Lumber Liquidators 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

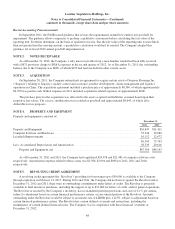

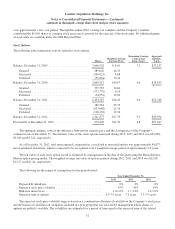

The tax effects of temporary differences that result in significant portions of the deferred tax accounts are as follows:

December 31,

2012 2011

Deferred Tax Liabilities:

Prepaid Expenses ....................................... $ 402 $ 372

Depreciation and Amortization ............................ 12,729 11,629

Other ................................................. 655 —

Total Gross Deferred Tax Liabilities ............................ 13,786 12,001

Deferred Tax Assets:

Stock-Based Compensation Expense ........................ 3,211 3,914

Reserves .............................................. 2,782 2,243

Employee Benefits ...................................... 1,685 118

Inventory Capitalization .................................. 3,454 2,168

Foreign Operations ...................................... 1,267 728

Other ................................................. — 342

Total Gross Deferred Tax Assets ............................... 12,399 9,513

Less Valuation Allowance .................................... (1,267) —

Total Net Deferred Tax Assets ................................. 11,132 9,513

Net Deferred Tax Liability .................................... $(2,654) $ (2,488)

In the fourth quarter of 2012, Canadian operations were in a cumulative loss position and the Company recorded a full

valuation allowance of $1,267 on the net deferred tax assets in Canada. In future periods, the allowance could be reduced if

sufficient evidence exists indicating that it is more likely than not that a portion or all of these deferred tax assets will be

realized.

As of December 31, 2012, the Company had Canadian net operating losses carryforwards of $5,446 which begin to

expire in 2030. These net operating losses may be carried forward up to 20 years to offset future taxable income.

The Company made income tax payments of $29,035, $7,067 and $14,282 in 2012, 2011 and 2010, respectively.

The Company files income tax returns with the U.S. federal government and various state and foreign jurisdictions. In

the normal course of business, the Company is subject to examination by taxing authorities. The Internal Revenue Service

has completed audits of the Company’s federal income tax returns for years through 2009.

NOTE 10. PROFIT SHARING PLAN

The Company maintains a profit-sharing plan, qualified under Section 401(k) of the Internal Revenue Code, for all

eligible employees. Employees are eligible to participate following the completion of three months of service and attainment

of age 21. The Company matches 50% of employee contributions up to 6% of eligible compensation. The Company’s

matching contributions, included in SG&A expenses, totaled $749, $620 and $520 in 2012, 2011 and 2010, respectively.

NOTE 11. RELATED PARTY TRANSACTIONS

The Company is party to an agreement dated June 1, 2010 with Designers’ Surplus, LLC t/a Cabinets to Go (“CTG”).

The Company’s founder is the sole member of an entity that owns a significant interest in CTG. Pursuant to the terms of the

agreement, the Company provides certain advertising, marketing and other services. The Company charges CTG for its

services at rates believed to be at fair market value. The revenue recognized by the Company from this agreement was $55,

$83 and $124 in 2012, 2011 and 2010, respectively.

54