plaintiffs have sought unspecified monetary damages, punitive damages, injunctive, equitable

and other relief.

On December 18, 2012, the Plaintiffs filed suit against the Company in the United States District Court for the Central

District of California. In that suit, in addition to the claims raised as in the State Court Action, the Plaintiffs alleged that the

Company violated certain of the Plaintiffs’ copyrights. The Plaintiffs have sought, among other things, a preliminary

injunction precluding the Company from using the Plaintiffs’ purported confidential information and selling seven specific

tool products. The Plaintiffs dismissed the State Court Action as it pertained to the Company but it remains pending as to the

individual employees.

The Company strongly disputes the Plaintiffs’ contentions and has been litigating this matter aggressively. Nevertheless,

the parties engaged in settlement processes and have reached a tentative understanding on certain matters. The Company,

however, cannot make any assurance that this matter will ultimately settle. In the event that a settlement is not consummated,

the Company will continue to defend this matter vigorously and believes that the ultimate outcome of the litigation will not

have a material adverse effect on its results of operations, financial position or cash flows. Based upon the proceedings to

date, the Company has recorded an accrual of approximately $500 in the fourth quarter of 2012 as its best estimate of the

probable loss at this time.

On August 30, 2012, Jaroslaw Prusak, a purported customer (“Prusak”), filed a putative class action lawsuit against the

Company in the United States District Court for the Northern District of Illinois. Prusak alleges that the Company willfully

violated the Fair and Accurate Credit Transactions Act (“FACTA”) amendment to the Fair Credit Reporting Act in

connection with printed credit card receipts provided to its customers. Prusak, for himself and the putative class, seeks

statutory damages of no less than $100 and no more than $1,000 per violation, punitive damages, attorney’s fees and costs,

and other relief. The Company intends to defend this matter vigorously. Given the uncertainty of litigation, the preliminary

stage of the case and the legal standards that must be met for, among other things, class certification and success on the

merits, no outcome can be predicted at this time. Based upon the current status of the matter and information available, the

Company does not, at this time, expect the outcome of this proceeding to have a material adverse effect on its results of

operations, financial position or cash flows.

55