Lumber Liquidators 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lumber Liquidators Holdings, Inc.

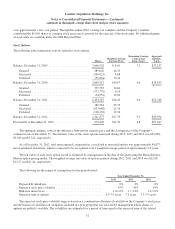

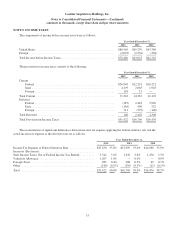

Notes to Consolidated Financial Statements

(amounts in thousands, except share data and per share amounts)

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Lumber Liquidators Holdings, Inc. (the “Company”) is a multi-channel specialty retailer of hardwood flooring, and

hardwood flooring enhancements and accessories, operating as a single business segment. The Company offers an extensive

assortment of exotic and domestic hardwood species, engineered hardwoods and laminates direct to the consumer. The

Company also features the renewable flooring products, bamboo and cork, and provides a wide selection of flooring

enhancements and accessories, including moldings, noise-reducing underlay, adhesives and flooring tools. These products

are primarily sold under the Company’s private label brands, including the premium Bellawood brand floors. The Company

sells primarily to homeowners or to contractors on behalf of homeowners through a network of 279 store locations in primary

or secondary metropolitan areas in 46 states and nine store locations in Canada at December 31, 2012. In addition to the store

locations, the Company’s products may be ordered, and customer questions/concerns addressed, through both the call center

in Toano, Virginia, and the website, www.lumberliquidators.com. The Company finishes the majority of the Bellawood

products on its finishing line in Toano, Virginia, which along with the call center, corporate offices, and a distribution center,

represent the “Corporate Headquarters.”

Organization and Basis of Financial Statement Presentation

The consolidated financial statements of the Company, a Delaware corporation, include the accounts of its wholly

owned subsidiaries. All significant intercompany transactions have been eliminated in consolidation. The balance sheets and

statements of stockholders’ equity reflect the segregation of treasury stock from additional capital.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States

requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial

statements and accompanying notes. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company had cash equivalents of $7,664 and $27,599 at December 31, 2012 and 2011, respectively. The Company

considers all highly liquid investments with a maturity date of three months or less when purchased to be cash equivalents, of

which there was $170 and $16,064 at December 31, 2012 and 2011, respectively. The Company accepts a range of debit and

credit cards, and these transactions are generally transmitted to a bank for reimbursement within 24 hours. The payments due

from the banks for these debit and credit card transactions are generally received, or settle, within 24-48 hours of the

transmission date. The Company considers all debit and credit card transactions that settle in less than seven days to be cash

and cash equivalents. Amounts due from the banks for these transactions classified as cash and cash equivalents totaled

$7,494 and $11,535 at December 31, 2012 and 2011, respectively.

Credit Programs

Credit is offered to the Company’s customers through a proprietary credit card, the Lumber Liquidators credit card,

underwritten by third party financial institutions and at no recourse to the Company. A credit line is offered to the

Company’s professional customers through the Lumber Liquidators Commercial Credit Program. This commercial credit

program is underwritten by a third party financial institution, generally with no recourse to the Company.

As part of the credit program with GE Money Bank (“GE”), the Company’s customers may use their Lumber

Liquidators credit card to tender installation services provided by the Company’s installation partner, The Home Service

Store, Inc. (“HSS”). GE funds HSS directly for these transactions and HSS is responsible for all credits and program fees. If

GE is not able to collect net credits or fees from HSS within 60 days, the Company has agreed to indemnify GE against any

losses related to HSS credits or fees. There are no maximum potential future payments under the guarantee. The Company is

able to seek recovery from HSS of any amounts paid on its behalf. The Company believes that the risk of significant loss

from the guarantee of these obligations is remote.

44