Lumber Liquidators 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2012, we completed the initial design of an expanded store showroom to enhance the shopping experience for our

customers. We refer to this showroom, coupled with an improved store warehouse design, as our “store of the future.” We

expect a store of the future showroom to average 1,600 square feet versus the 1,000 to 1,200 square feet previously targeted,

yet with a more efficient warehouse and inventory plan to allow the targeted total location to remain at 6,000 to 7,000 square

feet. The assortment of flooring options presented will expand, grouped by product category, displayed within color palate

and in a good-better-best format. The assortment of accessories displayed will expand dramatically. In 2013, we expect our

25 to 35 new store locations to be store of the future format, though the majority of the new locations will open after May 1st.

We expect capital expenditures of approximately $200,000 for each new store location, and merchandise inventory levels

carried in the store to increase approximately 10%. In addition to the new stores, we expect to remodel 20 to 25 existing

stores, either in their current location or relocated within the primary trade area.

Expansion of our store base continues to be an important driver of our growth, and we now believe the U.S. market will

support at least 600 store locations. In determining this location count, we coordinated efforts with certain third-party experts

in considering available market share, demographic drivers and certain store level, or “four-wall,” economics. We expect the

success of our multi-year strategic initiatives to continue to benefit key four-wall financial metrics, including operating

income and return on invested capital. In addition, we believe our market, and therefore, our available share, will expand

over the next three to five years. We expect four-wall financial metrics similar to our historical store model, adjusted for

market size.

In February of 2012, our Board of Directors authorized the repurchase of up to $50.0 million of our common stock, and

in November of 2012, authorized the repurchase of up to an additional $50.0 million. This stock repurchase program marks

an important step in returning value to our shareholders, and expresses confidence in our proven store model. Through

December 31, 2012, we had repurchased approximately 1.6 million shares of our common stock through open market

purchases, using approximately $49.1 million in cash.

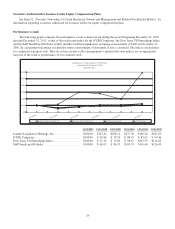

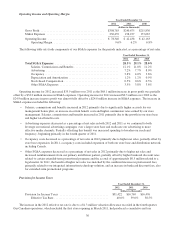

Results of Operations

Net Sales

Year Ended December 31,

2012 2011 2010

(dollars in thousands)

Net sales ............................................................... $813,327 $681,587 $620,281

Percentage increase .................................................. 19.3% 9.9% 13.9%

Number of stores open at end of period ...................................... 288 263 223

Number of stores opened in period .......................................... 25 40 37

Percentage increase (decrease)

Average sale1........................................................... 2.5% 2.8% (2.4%)

Average retail price per unit sold2........................................... 0.2% 6.8% (3.7%)

Comparable Stores3:

Net sales ........................................................... 11.4% (2.0%) 2.1%

Customers invoiced4................................................. 8.6% (4.7%) 4.5%

Net sales of stores operating for 13 to 36 months ........................... 23.3% 12.0% 12.1%

Net sales of stores operating for more than 36 months ....................... 9.1% (5.5%) (1.1%)

Net sales in markets with all stores comparable (no cannibalization) ............... 13.3% 2.2% 5.5%

Net sales in cannibalized markets5.......................................... 33.3% 18.6% 15.8%

1Average sale, calculated on a total company basis, is defined as the average invoiced sale per customer, measured on a

monthly basis and excluding transactions of less than $250 (which are generally sample orders, or add-ons or fill-ins to

previous orders) and of more than $30,000 (which are usually contractor orders)

2Average retail price per unit sold is calculated on a total company basis and excludes certain service revenue, which

consists primarily of freight charges for in-home delivery

3A store is generally considered comparable on the first day of the thirteenth full calendar month after opening

4Approximated by applying our average sale to total net sales at comparable stores

5A cannibalized market has at least one comparable store and one non-comparable store

27