Lumber Liquidators 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

Market Information

Our common stock trades on the New York Stock Exchange (“NYSE”) under the trading symbol “LL.” We are

authorized to issue up to 35,000,000 shares of common stock, par value $0.001. Total shares of common stock outstanding at

February 18, 2013 were 27,164,204, and we had 9 stockholders of record.

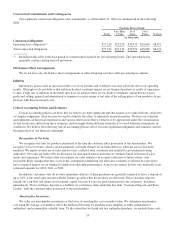

The following table shows the high and low sales prices per share as reported by the NYSE for each quarter during the

last two fiscal years.

Price Range

High Low

2012:

Fourth Quarter ........................................... $58.04 $48.14

Third Quarter ............................................ 53.73 32.49

Second Quarter ........................................... 33.79 23.47

First Quarter ............................................. 25.17 17.38

2011:

Fourth Quarter ........................................... $17.80 $14.44

Third Quarter ............................................ 26.06 13.87

Second Quarter ........................................... 26.97 22.40

First Quarter ............................................. 28.73 22.76

Issuer Purchases of Equity Securities

The following table presents our share repurchase activity for the quarter ended December 31, 2012 (dollars in

thousands, except per share amounts):

Period

Total

Number

of Shares

Purchased

Average

Price Paid

per Share

Total Number

of Shares

Purchased as

Part of Publicly

Announced

Plans

or Programs(2)

Maximum

Dollar Value

that May

Yet Be Purchased

Under the Plans

or Programs(2)

October 1, 2012 to October 31, 2012 .......................... — $ — — $ 9,866

November 1, 2012 to November 30, 2012(1) .................... 61,590 54.23 58,700 56,681

December 1, 2012 to December 31, 2012 ...................... 112,500 51.08 112,500 50,932

Total ................................................... 174,090 $52.20 171,200 $50,932

(1) In addition to the shares of common stock we purchased under our $100 million stock repurchase program, we

repurchased 2,890 shares of our common stock at an aggregate cost of $157 thousand, or an average purchase price of

$54.26 per share, in connection with the net settlement of shares issued as a result of the vesting of restricted stock

during the quarter ended December 31, 2012.

(2) Except as noted in footnote 1 above, all of the above repurchases were made on the open market at prevailing market

rates plus related expenses under our stock repurchase programs. Our initial stock repurchase program, which

authorized the repurchase of up to $50 million in common stock, was authorized by our Board of Directors and publicly

announced on February 22, 2012. Our subsequent stock repurchase program, which authorized the repurchase of up to

an additional $50 million in common stock, was authorized by our Board of Directors and publicly announced on

November 15, 2012.

Dividend Policy

We have never paid any dividends on our common stock. Any future decision to pay cash dividends will be at the

discretion of our board of directors and will be dependent on our results of operations, financial condition, contractual

restrictions and other such factors that the board of directors considers relevant.

23