Lumber Liquidators 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

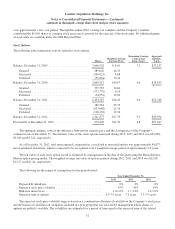

Cost of Sales

Cost of sales includes the cost of the product sold, the transportation costs from vendor to the Company’s distribution

center or store location, any applicable finishing costs related to production of the Company’s proprietary brands, the

transportation costs from the distribution center to the store locations, transportation costs for the delivery of products from

the store locations to customers, any inventory adjustments, including shrinkage, and the costs to produce samples, reduced

by vendor allowances.

The Company offers a range of prefinished products with warranties on the durability of the finish ranging from 10 to

100 years. Warranty reserves are based primarily on claims experience, sales history and other considerations, and warranty

costs are recorded in cost of sales. This reserve was $440 and $454 at December 31, 2012 and 2011, respectively.

Vendor allowances primarily consist of volume rebates that are earned as a result of attaining certain purchase levels

and reimbursement for the cost of producing samples. Vendor allowances are accrued as earned, with those allowances

received as a result of attaining certain purchase levels accrued over the incentive period based on estimates of purchases.

Volume rebates earned are initially recorded as a reduction in merchandise inventories and a subsequent reduction in cost of

sales when the related product is sold. Reimbursement received for the cost of producing samples is recorded as an offset

against cost of sales.

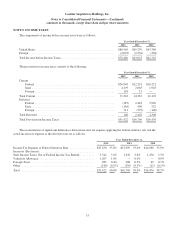

Advertising Costs

Advertising costs charged to selling, general and administrative (“SG&A”) expenses, net of vendor allowances, were

$58,548, $52,345 and $49,797 in 2012, 2011 and 2010, respectively. The Company uses various types of media to brand its

name and advertise its products. Media production costs are generally expensed as incurred, except for direct mail, which is

expensed when the finished piece enters the postal system. Media placement costs are generally expensed in the month the

advertising occurs, except for contracted endorsements and sports agreements, which are generally expensed ratably over the

contract period. Amounts paid in advance are included in prepaid expenses and totaled $1,649 and $818 at December 31,

2012 and 2011, respectively.

Store Opening Costs

Costs to open new store locations are charged to SG&A expenses as incurred, net of any vendor support.

Other Vendor Consideration

Consideration from non-merchandise vendors, including royalties and rebates, are generally recorded as an offset to

SG&A expenses when earned.

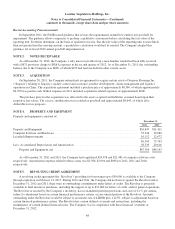

Depreciation and Amortization

Property and equipment is carried at cost and depreciated on the straight-line method over the estimated useful lives.

The estimated useful lives for leasehold improvements are the shorter of the estimated useful lives or the remainder of the

lease terms. For leases with optional renewal periods, the Company uses the original lease term, excluding optional renewal

periods, to determine the appropriate estimated useful lives. Capitalized software costs, including those related to the

Company’s integrated information technology solution, are capitalized from the time that technological feasibility is

established until the software is ready for use. The estimated useful lives are generally as follows:

Years

Property and Equipment ................................................ 5to10

Computer Software and Hardware ........................................ 3to10

Leasehold Improvements ............................................... 1to15

46