Lumber Liquidators 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

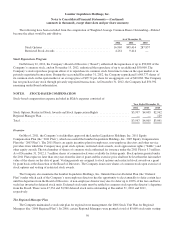

over approximately a five year period. Through December 2010, vesting was complete and the Company’s founder

contributed the 85,000 shares of common stock necessary to provide for the exercise of the stock units. No additional grants

of stock units are available under the 2006 Regional Plan.

Stock Options

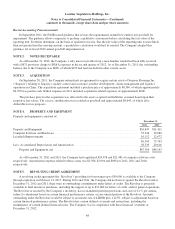

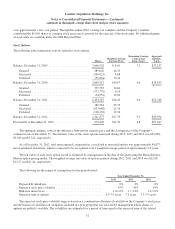

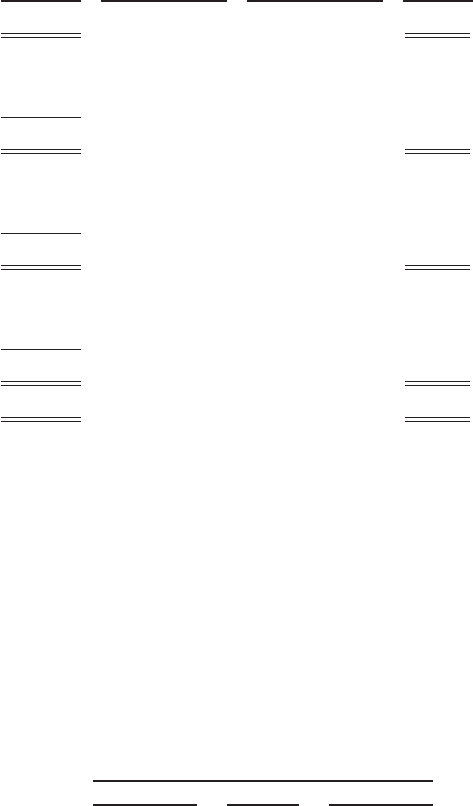

The following table summarizes activity related to stock options:

Shares

Weighted Average

Exercise Price

Remaining Average

Contractual

Term (Years)

Aggregate

Intrinsic

Value

Balance, December 31, 2009 ............................ 2,046,976 $ 8.61 7.2 $37,237

Granted ......................................... 289,026 24.35

Exercised ....................................... (206,821) 8.68

Forfeited ........................................ (59,664) 13.24

Balance, December 31, 2010 ............................ 2,069,517 $10.67 6.6 $29,635

Granted ......................................... 557,557 24.64

Exercised ....................................... (377,775) 8.14

Forfeited ........................................ (54,952) 19.82

Balance, December 31, 2011 ............................ 2,194,347 $14.42 6.6 $12,746

Granted ......................................... 182,281 25.73

Exercised ....................................... (937,048) 11.16

Forfeited ........................................ (128,203) 19.94

Balance, December 31, 2012 ............................ 1,311,377 $17.79 6.5 $45,954

Exercisable at December 31, 2012 ........................ 670,420 $11.59 4.8 $27,647

The aggregate intrinsic value is the difference between the exercise price and the closing price of the Company’s

common stock on December 31. The intrinsic value of the stock options exercised during 2012, 2011 and 2010 was $22,881,

$5,583 and $3,742, respectively.

As of December 31, 2012, total unrecognized compensation cost related to unvested options was approximately $4,877,

net of estimated forfeitures, which is expected to be recognized over a weighted average period of approximately 2.6 years.

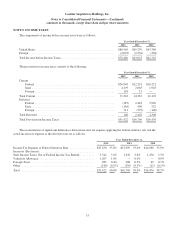

The fair value of each stock option award is estimated by management on the date of the grant using the Black-Scholes-

Merton option pricing model. The weighted average fair value of options granted during 2012, 2011 and 2010 was $12.68,

$12.57 and $11.44, respectively.

The following are the ranges of assumptions for the periods noted:

Year Ended December 31,

2012 2011 2010

Expected dividend rate ..................................... 0% 0% 0%

Expected stock price volatility ............................... 45% 45% 45%

Risk-free interest rate ...................................... 1.0-1.6% 1.7-3.0% 1.9-3.2%

Expected term of options ................................... 6.5-7.5 years 7.5 years 3.5-7.5 years

The expected stock price volatility range is based on a combination of historical volatility of the Company’s stock price

and the historical volatilities of companies included in a peer group that was selected by management whose shares or

options are publicly available. The volatilities are estimated for a period of time equal to the expected term of the related

51